A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Italian, Japanese, British and European 2-year government bond yields

British and European 3-year bond yields

Czech, British, Greek, Indonesian, Italian, Norwegian and Portuguese 10-year bond yields

Oats *

AUD/ZAR

CAD/EUR

CAD/GBP

USD/KRW

Overbought (RSI > 70)

Australian 2- & 3-year government bond yield

Australian 10 year minus U.S. 10-year bond yield spread

North European Hot Rolled Coil Steel

Gold in AUD, CAD, CHF, EUR, GBP, USD and ZAR *

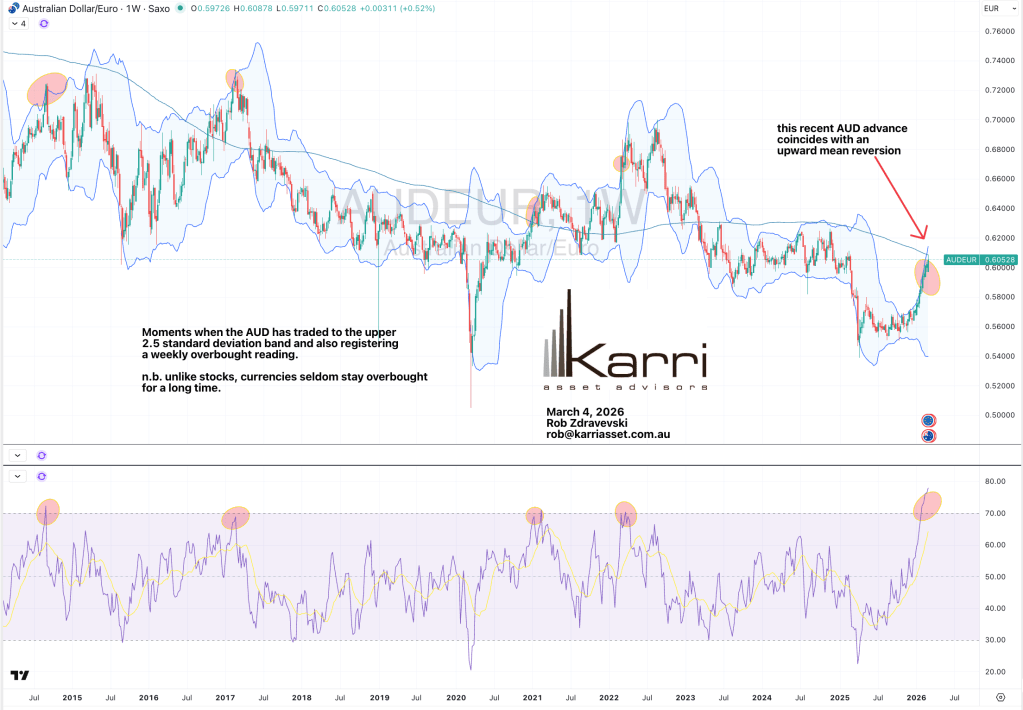

AUD/EUR *

AUD/GBP *

AUD/IDR *

AUD/INR *

AUD/JPY *

AUD/SGD *

AUD/THB

CHF/JPY *

CNH/USD *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Richards Bay Coal

Aluminium *

Rotterdam Coal

Bloomberg Commodity Index

Brent Crude Oil

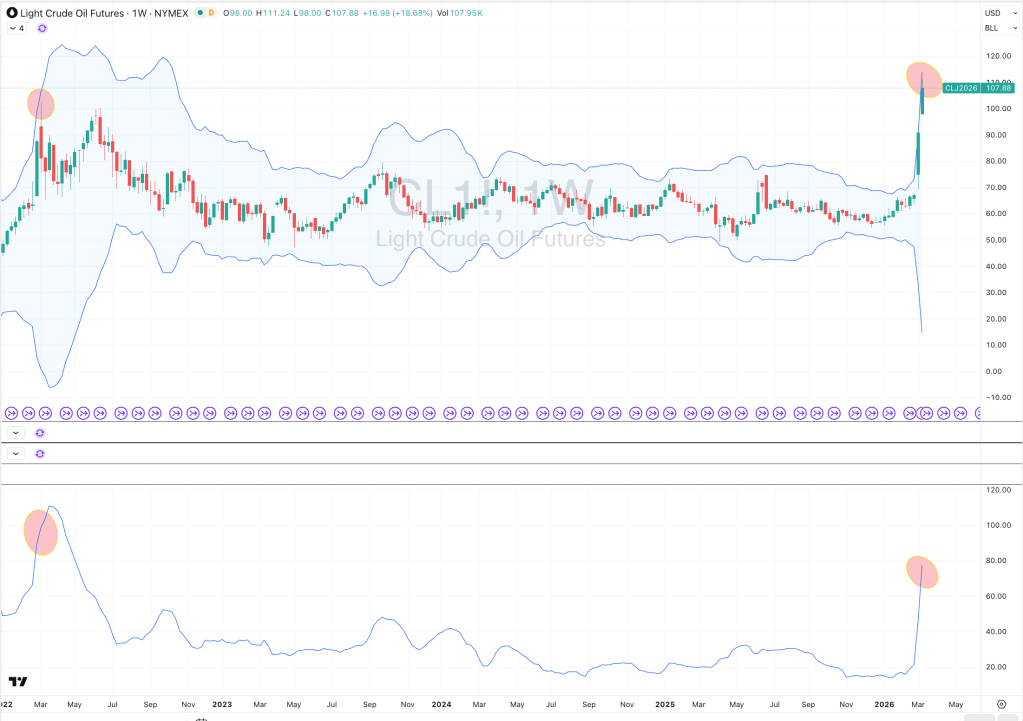

WTI Crude Oil

Heating Oil

North American Hot Rolled Coil Steel

JKM LNG in USD and Yen

Newcastle Coal

Gasoline

S&P GSCI Index

CRB Index

Dutch TTF Gas

Urea (U.S, Gulf and Middle East)

Gasoil

Wheat *

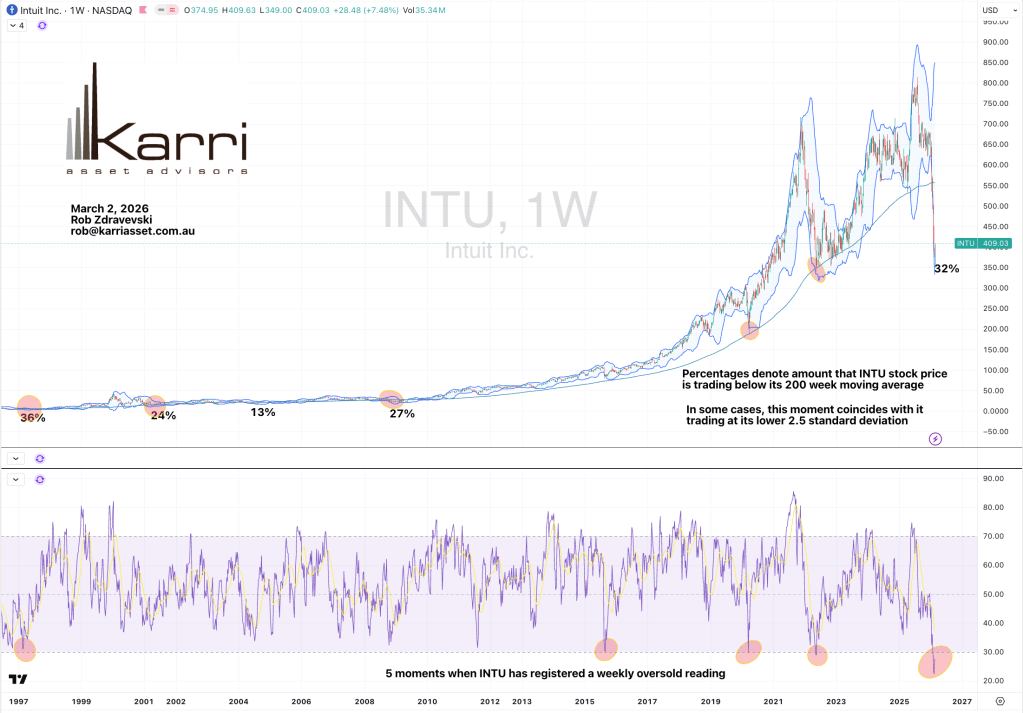

Extremes below the Mean (at least 2.5 standard deviations)

U.S. 5-year bond yield minus U.S. 5-year inflation breakeven rate

U.S. 10-year bond yield minus U.S. 10-year inflation breakeven rate

China A50 index

IDX Composite

HSCEI

Hang Seng

NIFTY

SENSEX

Oversold (RSI < 30)

Australian 10 year minus Aussie 2-year yield spread *

Australian 10 year minus Aussie 5-year yield spread

U.S. 10-year minus Aussie 10-year yield spread

London and CME Cocoa *

Sugar #16 *

EUR/AUD *

JPY/AUD *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

EUR/CHF

NZD/AUD *

Notes & Ideas:

Government bond yields soared.

And with that, we see many new entries amongst the ‘extremes’.

Chilean 2 year yields have risen for 5 weeks,

While Japanese 10 year yield shave fallen for 5 weeks.

Every other previous streak has been broken.

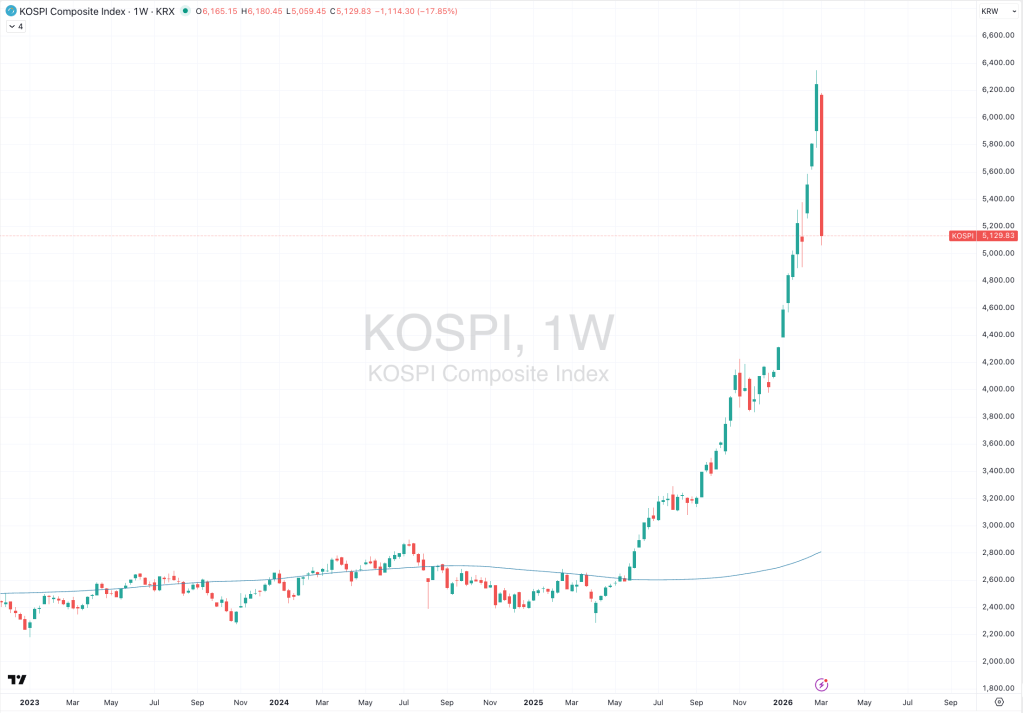

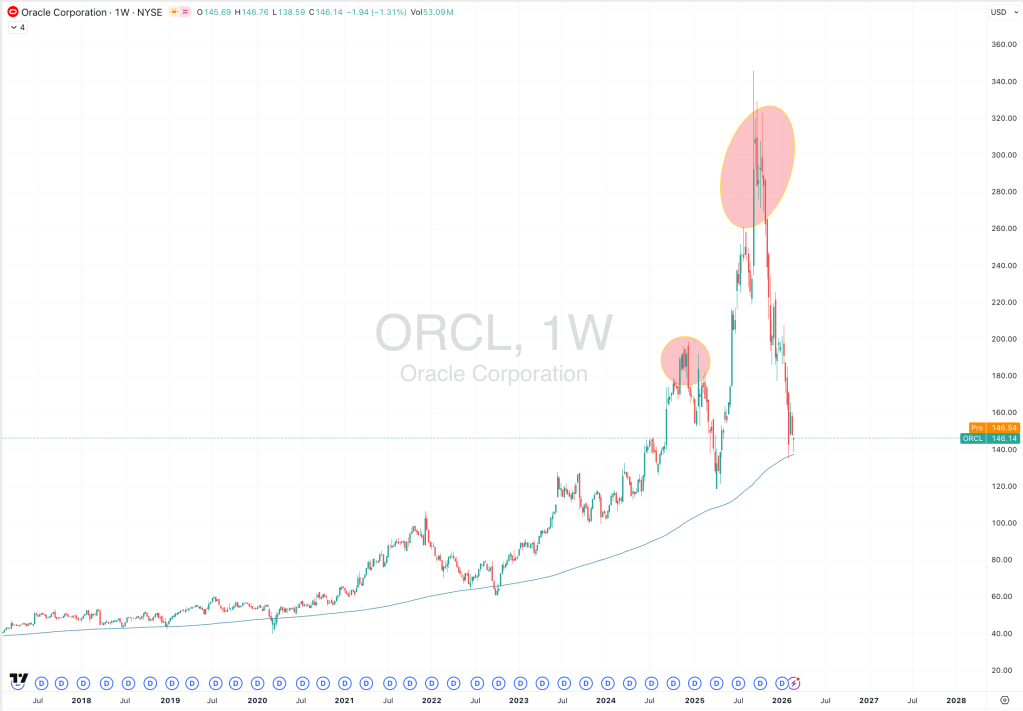

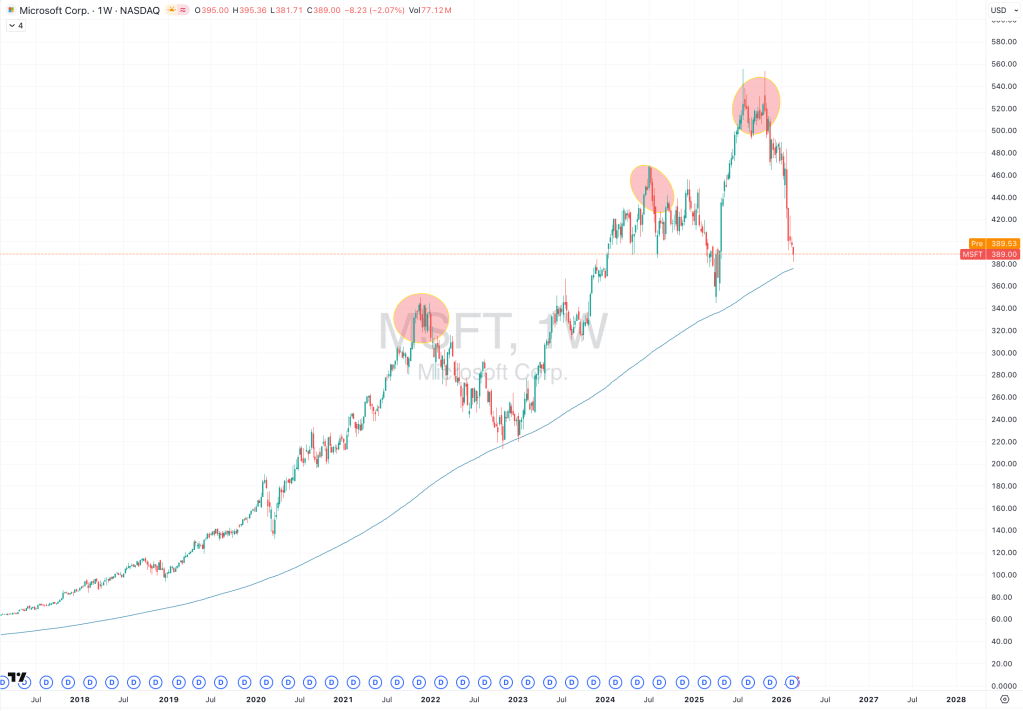

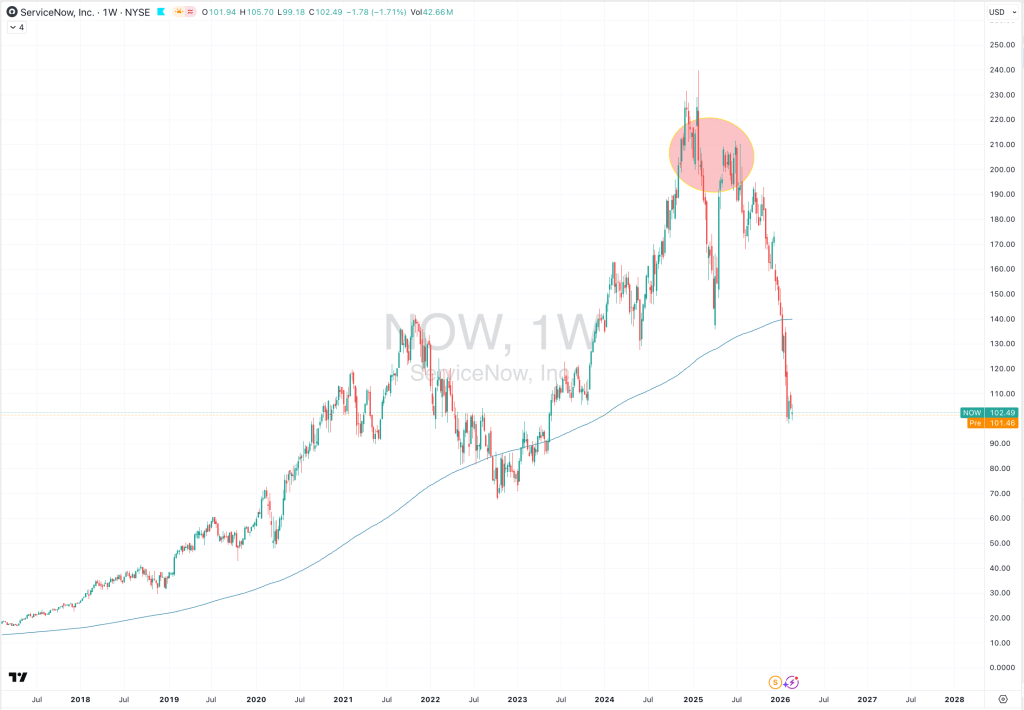

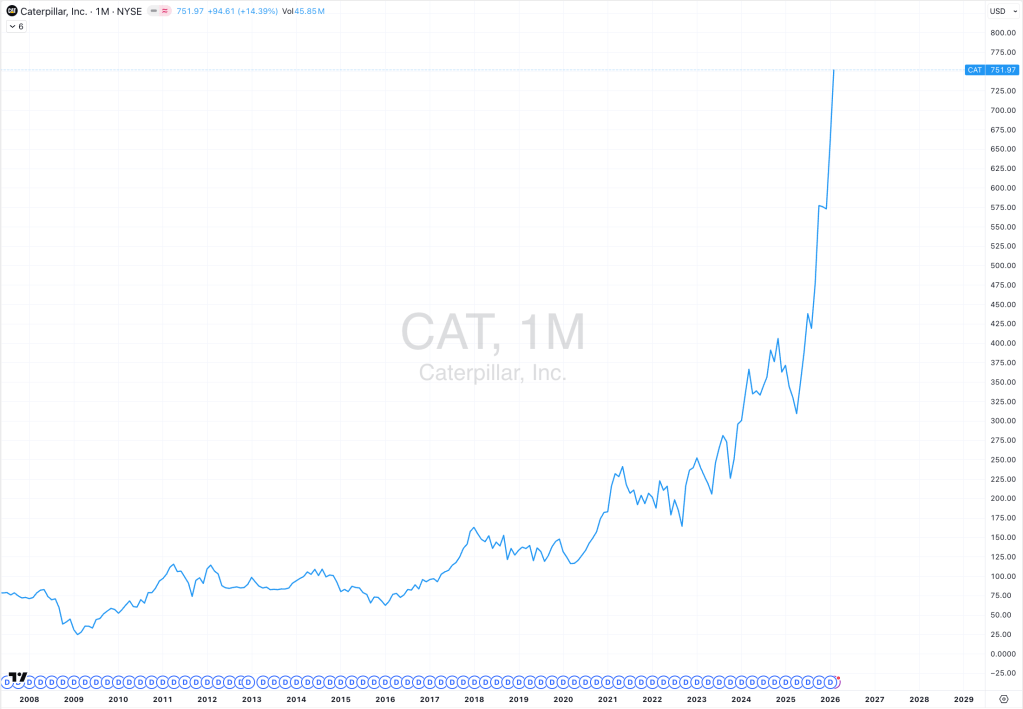

Equities were smashed.

The list of extraordinary declines appear the bottom of this note.

Except for the TAIEX, all of last week’s overbought indices departed the list.

All of the winning streaks which appeared last week been snapped.

The only winning streak is Norway’s OBX sitting at 6 weeks.

Thailand’s SET, South Korea’s KOSPI and the Nikkei 225 gave up half of its gains garnered in the previous 3 or 4 weeks.

Germany’s DAX is at its lowest close in 5 months, last seen during the week ending November 17, 2025.

Spain’s IBEX closed at the same price seen during the week of December 8, 2025.

While several Asian indices are overbought.

Commodities were strong.

Coal, Oils, Distillates, Gases, Coffee, Urea and Oats were the notable gainers.

Copper, Tin, Nickel and the precious metals were amongst the decliners.

JKM LNG mean reverted, upwards.

Wheat has advanced for 4 weeks.

Gold in ZAR and Soybeans have climbed for 5 weeks.

North American Hot Rolled Coil Steel is in a 7-week winning streak.

U.S. Gulf Urea prices have risen for 13 consecutive weeks.

Natural Gas rose and broke a 4-week losing streak.

Australian Coking Coal rose to end its 5 weeks of losses.

Gold in CAD and USD fell and snapped a 4-week winning streak.

The Copper/Gold Ratio has closed at its lowest level since February 1990 and it’s Monthly oversold reading is worth noting.

Currencies were busy.

While the Aussie fell, many of its pairs still appear amongst the extremes.

AUD/EUR in 11 week rising streak.

All of other AUD streaks came to an end, including the 8 week winning streaks for the AUD/GBP and AUD/IDR.

The USD and CAD rose.

The Euro and British Pound were firmer,

While the Yen fell.

The larger advancers over the past week comprised of;

Australian Coking Coal 2.8%, Richards Bay Coal 14.6%, Aluminium 9.8%, Rotterdam Coal 19.8%, Bloomberg Commodity Index 8.1%, Brent Crude 27.2%, Cocoa 11.8%, WTI Crude 35.6%, Palm Oil 8%, Heating Oil 39.5%, JKM LNG 46.5%, Arabica Coffee 4.5%, LNG in Yen 84.4%, Newcastle Coal 15.9%, Natural Gas 11.4%, Gasoline 20.2%, Robusta Coffee 4.1%, Sugar 1.5%, S&P GSCI 14.7%, CRB Index 12.6%, Dutch TTF Gas 67%, U.S. Gulf Urea 24.5%, Gasoil 53.9%, Middle East Urea 33.8%, Gold in ZAR 2%, Corn 2.7%, Oats 6.7%, Rice 4.4%, Soybeans 2.6%, Wheat 4.3% and Israel’s TA-35 equity index rose 5.5%.

The group of largest decliners from the week included;

Baltic Dry Index (6.1%), Cotton (2.2%), Copper (4.2%), Lithium Hydroxide (3.9%), Tin (13.5%), Nickel (2.2%), Palladium (9.1%), Platinum (9.8%), Silver in USD (10%), Gold in CAD (2.6%), Gold in GBP (1.5%), Gold in USD (2%), All World Developed ex USA (6.9%), AEX (4.6%), ATX (5.2%), KBW Banks (3.6%), BUX (3.7%), CAC (6.8%), IDX (7.9%), DAX (6.7%), DJ Industrials (3%), DJ Transports (6.2%), EGX (3.5%), FCATC (5%), MIB (6.5%), HSCEI (2.6%), IBB (4.5%), HSI (3.3%), IBEX (7%), BOVESPA (5%), S&P Small Cap 600 (3.8%), Russell 2000 (4%), TAIEX (5.1%), KRE Regional Banks (2.8%), KSE (6.3%), KOSPI (10.6%), FTSE 250 (5.3%), S&P MidCap 400 (4.6%), Mexico (5.7%), NBI (4.2%), Nikkei 225 (5.5%), NIFTY (2.9%), Copenhagen (2.2%), Helsinki (3.3%), Stockholm (5.7%), PSE (4.4%), PX (2.2%), SA40 (9.7%), SENSEX (2.9%), SET (7.7%), SMI (6.6%), SOX (7.2%), IGPA (5%), S&P 500 (2%), STI (2.(%), Nasdaq Transport (7.8%), TSX (3.7%), FTSE (5.7%), Vietnam (6%), WIG (4.8%), Nasdaq Biotech (2.7%), ASX Financials (3.3%), ASX 200 (3.8%), ASX Materials (8.5%), ASX Industrials (3.2%), ASX Small Caps (4.5%), BIST (6.7%) and Dubai’s DFM fell 9%.

March 8, 2026

By Rob Zdravevski

rob@karriasset.com.au