A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

U.S. 10 year minus U.S. 5 year government bond yield spread *

U.S. 10 year bond yield minus U.S. inflation rate (YoY)

GBP/EUR

GBP/USD

KOSPI *

Nikkei 225

Russell 2000

Toronto’s TSX

And the Israel’s Tel Aviv 35 index

Overbought (RSI > 70)

Russian 10 year government bond yields

Coffee – both Arabica and Robusta *

GBP/JPY

Netherlands AEX *

Hungary’s BUX *

Pakistan’s KSE *

Nasdaq Composite *

Nasdaq 100 *

NIFTY *

SENSEX *

Philadelphia Semiconductor Index (SOX) *

S&P 500 *

U.S. Regional Banks Index

Turkiye’s BIST 100 *

and Taiwan’s TAEIX *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Nasdaq Biotech Index

Singapore’s Strait Times Index *

Extremes below the Mean (at least 2.5 standard deviations)

South Korean 10 year government bond yield

Soybeans

CAD/GBP

Shanghai Composite Index *

China’s CSI 300 Index *

Oversold (RSI < 30)

North European Hot Rolled Coil Steel *

U.S. Midwest Hot Rolled Coil Steel *

Lumber *

Lithium Hydroxide *

And the Chinese RMB *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

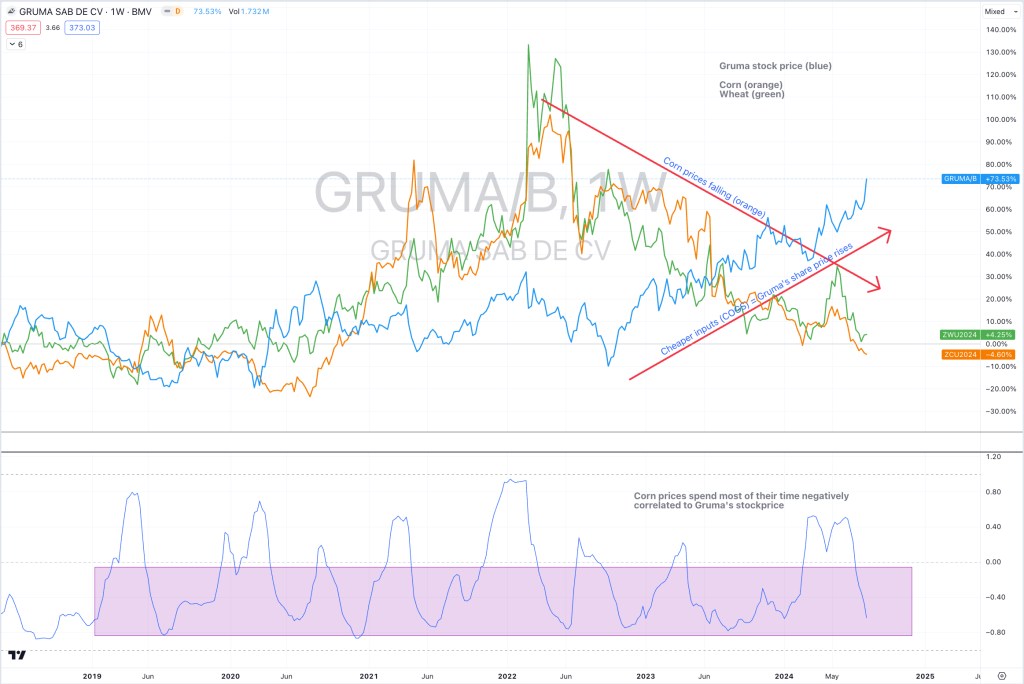

Corn *

Russia’s MOEX equity index

Notes & Ideas:

Government bond yields fell. Most of them for the 2nd consecutive week.

Except for the Belgium, Danish and Finnish 10’s.

The Australian 10 year minus U.S. 10 year bond yield spread has risen for 5 consecutive weeks.

Inversely, the U.S.10Y minus Aussie 10’s spread have fallen for 5 weeks.

Chilean 2’s are in a 4 week winning streak.

Czech 10’s have fallen fro 5 of the past 6 weeks.

Brazilian 10 year bond yields are not overbought anymore

And IEF is in the early stages of an upward trend.

Equities were mostly higher, again !

For example, the Nasdaq Composite has risen for 11 out of the past 12 weeks.

The S&P 500 has climbed higher for 5 of the past 6 weeks.

There was a stunning rotation late in the week, from large caps into the smaller and mid cap companies.

China’s CSI 300 and Shanghai Composite rose and broke their 7 week losing streak and the KOSPI broke its 5 straight weeks of advance.

The DAX is in a 4 week winning streak as is Indonesia’s IDX 30.

Indonesia’s main index has climbed 9.5% over the past 4 weeks.

The Developed World equities index ex USA along with the FTSE 250 have risen 4.4% over the past fortnight.

And Sweden’s OMX30 along with the Dow Jones Transports and Nasdaq Transports Index had bullish outside reversal weeks.

Commodities were mixed, although the bias was towards weakness, again.

Again, Cocoa, Coffee, Tin, Orange Juice and Urea were the prominent winners for the week.

Aluminium, Coal, Oil, Gases, Grains, PGM’s, Nickel and Cattle were the largest losers.

WTI Crude, Brent Crude, gasoline and Heating Oil both broke their 4 week winning streaks.

Cotton moved out of oversold territory.

Lean Hogs have slumped for 10 of the past 12 weeks, falling 15% over that time.

Natural Gas broke its 4 week losing streak, by rising 0.4% for the week. Natural Gas has posted a 26% loss during the previous 4 weeks.

Palladium fell 7%, shaving half off the 15% advance seen in the previous 3 weeks.

Lumber showed some spirit although it has fallen for 11 weeks of the past 16 weeks.

And Lithium Hydroxide has now spent 52 consecutive weeks in weekly oversold territory.

Currencies continue to provide action, again and again.

The Yen bounced and the extremes seen amongst its pairs are not there this week.

The AUD has risen for 4 consecutive weeks against the CAD, INR, NZD and USD,

While it broke its trending streaks against the JPY, EUR, SGD and THB.

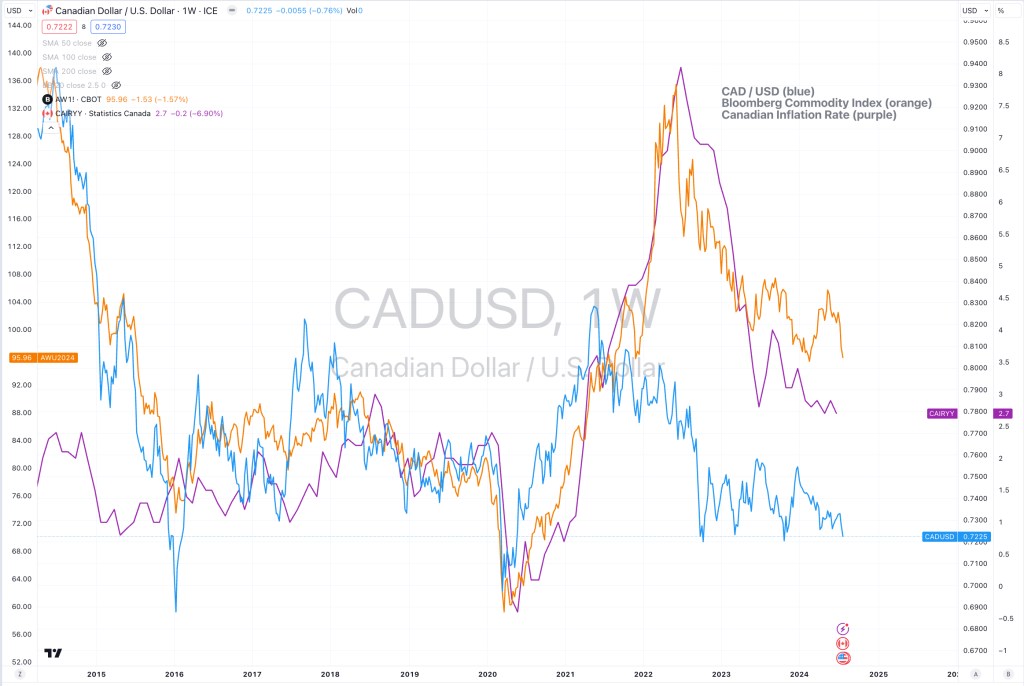

The Canadian Dollar was mostly weaker.

The CAD/AUD has fallen for 5 weeks, while the Loonie against the USD has climbed for 5 straight weeks.

And strength in the British Pound continue.

The larger advancers over the past week comprised of;

Baltic Dry Index 1.6%, Cocoa 6%, Arabica Coffee 8.7%, Tin 4.5%, Orange Juice 3.8%, Robusta Coffee 10.3%, Urea Middle East 1.7%, Developed World equities index ex USA 2.3%, KBW Bank Index 4.3%, DAX 1.5%, DJ Industrials 1.7%, DJ Transports 1.6%, MIB 1.7%, HSCEI 2.4%, Hang Seng 2.8%, IBEX 2.1%, BOVESPA 2.1%, S&P SmallCap 600 5.5%, Russell 2000 6.1%, KRE Regional Banks 8.7%, FTSE 250 2%, S&P MidCap 4.4%, Mexico 5%, Nasdaq Biotech 6.8%, Stockholm 2.9%, Philippines PSE 2.4%, SET 1.5%, SMI 3%, SOX 2,1%, STI 2.6%, TAEIX 1.5%, TSX 2.8%, ASX 200 1.8%, ASX Industrials 1.9%, ASX Small Caps 2.6%, BIST 2.2% and Israel’s TA35 rose 2.6%.

The group of largest decliners from the week included;

Aluminium (2.8%), Bloomberg Commodity Index (1.7%), China Coking Coal (3%), Heating Oil (3.6%), HRC (1.5%), Cattle (2.2%), JKM in Yen (5.2%), Nickel (3.1%), Palladium (6.5%), Platinum (3.1%), Gasoline (1.7%), Biodiesel (3.4%), Sugar (4.7%), S&P GSCI (2.5%), Dutch TTF Gas (4.1%), Brent Crude (2.2%), Gasoil (3.1%), Silver in AUD (1.9%), MOEX (5.6%), Corn (2.1%), Soybean (5.7%) and Wheat fell 6.7%.

July 14, 2024

by Rob Zdravevski

rob@karriasset.com.au