On September 7, 2022, I dispensed comments to clients about my views on the AUD/USD.

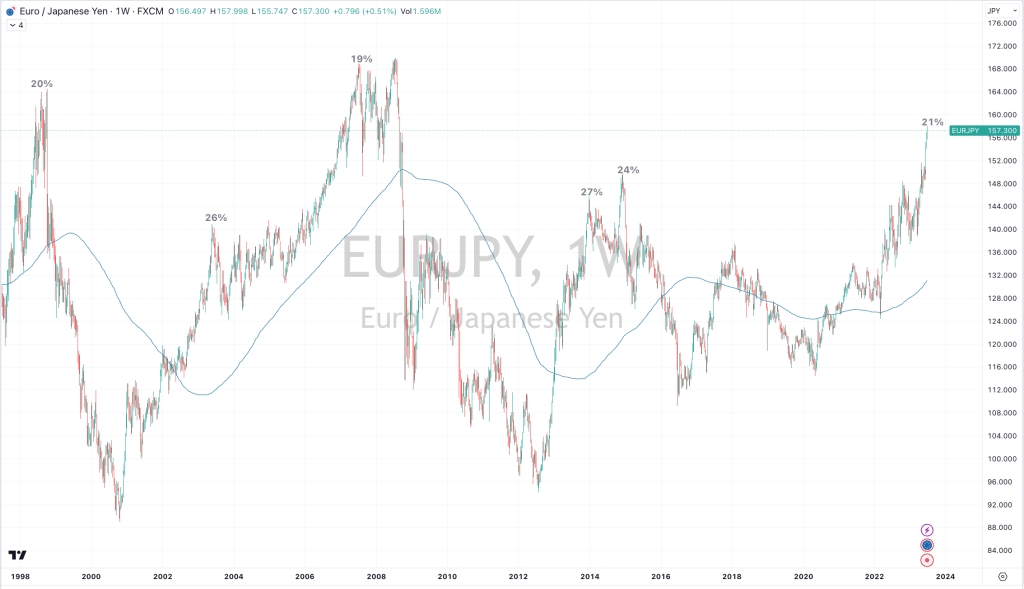

I cited how perverse it was that the Aussie was strong versus the EUR, GBP and JPY….

while it continued to weaken against the USD.

This so called perverse scenario is because you don’t generally see AUD strength against other G-8 currencies whilst it inversely exhibits weakness against the USD.

Then, I thought it was appropriate for operational businesses (whether requiring to do so physically or for hedging purposes) is to…….

1) take your strong AUD and buy either GBP, EUR or JPY (the Aussie has since weakened 1.4% against these crosses)

but then…..

2) prepare to sell your strong USD and buy AUD

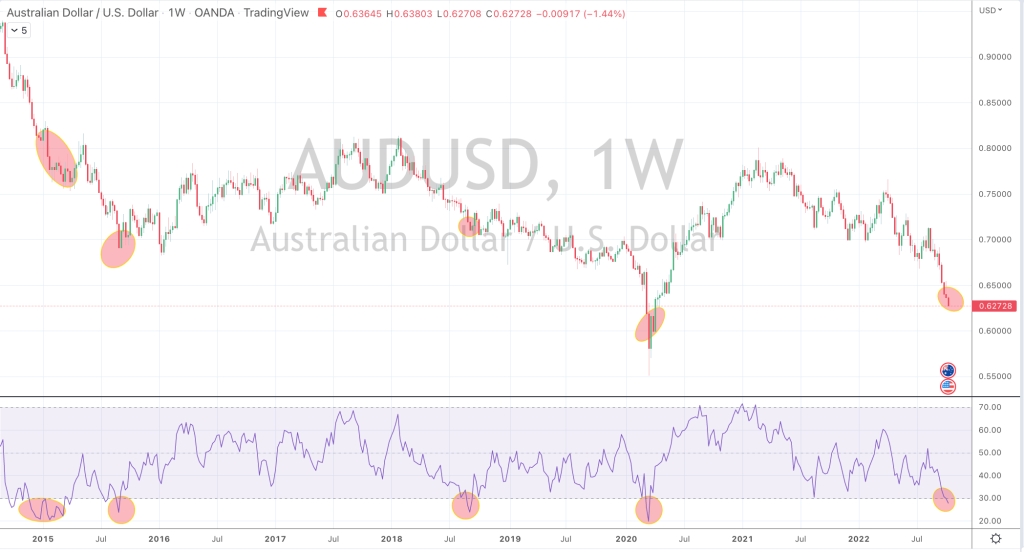

Back then (Sept 7th), the AUDUSD was trading at 0.6717.

My advice said that it needs to trade below 0.6680 if it is to make a move to 0.6464.

But I noted that the AUD/USD is within the process of being in the lower quintile (the last legs) of the larger downtrend which commenced at 0.7600 in April 2022.

Now, I think it’s time to prepare for the 2nd piece of that previous commentary.

Overnight, the AUD/USD broke below the 0.6680 level mentioned.

At the time of writing it is now trading at 0.6590.

It has weakened 2.6% since September 7th, 2022.

The velocity of the downtrend is increasing, albeit slightly.

However we are nearing interim support of 0.6560

I still see the 0.6460 region as major support.

My work and probability suggests locking in hedges or actually Selling USD / Buying AUD around this 0.6580 – 0.6460 mark is prudent.

A visit to 0.6340 would be an outlier 4 standard deviation, only seen twice in the past 20 years.

- not personal advice, see disclaimer

September 22, 2022

by Rob Zdravevski

rob@karriasset.com.au