Currencies tell the truth

August 5, 2024 Leave a comment

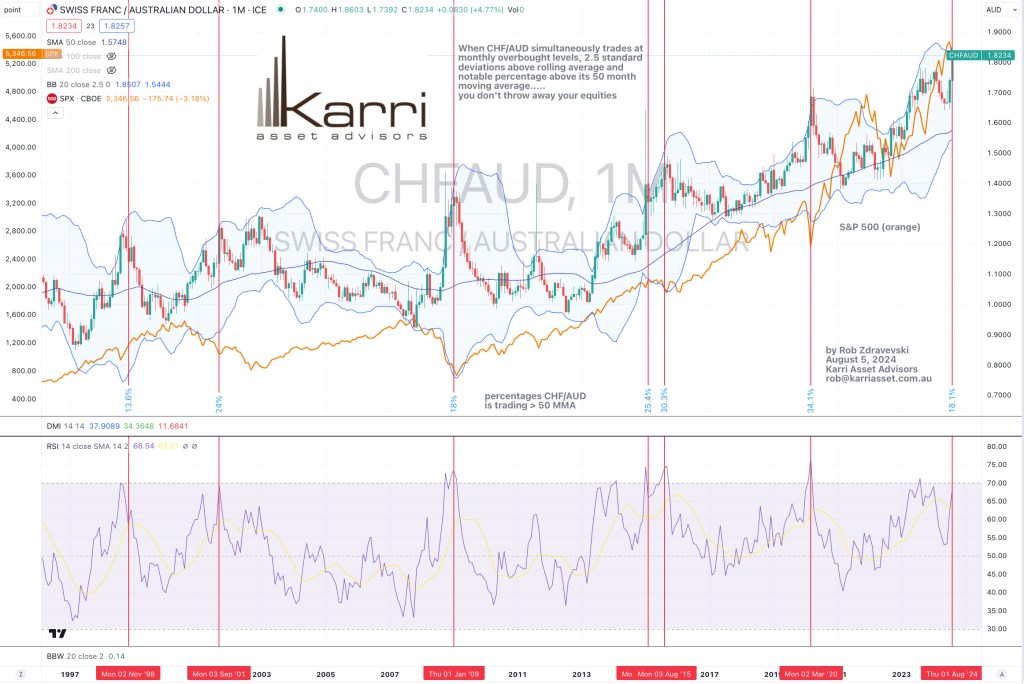

Worried? Risk averse?

That’s when investors huddle in the Swiss Franc or the Japanese Yen…..inversely they dispose of their Australian Dollars.

We are approaching the 7th time (in the past 30 years) that such defensive huddling and perhaps maximum risk aversion has occurred.

The attached monthly study shows that when the CHF/AUD simultaneously registers a monthly overbought reading, trades at 2.5 standard deviations above its rolling average and at a notable percentage above its 50 month moving average…….

you don’t throw away your equities, in a wholesale manner.

In fact, consider the antithesis.

August 5, 2024

by Rob Zdravevski

rob@karriasset.com.au