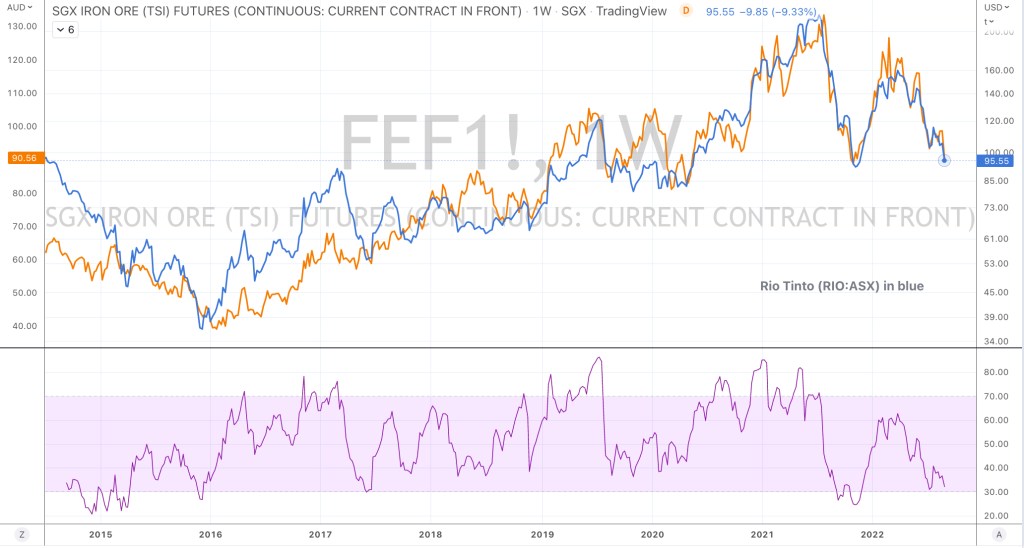

One more dip in Iron Ore

November 12, 2024 Leave a comment

The price action and ‘set-up’ for the stock prices of various Iron Ore companies isn’t attractive.

I’m watching a few signals before I become confident about the expected ugliness.

BHP and Fortescue may be the first to make the move lower.

If so, Rio Tinto’s ASX stock price could test A$93.00 initially and I’d become a giddy buyer at A$85.65.

November 12, 2024

rob@karriasset.com.au