What’s next for Natural Gas prices

October 22, 2022 Leave a comment

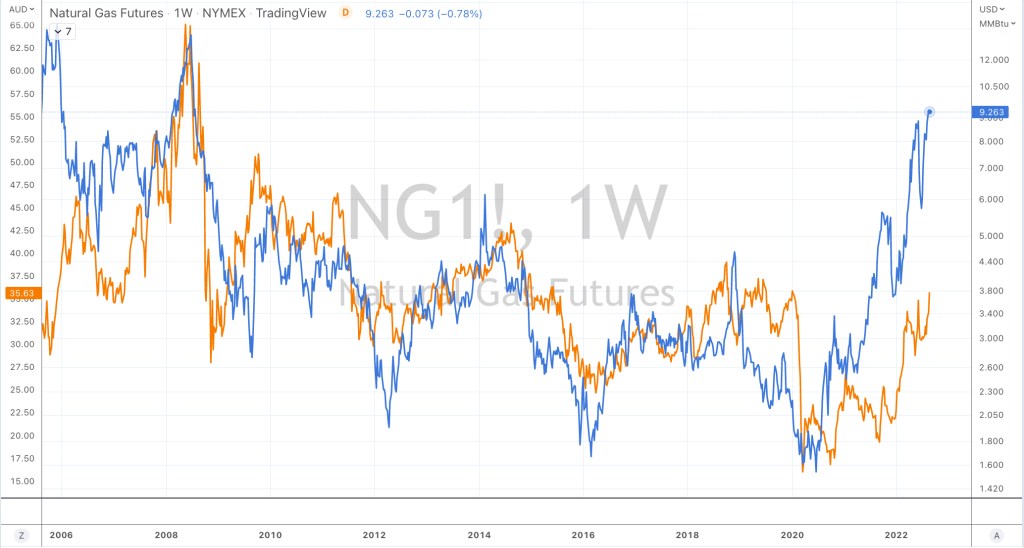

Today, the price of Natural Gas reached my $5 target, having halved from its (exuberant) $10 peak, only 2 months ago.

My series of posts commenced on June 7th, 2022 when I called Natural Gas the ‘mother of all peaks’.

In mid-late August 2022, I started to publish my views that the price of Henry Hub Natural gas would halve.

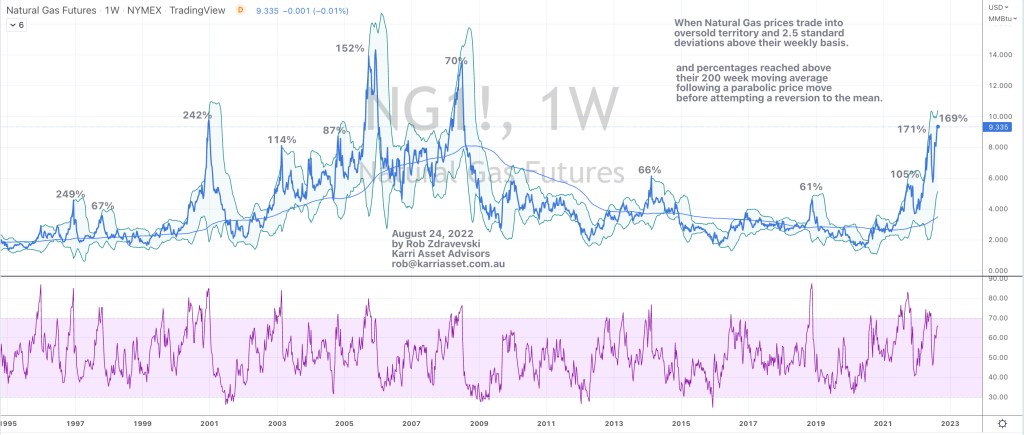

I warned of the risks chasing parabolic price moves in Natural Gas in this post.

On August 25th, 2022, 2 days following the peak and the original post, I made my $5 price target call and cryptically cited that it would have a negative affect of the stockmarket.

The S&P 500 closed at 4,199 on August 25th 2022.

Today, the S&P 500 closed at 3,753.

Even after this week’s 4.7% advance, the S&P has declined 10.6% over the past 2 months.

Then, this next note was written when Natural Gas reached its half way point at $7.50

On Sept 23rd, (a month into this trade), I refined the timing of when I expect to see my $5 target reached.

I said, “I see $5 in Natural Gas being reached in the last days of October or into the first 10 days of November 2022.”

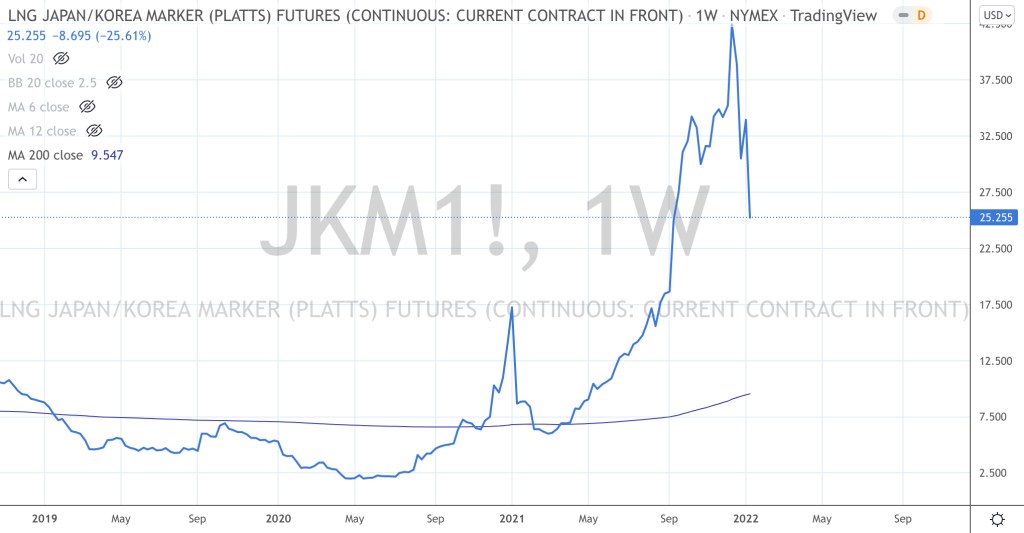

And this decline in Natural Gas (and pending moves across the energy complex) should have correlating effects to energy stocks and inflation, or rather deflationary effects.

In early September, I wrote about the correlation of the U.S. Natural Gas price with the Australian inflation rate

A few days ago, I added these comments along the same thinking.

And highlighted the massive declines amongst the previously rampaging ‘other’ gas prices.

Today, the price of Natural Gas reached my $5 target.

What’s next for the Natural Gas price?

I would expect a bounce over the next week or so before the weakness resumes.

Statistically, NG has declined for 8 weeks consecutive weeks. A streak that is hasn’t seen since for 10 years.

Natural Gas saw a 6 week declining streak in mid 2014 when it fell from $4.26 to $2.94.

A 7 week losing streak in 2010 and a 9 week streak of weekly declines in the 1st quarter of 2012.

Commodities, currencies, equities and bond yield seldom string together more than 7 consecutive weeks of one-way travel.

However, the downtrend across a few timeframes remains intact.

$4.76 – $4.80 is a major support for the Natural Gas price.

A decisive break below that, pending my other indicator work may increase probability of a visit of to $3.38 – $3.44 region.

$4.20 would be a more plausible bottom.

October 22, 2022

by Rob Zdravevski

rob@karriasset.com.au