The energy dominos are falling one by one

October 25, 2022 Leave a comment

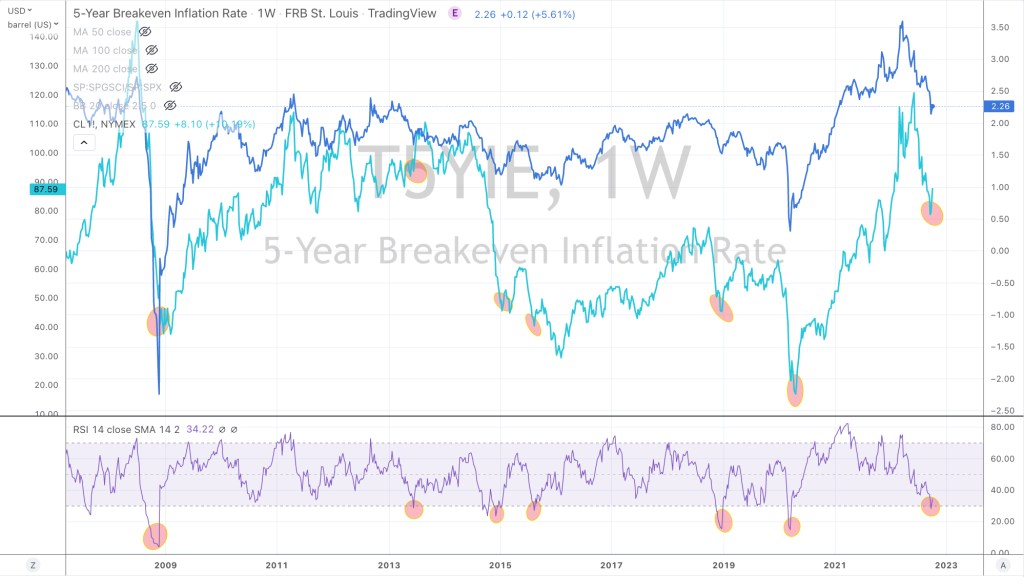

Now that RBOB Gasoline, Natural Gas, Dutch TTF Gas and the JKM LNG Marker prices have halved, I think other commodities in the energy complex are at a critical juncture.

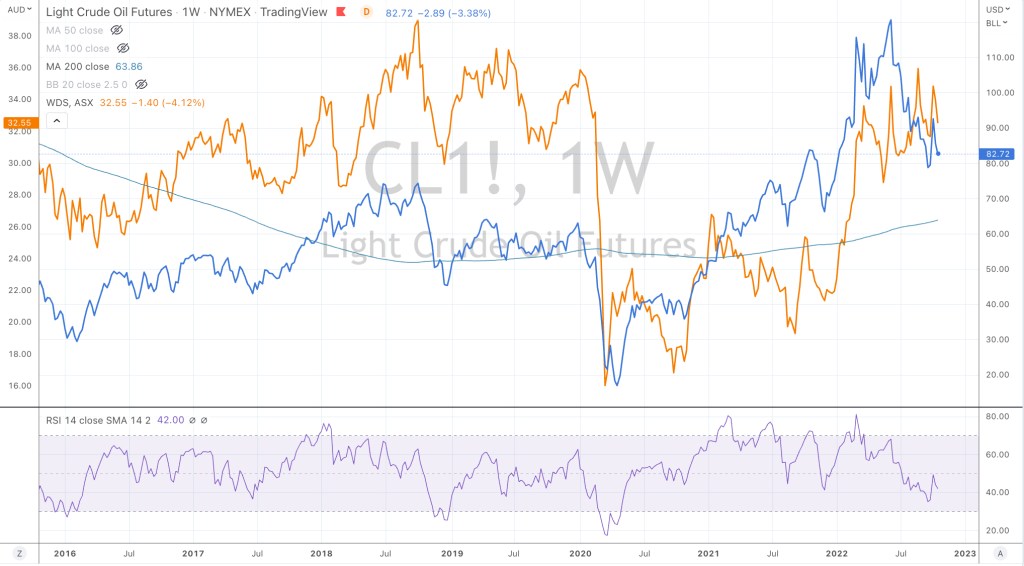

While I remain cautious and specifically bearish on crude oil prices (I expect WTI Crude to move towards $65-$68 from its current $84.50), the larger declines could be seen in Heating Oil and Diesel (Gasoil).

They are currently trading at $3.95 and $10.82 respectively.

Both Heating Oil and Gasoil remain in downtrends across various timeframes and now I am watching a few more indicators to confirm strength and the next leg downwards.

If so, there could be 40% further downside in Heating Oil and Gasoil.

This view all seems quite perverse as the Northern Hemisphere winter approaches.

p.s. the largest use of diesel is in transportation, not electricity generators

I’ll write when/if the probability of this increases.

October 25, 2022

by Rob Zdravevski

rob@karriasset.com.au