AUD/JPY at exteme highs

April 26, 2024 Leave a comment

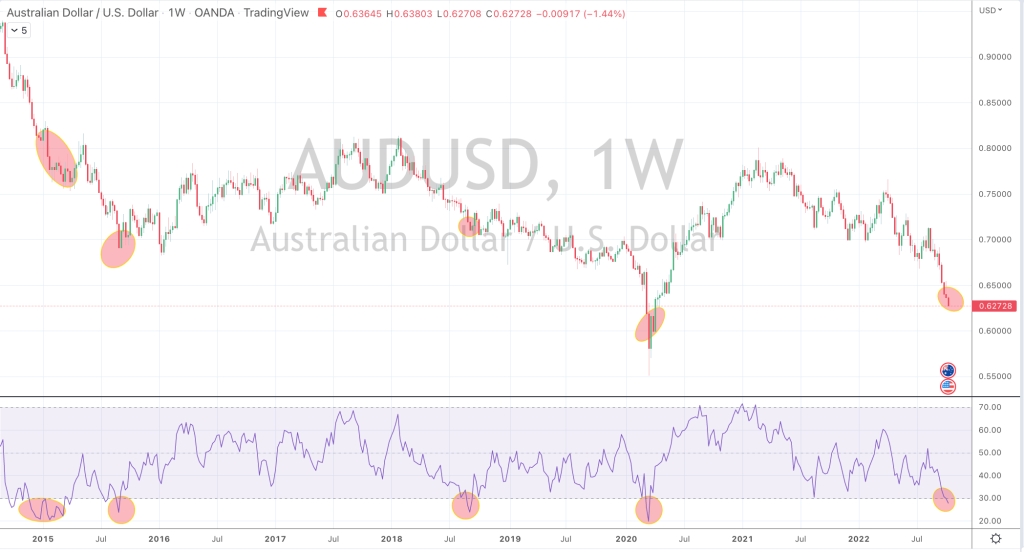

Its the 4th time in 10 years that the Australian Dollar #AUD has traded a) at a certain percentage above my long term moving average while b) simultaneously registering an overbought weekly reading and also c) trading at stretched standard deviations above its rolling weekly mean……against the Japanese #JPY Yen.

#AUDJPY

I like watching this currency pair as an indicator of risk appetite.

April 26, 2024

by Rob Zdravevski

rob@karriasset.com.au