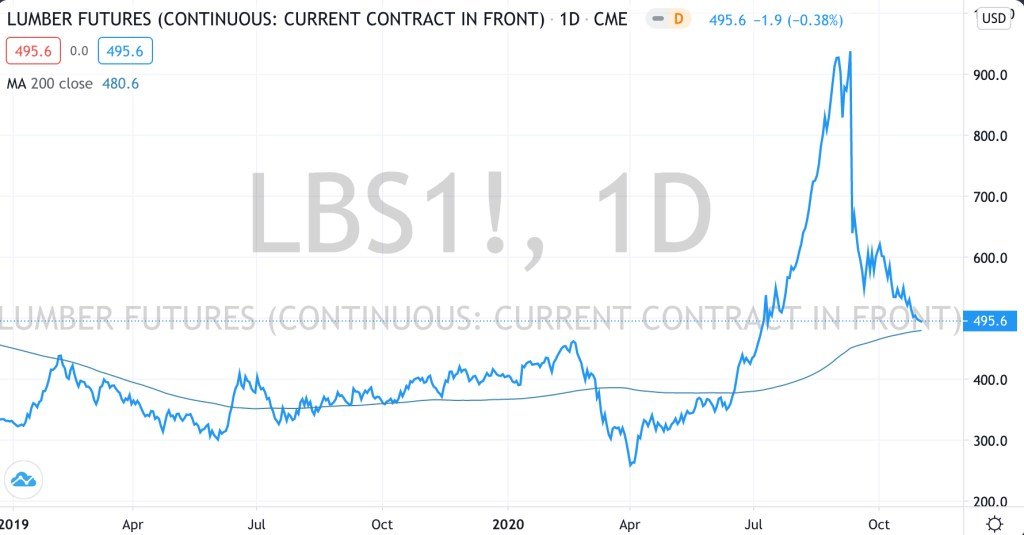

Lumber – nearing a buying moment

May 3, 2023 Leave a comment

The last time Lumber saw a closing price this low was 3 years ago.

But it’s not telling me to buy it yet.

Following the buying frenzy to secure supply, this savage washout and mean reversion will have a deflationary effect but also create discounting pressures on those whom are holding inventory and insisting on charging last years prices.

There will be a lag for these ‘market’ prices to flow through to your lumber yards and suppliers (why drop prices when you can maintain a story about scarcity and supply blockages) but at least you’ll know that lower prices will filter through.

Furthermore, those who have delayed construction projects should be rewarded.

Whilst, it’s relevant to note that the price of Lumber also has a correlation with the share prices of listed homebuilders.

May 3, 2023

by Rob Zdravevski

rob@karriasset.com.au

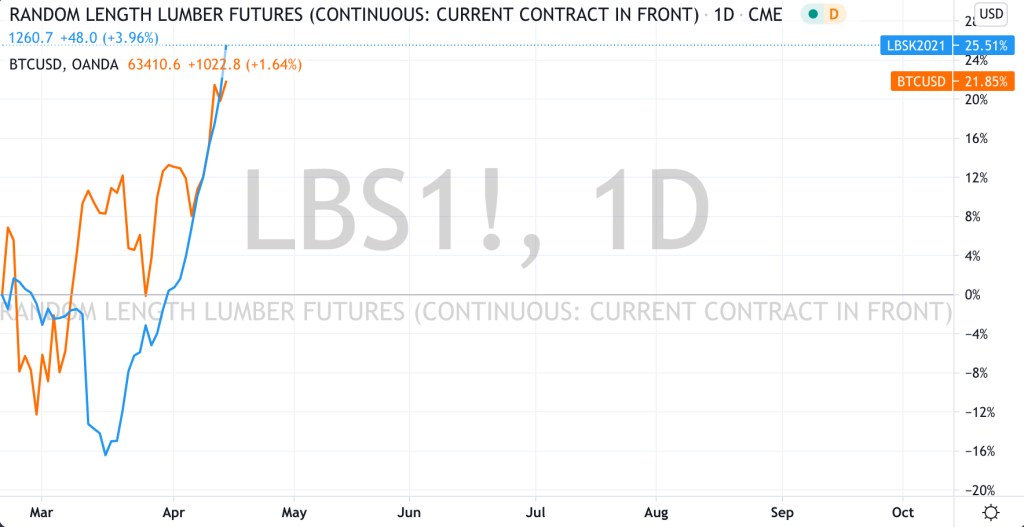

Yes…..Lumber. (see chart below)

All have doubled over the past 4 months.

Where to next….

Oil’s bullish trend is still intact,

Silver is overbought, at extremes and warrants caution if you are long (susceptible to a pullback to $18),

and Lumber is a Sell. With its 3 standard deviation above its ‘weekly’ mean and an outside reversal week, it’s time to cash in the (wood) chips.

by Rob Zdravevski

July 27, 2020

rob@karriasset.com.au