Australia is on sale

December 19, 2024 Leave a comment

I don’t think the bottom in the AUD/USD is in yet but its close.

Holding 0.6170 is a requisite.

Irrespective, Australia is on sale.

December 19, 2024

rob@karriasset.com.au

Trying to hear what's not being said

December 19, 2024 Leave a comment

I don’t think the bottom in the AUD/USD is in yet but its close.

Holding 0.6170 is a requisite.

Irrespective, Australia is on sale.

December 19, 2024

rob@karriasset.com.au

December 9, 2024 Leave a comment

ANZ Group’s (Bank) stock price confirmed its downtrend (on a daily basis) on November 27, 2024, when #ANZ.AX was trading around $31.60.

Now, the stock price (currently at $30.20) is a whisker from confirming a ‘weekly’ downtrend.

I think the stock will ladder its way down to $26.15.

That’s 13% lower than today’s price.

In the meantime, I’ll monitor if the downtrends develop strength,

and let’s watch the magnetic pull of the 200 week moving average.

December 9, 2024

rob@karriasset.com.au

July 11, 2024 Leave a comment

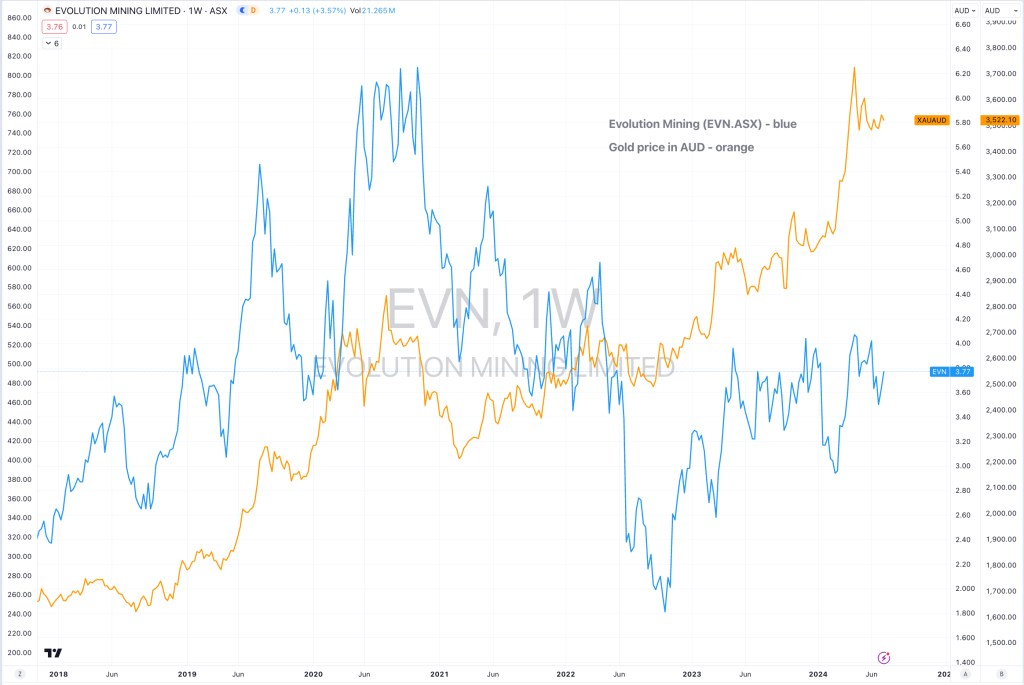

The Gold price in AUD has risen yet the equity price in gold mining companies are lagging and subdued.

Here is a study of the stock price of ASX listed Evolution Mining and the Gold price in AUD.

Mining is difficult…..when publicly listed, you are forced to produce, irrespective of the costs.

And it matters how an investor expresses their view relating to a particular theme or idea.

July 11, 2024

by Rob Zdravevski

rob@karriasset.com.au

December 23, 2023 Leave a comment

Mexico’s stock market has hit an all-time high, following a recent 6 week winning streak.

In fact, the index has risen 8 of its past 9 weeks.

This week, Mexico’s main index registered a quinella of ‘overbought extremes’ and while momentum can suggest prospects of an extended move higher, my probability is conditioned towards selling, trimming and/or short.

Some may dismiss the importance of Mexico’s equity market but it’s GDP is ranked 15th in the world, which isn’t not too far away from Australia’s position at 13.

https://countryeconomy.com/countries/compare/mexico/australia

Incidentally, since the lows seen in 2009, the ASX 200 has risen 131% while Mexico’s IPC Index has climbed 225%.

December 23, 2023

by Rob Zdravevski

rob@karriasset.com.au

October 26, 2023 Leave a comment

The market swoon in the ASX 200 should be nearing its conclusion.

The ASX 200 is a whisker from trading 2.5 standard deviations below its weekly mean.

The study below shows the various moments it has done so over the past 10 years.

Probability suggests allocating money at such moments but you’ll be disappointed if you’re seeking quick results.

October 26, 2023

by Rob Zdravevski

rob@karriasset.com.au

June 28, 2023 Leave a comment

An Aussie inflation is abating…

Australian inflation rates have eased from 8.4% to 5.6%.

My notes are calling for 4.8% – 5% before (like the Canadian story in the immediately preceding post) inflation makes another move higher.

So, I’ll look for the Australian 2 year bond yields (currently 4.05%) to fall to the 3.60% – 3.35% range before rates embark on their next wave higher.

This move in interest rates should also extend the rally in growth stocks.

Also, watch for the AUD/USD to also decline a little more.

Until then, recent buyers of bonds will make money, perhaps equity like returns?

While that is playing out, I’m then looking for a 3rd wave of inflation in the form of ‘excuse inflation’ as prices of raw materials and finished products remain stubborn with sellers reluctant to discount and adjust.

It should be a short lived 3rd wave of inflation before meaningful demand destruction takes the upper hand and forces the sellers hand.

A later date, we’ll look for much more lower interest rates for the Aussie 2’s, maybe between 1.70% and 2.30%, 15 months from now?

That’s when bond owners will do very well.

June 28, 2023

by Rob Zdravevski

Karri Asset Advisors

rob@karriasset.com.au

June 16, 2023 Leave a comment

The blue line in the attached chart represents the Brazilian 2 year bond yield.

It has fallen from 14.8% to 11.4%.

The orange line plots Brazil’s inflation rate.

It has abated from 12% to 4%.

Today, Brazil’s inflation rate is back to where it spent most of 2018 and 2019. Funnily, it’s also at the same level as the United States.

The Brazilian central bank started hiking rates in March 2021. That was 1 year before G10 nations did.

Brazil’s central bank rates increased by a factor of 7.

From 2% to 13.75%.

They stopped raising rates in September 2022 and now for the 6th consecutive meeting have paused.

It would bode well for the central banks of other commodity sensitive economies such as Australia and Canada to study Brazil’s interest rate strategy, although Aussie and Canadian citizens are amongst the most indebted households in the world.

This poses a social and political risk to those central banks possibly ‘breaking the system’.

Brazilians are not so indebted.

While I expect the Brazilian 2 year bond yield to converge towards its 200 week moving average, perhaps somewhere close to 9.20%, for now bond yields are oversold and they should now hold these levels and move a little higher as will inflation.

p.s. at the bottom of this page are 3 links of recent articles I have written on the topic Brazilian interest rates.

June 16, 2023

by Rob Zdravevski

rob@karriasset.com.au

June 10, 2023 Leave a comment

There is more to this analysis, but the chart and notations below are keeping simple.

Today, the AUD/USD needs to break that most immediate previous high of 0.6818, but I think it’ll peak and exhaust itself at 0.6805 (+/- 10bps)

Watching this currency cross along with the AUD/JPY could provide an interesting analog and correlation to ‘risk’ and a queue on the Nasdaq 100.

June 10, 2023

by Rob Zdravevski

Karri Asset Advisors

rob@karriasset.com.au

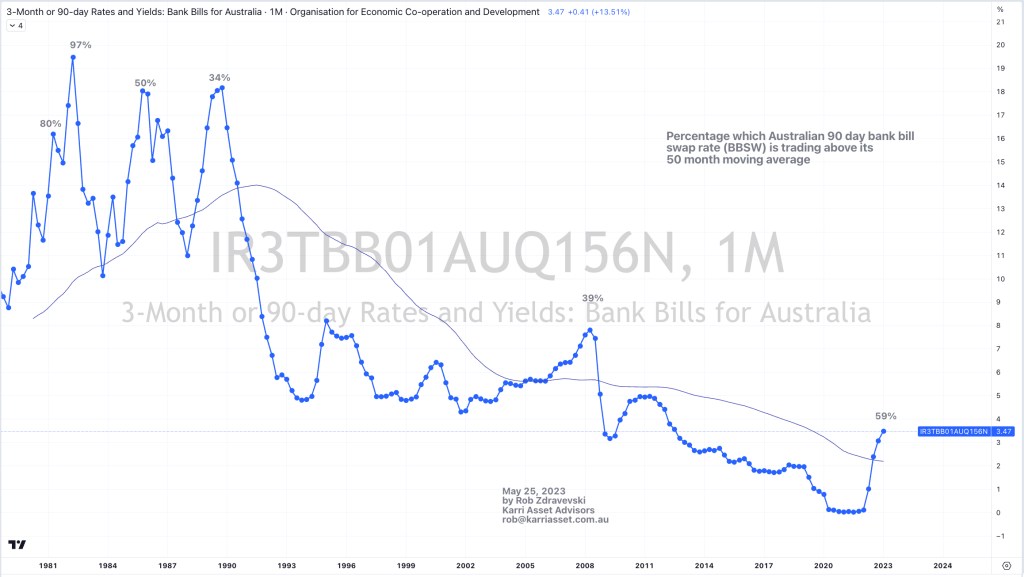

May 25, 2023 Leave a comment

Used in isolation, the study below tells me to to ponder a couple things;

When coupled with other observations in government bond yields and deflating commodity prices, it should (already is) lead towards lower inflation and GDP readings…….hence interest rates in the money markets should moderate by a 1% or little more, depending on the maturity you are watching.

For example, the Australian 2 year bond yield may decline from its current 3.58% to around the 1.80% region.

While the 90 day bank bill may ease from 3.47% to 2.40%.

The Reserve Bank of Australia policy changes will come many, many months later, for they are not a leading indicator nor a barometer.

May 25, 2023

by Rob Zdravevski

rob@karriasset.com.au

May 25, 2023 Leave a comment

The bias for the ASX 200 is lower.

Combined with my other studies and analyses, it’s price action is filling me with conviction.

Much like the S&P 500 (as written in an earlier post today), the ASX 200 has been trend less over the past year.

While this post-mortem validates my opinion that it would be a stockpickers market, invariably this has also left passive, index huggers wondering why adequate returns haven’t been easy to come by.

In the price chart below, the ASX 200 is yet to break the high seen in late January 2023.

That high remains below the high registered almost 2 years ago, in August 2021.

Furthermore, the recent March 2023 low was lower than its January 2023 low.

And the recent peak of 7,391 was not higher than the early February 2023 high of 7,568.

So we have a series of lower highs and lower lows.

For a bunch of reasons, it’s not a market which suggests piling into.

Inversely, it’s not selling to short it either.

May 25, 2023

by Rob Zdravevski

rob@karriasset.com.au