Selling Euro strength

April 24, 2025 Leave a comment

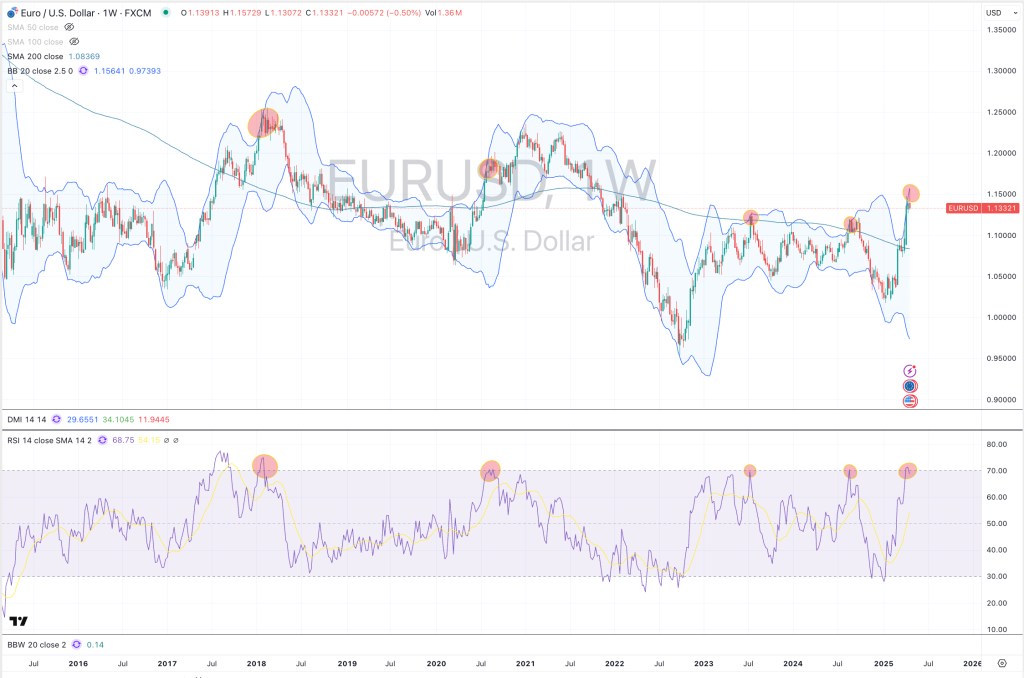

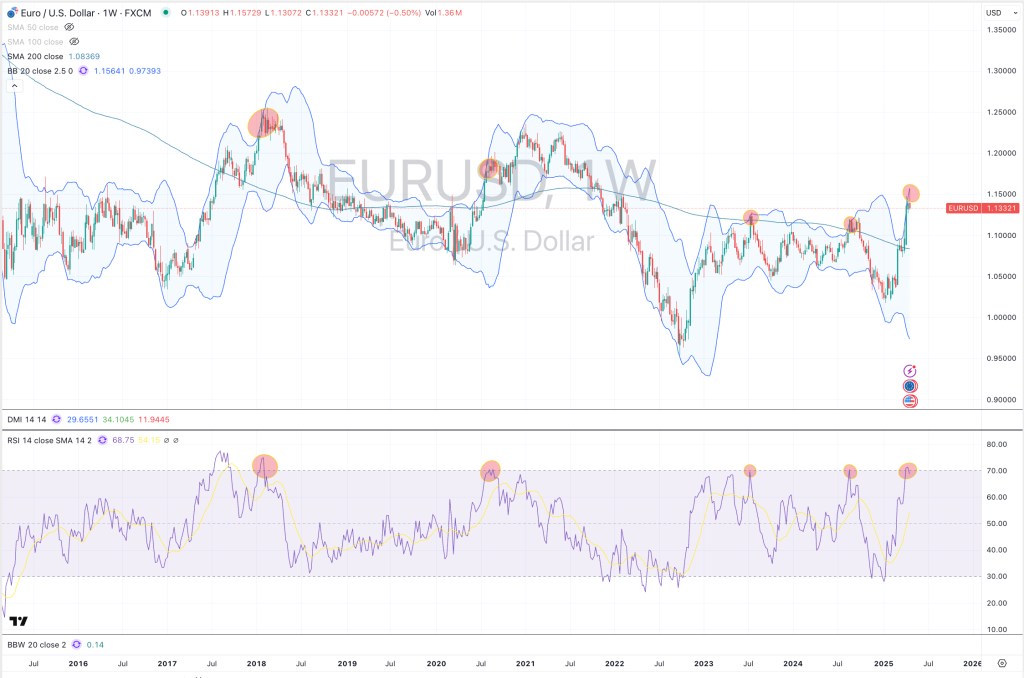

Enough for the Euro, for now.

Here are the 5 moments over the past 10 years when the Euro has traded at particular extremes against the U.S. Dollar.

April 24, 2025

rob@karriasset.com.au

Trying to hear what's not being said

April 24, 2025 Leave a comment

Enough for the Euro, for now.

Here are the 5 moments over the past 10 years when the Euro has traded at particular extremes against the U.S. Dollar.

April 24, 2025

rob@karriasset.com.au

March 13, 2025 Leave a comment

#AUDEUR The Aussie Dollar is approaching its 8th moment over the past 25 years when it’s trading at extreme lows (across my various metrics) against the Euro.

And so Australian assets are also on sale in EUR terms.

Expect to see European private equity firms scouring through ASX listed securities.

March 13, 2025

rob@karriasset.com.au

December 11, 2024 Leave a comment

In real #currency news, the GBP/EUR looks like running up to the 1.2280 region, but its close enough as it approaches an interim extreme amidst a weak trend.

Time to sell British #Pounds and buy #Euro, in case you are buying an airplane from Airbus…..

Incidentally, the Euro’s weakness against the USD persists, even after it traded at an oversold extreme some 3 weeks ago. This downtrend is exhibiting strength.

December 11, 2024

rob@karriasset.com.au

August 21, 2024 Leave a comment

When analysing moves in capital markets, I believe currencies (and credit) before trusting equities.

Currencies don’t tell lies. Equities do.

and also nobody takes a currency on a institutional investing roadshow……

August 21, 2024

by Rob Zdravevski

rob@karriasset.com.au

August 4, 2024 Leave a comment

The only thing you are forced to decide is to choose a #currency.

This is applicable when making, settling or holding an investment.

Holding cash is also an investment and many of the ‘truly’ global investors also ponder which (mix of) currency to hold their cash in.

Recently, I have highlighting the extreme weakness at which the #Japanese Yen has been trading at and more specifically, the Australian Dollar’s strength again the Yen (which is a good indicator of investors risk appetite).

Prompts to buy the Yen appeared in my weekly macro extremes publication and in this recent “Bigger Calls” newsletter.

https://mailchi.mp/karriasset/the-bigger-calls-q3-2024

If I chose the worst entry point (over the past 5-7 weeks) to have bought #Yen and sold #AUD, the current return would resemble at least 8% over the past 3 weeks or perhaps 11% if your timing was impeccable.

I think that is a bit more than interest earned in an Australian term deposit?

As a standalone #FX trade with the AUD/JPY trading at 95.40, it is now in the category of “good enough”.

August 4, 2024

by Rob Zdravevski

rob@karriasset.com.au

May 16, 2024 Leave a comment

Whilst the AUD/USD is currently in a medium and longer term upward trend, I think that it looks constrained around the 0.6750 – 0.6722 mark.

My read is that it needs make a ‘higher high’. If not, the AUD/USD will continue its digestive and consolidation pattern lower.

and so….it would go for commodities and bond yields.

May 16, 2024

by Rob Zdravevski

rob@karriasset.com.au

May 5, 2024 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

Extremes “above” the Mean (at least 2.5 standard deviations)

Australian 2, 3, 5 & 10 year government bond yields *

Japanese 2 year government bond yield

South Korean 10 year government bond yield *

Copper/Gold Ratio

U.S. 5 year government bond yield minus U.S. 5 year inflation breakeven rate *

Newcastle Coal

Oats

AUD/IDR *

AUD/THB *

Hang Seng China Enterprises Index (HSCEI) *

Hang Seng Index *

J’burg 40

Singapore Straits Times Index *

Overbought (RSI > 70)

Russian 10 year government bond yield

AEX

Budapest

Malaysia’s KLSE *

Pakistan’s KSE Index *

FTSE 250

and Turkiye’s BIST 100 *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Brazilian 10 year government bond yields

Copper

Extremes “below” the Mean (at least 2.5 standard deviations)

SHY

PHP/USD *

Dow Jones Transports *

And Indonesia’s IDX30 *

Oversold (RSI < 30)

Lithium Hydroxide

North European Hot Rolled Coil Steel

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Lumber

Urea

Notes & Ideas:

Government bond yields fell.

Many streaks were broken such as the 5 week winning streak in Canadian and South Korean 10’s along with all the yields across the British curve.

Chinese 10 year bond yields is no longer oversold as its yield rose.

Equities were mostly higher.

However, selected European bourses did see weakness.

China’s A50 Index and the U.S. KBW Bank Index have risen 7.5% and 5.2% respectively, over the past 3 weeks.

IBEX, MIB, & Stockholm’s OSX 30 aren’t overbought anymore.

The HSCEI and Hang Seng both rose 4.5% for the week, adding to last week’s 9% advance.

Furthermore, the Hang Seng and U.S. (KRE) Regional Banks Index are in a 3 week winning streak.

The SOX finished flat following last week’s stunning 10% rise.

Karachi broke its 6 week winning streak.

The Nasdaq Transports has declined for 5 consecutive weeks.

And Toronto’s TSX registered a bearish outside reversal week.

Commodities were mostly lower, again.

Weakness was seen in Cocoa, Coffee, Precious Metals, Oils and Distillates.

Strength was evident in Base Metals, Coal, Gases and Grains.

Some of the grains have strung 3 weeks of consecutive gains.

Aluminium, Tin & Nickel are not overbought anymore, nor is Cocoa, Coffee or Gold (in any currency).

Cocoa has fallen 31% in the past fortnight and has broken its overbought streak of 27 weeks.

While Australian Coking Coal isn’t oversold this week.

Robusta Coffee has fell 15% accounting for nearly half of the 39% rise seen in the prior 9 weeks.

Cotton has fallen for 8 consecutive weeks while Rubber has sunk for 6 weeks straight.

Iron Ore in a 5 week winning streak.

U.S. Hot Rolled Coil Steel performed a bearish weekly outside reversal.

And Lithium Hydroxide has now spent 42 consecutive weeks in weekly oversold territory.

Currencies are providing stealth guidance for the health of various asset trends.

The big news was the strength in the Japanese Yen and it’s no longer at last weeks extremes.

The AUD rose against all except the Yen.

The Canadian Loonie fell while the Euro was mixed.

The British Pound fell with the exception of the USD pair.

The Thai Baht broke its 7 week losing streak against the USD.

And the USD/SEK registered a outside weekly bearish week.

The larger advancers over the past week comprised of;

Australian Coking Coal 3.2%, Baltic Dry Index 9%, China Coking Coal 4.7%, Tin 2%, Newcastle Coal 5.8%, Natural Gas 11.4%, Platinum 4.7%, Dutch TTF Gas 5.5%, Uranium 5.5%, Corn 2.3%, Oats 7.9%, Soybeans 3.2%, China A50 2%, HSCEI 4.4%, Hang Seng 4.7%, Russell 2000 1.8%, KRE Regional Bank Index 3%, FTSE 250 1.7%, Nasdaq Biotechs 5.9%, Chile 2.6% and the BIST 100 rose 3.6%.

For reference, the S&P 500 rose 0.6% for the week.

The group of largest decliners from the week included;

Aluminium (1.9%), Cocoa (23.1%), WTI Crude (6.9%), Cotton (3.5%), Lean Hogs (2%), Heating Oil (4.7%), Coffee (Arabica) (10.4%), Lumber (2.7%), Lithium (5.7%), Gasoline (6.9%), Coffee (Robusta) (14.7%), SPGSCI (3.8%), CRB Index (3.5%), Brent Crude Oil (6%), Gasoil (5.3%), Urea Middle East (2.1%), Silver in AUD (3.6%), Silver in USD (2.4%), Gold in AUD (2.7%), Gold in CHF (2.6%), Gold in EUR (2.2%), Gold in GBP (2%), Gold in ZAR (3%), CAC (1.6%), MIB (1.8%) and Spain’s IBEX fell 2.7%.

May 5, 2024

by Rob Zdravevski

rob@karriasset.com.au

April 26, 2024 Leave a comment

Its the 4th time in 10 years that the Australian Dollar #AUD has traded a) at a certain percentage above my long term moving average while b) simultaneously registering an overbought weekly reading and also c) trading at stretched standard deviations above its rolling weekly mean……against the Japanese #JPY Yen.

#AUDJPY

I like watching this currency pair as an indicator of risk appetite.

April 26, 2024

by Rob Zdravevski

rob@karriasset.com.au

February 12, 2024 Leave a comment

The currency markets are currently telling me that the mood is “risk-off” which opposes (and somewhat belligerent) the mood of ‘glamour’ equity indices barrelling higher.

The Aussie Dollar is aimless with a bias towards lower prices.

Specifically against the USD, I see it visiting the 0.6350 region and ultimately holding 0.6150 (+/- 30 pips).

There is similar pattern recognition in the #AUD/JPY and the AUD/CHF.

February 12, 2024

by Rob Zdravevski

rob@karriasset.com.au

#riskmanagement

December 29, 2023 Leave a comment

In late August 2023, I wrote that the AUD/USD should hold the 0.63/0.64 mark…..and that I didn’t believe the pundits calls back then that it would trade to 60 cents.

It’s lowest weekly closing price was 0.6295.

4 months later, the AUDUSD is now trading at 0.6870 which is 2.5 standard deviations above its weekly mean.

If the strength of the current uptrend wanes, the AUD/USD will lose steam between its current price and 0.70000.

It’s good enough. So far, this has been a 9% move within those 4 months.

Also likely to hamper its progress {sic} will include those same ‘wealth management’ pundits prediction of a 75 cents price.

This advance in the AUD (versus the USD) had a corollary to the ‘risk-on’ feeling that markets exhibited.

It’s pending exhaustion will have the opposite.

December 29, 2023

by Rob Zdravevski

rob@karriasset.com.au