Watch the signals, not the headlines

May 7, 2025 Leave a comment

Today I was giving some presentations in the big smoke.

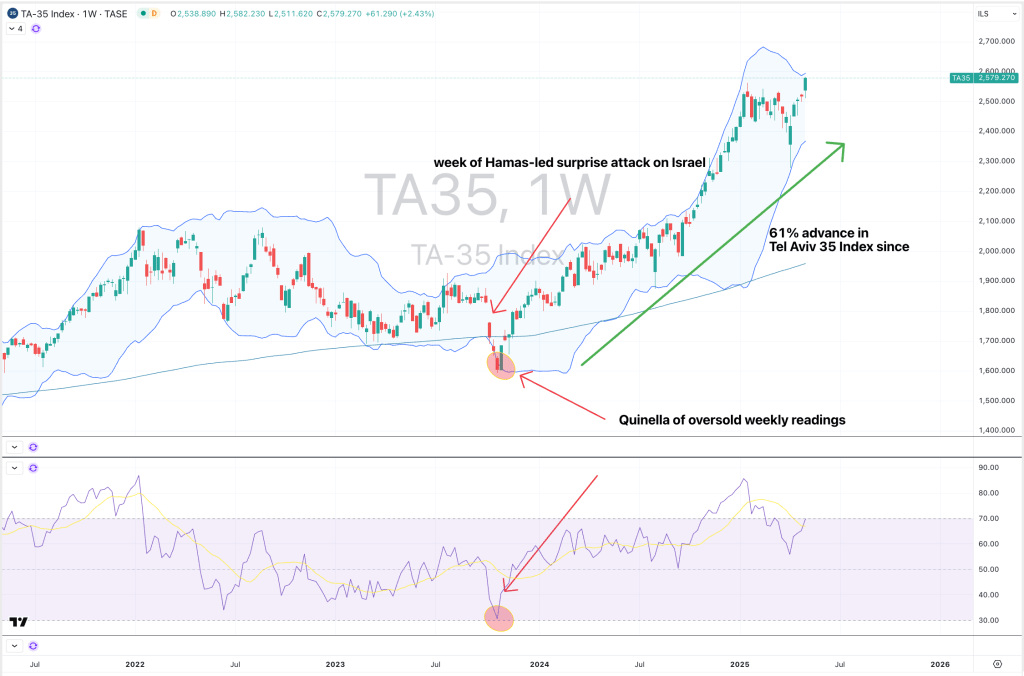

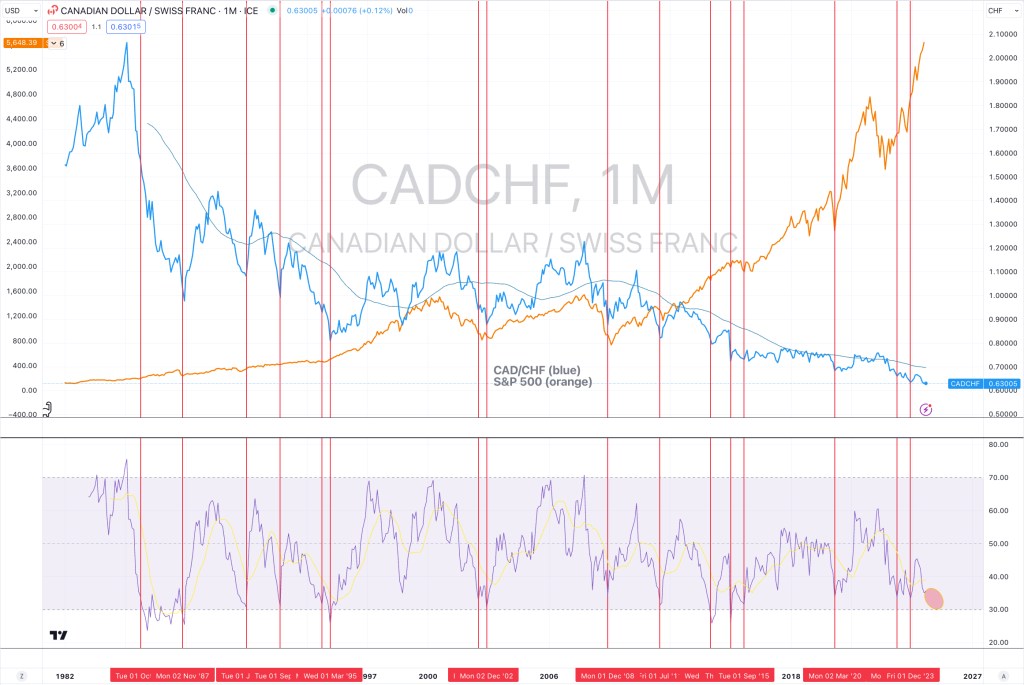

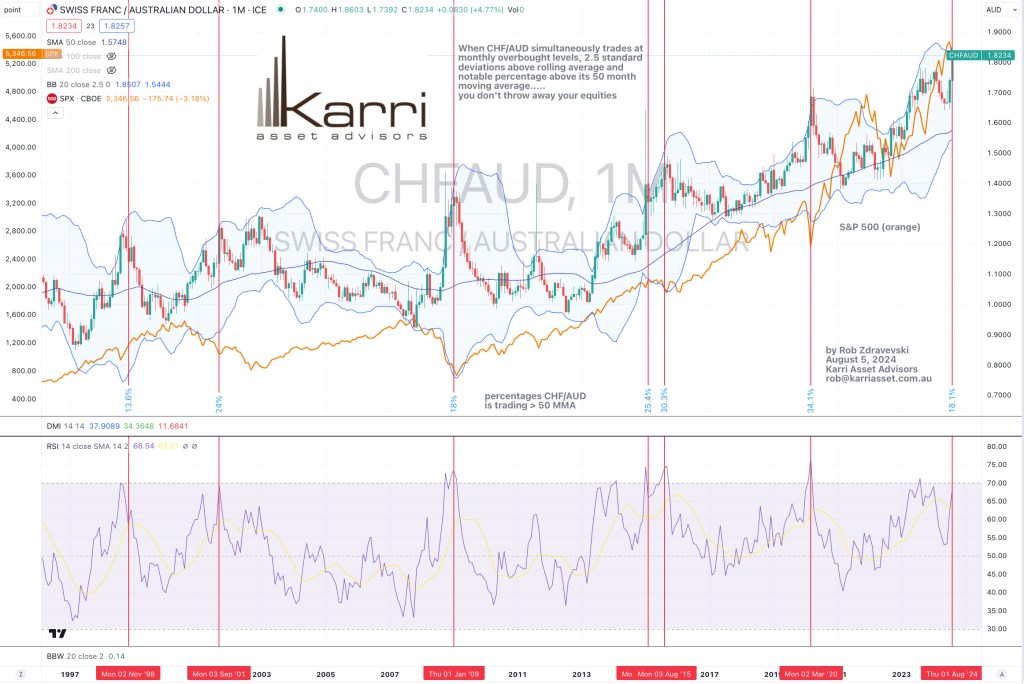

I was espousing the thesis of “trading the signals, not the headlines”.

Under the category of “when you think you know capital markets”, I used these 2 examples of how perverse things can become…..

but it helps to use the signals and not the headlines and certainly not “the narrative”.

May 7, 2025

rob@karriasset.com.au