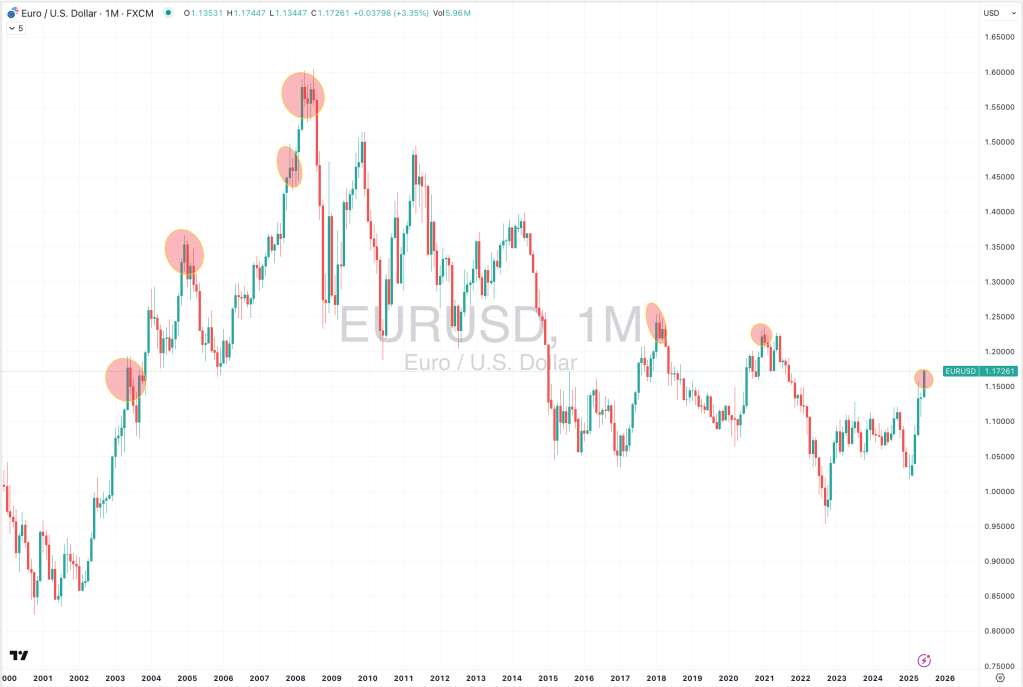

Extreme strength in the EUR/USD

June 26, 2025 Leave a comment

The Euro is trading at a rare pricing extreme (according to my metrics and work) compared to the U.S. Dollar, seen for the 7th time in 25 years.

Inversely, the U.S. Dollar is at a monumental low against the EUR.

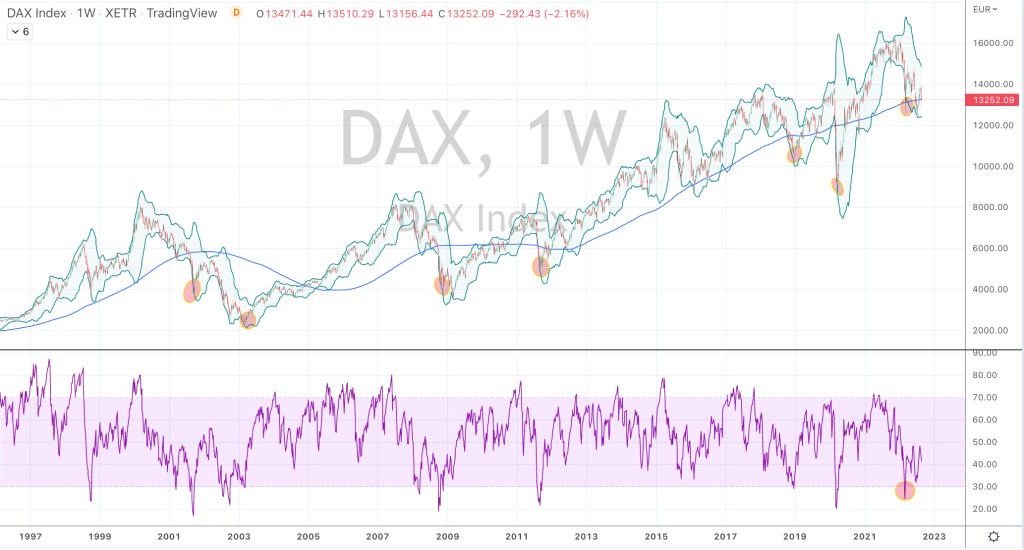

Europeans should be buying American assets, should they think their capital is either welcomed or will be treated well there…….

June 26, 2025

rob@karriasset.com.au