Dr Copper says…..

January 13, 2026 Leave a comment

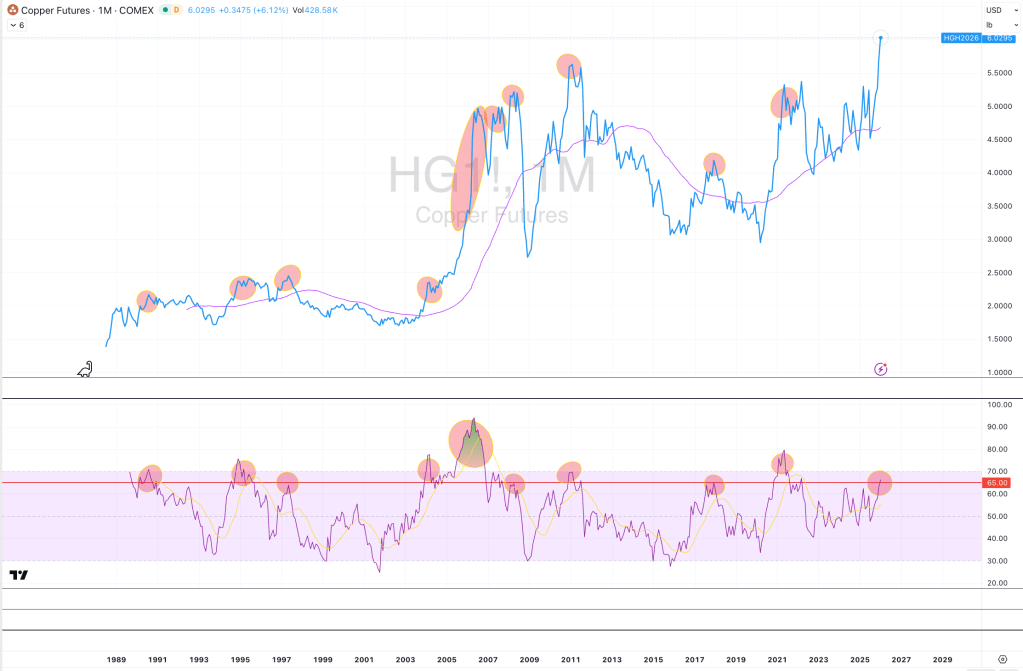

I don’t think it’s the best time to buy (or chase) Copper when the circles start appearing.

January 13, 2026

rob@karriasset.com.au

#meanreversion

#parabolas

Trying to hear what's not being said

January 13, 2026 Leave a comment

I don’t think it’s the best time to buy (or chase) Copper when the circles start appearing.

January 13, 2026

rob@karriasset.com.au

#meanreversion

#parabolas

February 8, 2025 Leave a comment

Is Arabica #Coffee a better store of value than #Bitcoin?

I might put it on the blockchain?

(of course I picked a starting date which suited me)

February 7, 2025 Leave a comment

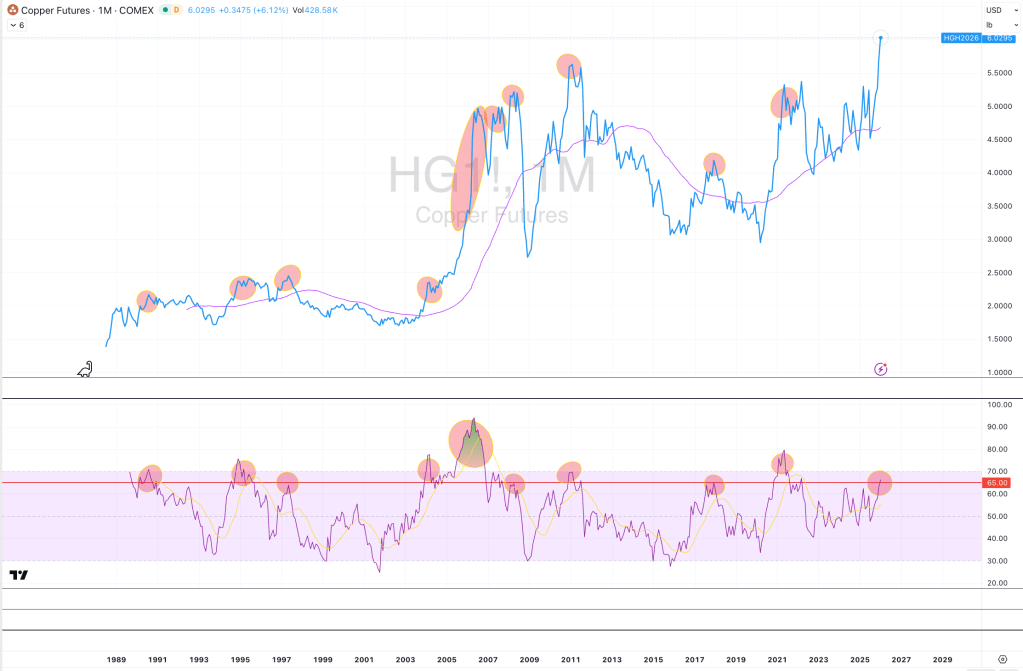

While much damage has been done to the Nickel price, I think there is a little a more lower travel ahead before dearth of supply meets an apathy of interest.

At the time of writing the price of LME (forward month) Nickel futures are trading at US$15,623.

February 7, 2025

rob@karriasset.com.au

February 1, 2025 Leave a comment

Cattle ranchers (farmers) should be selling more of their herd than usual…….

And so, at your regional mid-week cattle yard sales……offer more of your stock than you usually do.

Live #Cattle prices are stretched in absolute terms,

and in empirical terms….very much so !

#Beef purchasers (perhaps processors) should be cautious paying up to secure supply at these prices.

Lovers of steaks and hamburgers…..while aggrieved with ‘recent’ higher prices, you should see lower prices from hereon in.

February 1, 2025

rob@karriasset.com.au

February 1, 2025 Leave a comment

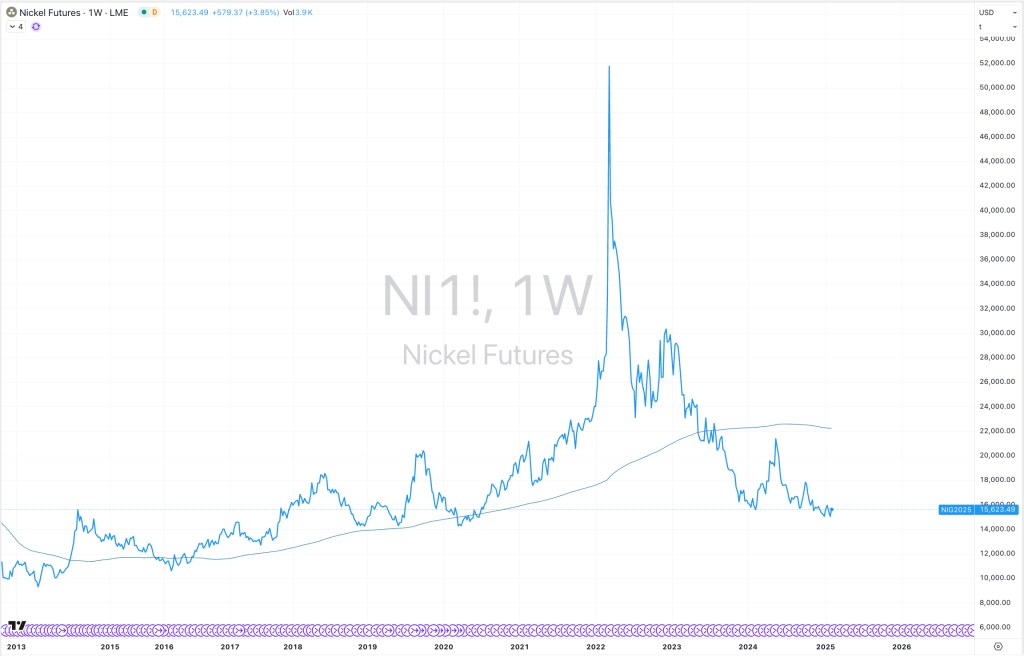

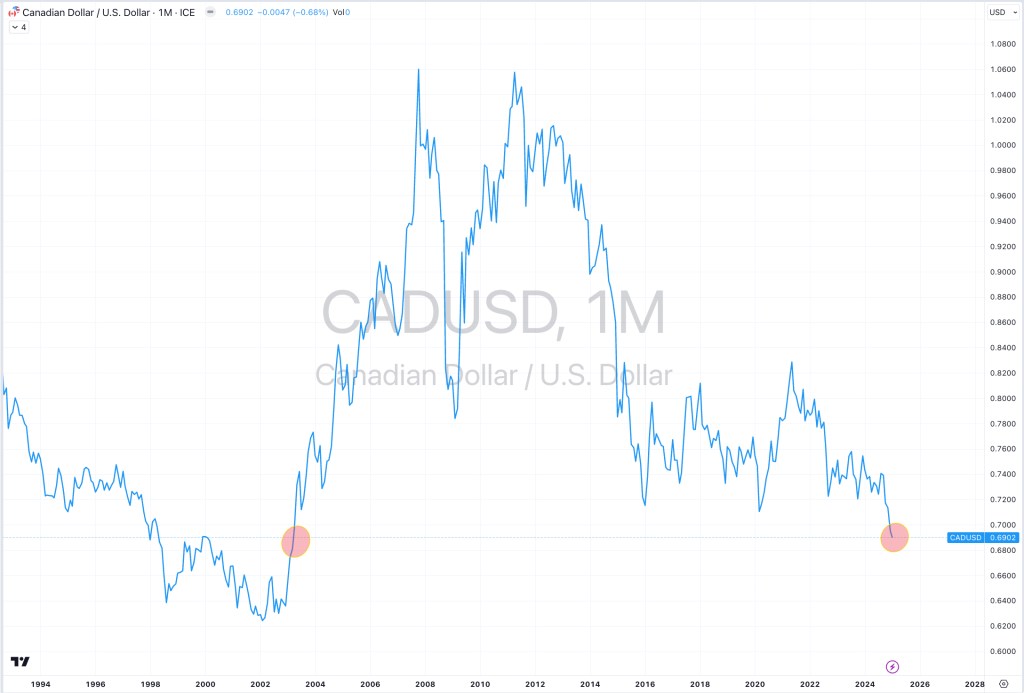

The #CAD/USD is registering a weekly oversold reading.

The larger picture sees the #Loonie (not withstanding the lower spike in January 2016 and March 2020) trading at its lowest against the Greenback in 22 years.

American companies would be well advised to buy up cheap Canadian assets and see if they can work their way through alleviating tariff concerns……

or perhaps Americans can buy property in Alberta, Newfoundland/Labrador, Nova Scotia or New Brunswick?

and possibly immigrate??

At the very least, #Canada is on sale, on a USD basis……

February 1, 2025

rob@karriasset.com.au

January 18, 2025 Leave a comment

The #Canadian Dollar is at its lowest weekly and monthly closing price since April 2003.

On a weekly basis, it is trading at one of my extremes.

Not yet on a monthly basis,

but there lows in the #loonie correlates to the overall #commodity complex.

January 18, 2025

rob@karriasset.com.au

December 19, 2024 Leave a comment

I don’t think the bottom in the AUD/USD is in yet but its close.

Holding 0.6170 is a requisite.

Irrespective, Australia is on sale.

December 19, 2024

rob@karriasset.com.au

September 4, 2024 Leave a comment

It’s nearly 10 years since Australian Iron Ore and Lithium mining company, Mineral Resources (MIN.AX) last traded this many percentage points below its 200 week moving average.

September 4, 2024

by Rob Zdravevski

rob@karriasset.com.au

September 3, 2024 Leave a comment

I’ll still waiting for lower uranium, copper and iron ore prices.

Equally, I’m not interested in oil or gold unless they are 20% lower than today’s price.

It all may sound odd as I’ve been warming towards commodities for the past few months…….it’s just not these ones, yet!

September 3, 2024

by Rob Zdravevski

rob@karriasset.com.au