A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

Extremes “above” the Mean (at least 2.5 standard deviations

U.S. 5-7 year corporate bond yield

Brazilian 10 year government bond yield

Japanese 2 and 10 year government bond yields

TBX

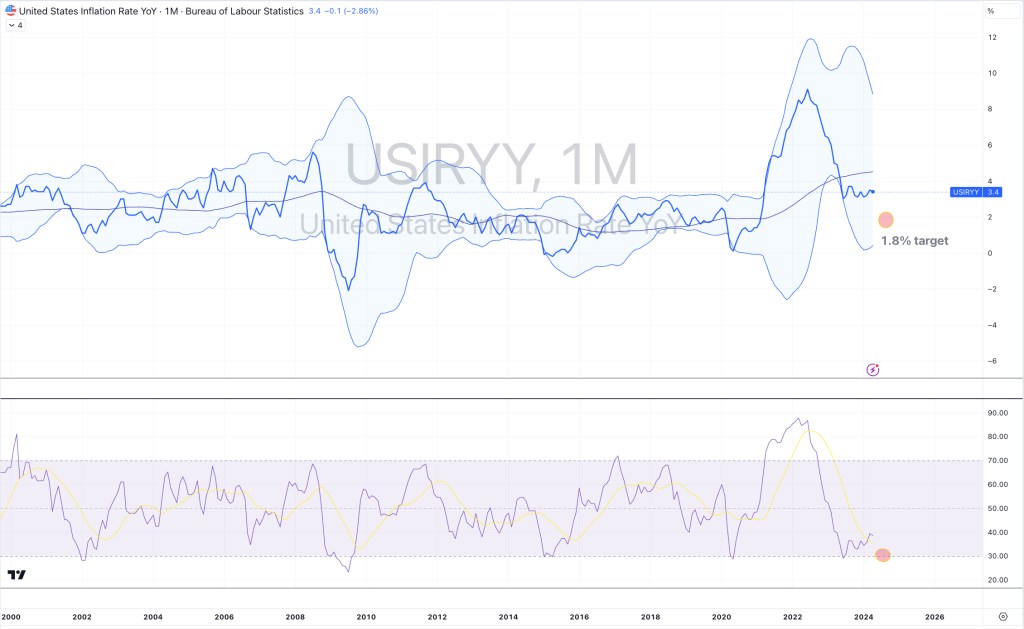

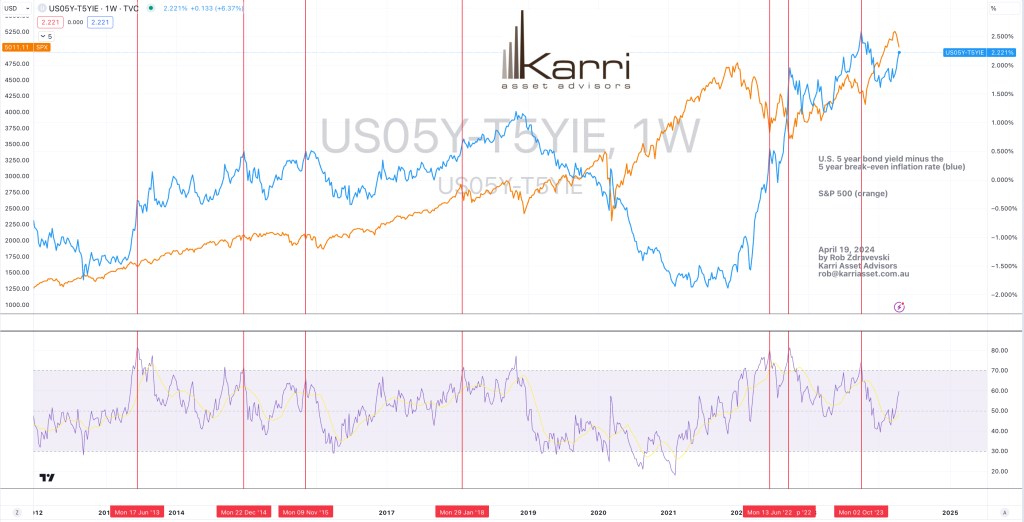

U.S. 5 year government bond yield minus U.S. 5 year inflation breakeven rate

U.S. 5 year government bond yield minus U.S. 3 month bill yield

U.S. 2, 3, 5, 7, 10 and 20 year government bond yields

U.S. 10 year government bond yield minus U.S. 10 year inflation breakeven rate

Bloomberg Commodity Index

U.S. Dollar Index

Gold Volatility Index

Copper

AUD/JPY

AUD/THB

COP/USD

Austria’s ATX

Russia’s MOEX

And India’s NIFTY 50

Overbought (RSI > 70)

Russian 10 year bond yield

U.S. 10 year bond yield minus Australian 10 year bond yield

U.S. 10 year bond yield divided by Australian 10 year bond yield

Aluminium

Cocoa

Biodiesel

CRB Index

Brent Crude Oil

Coffee (Robusta)

AEX

Budapest

Italy’s MIB

TAIEX

And Turkiye’s BIST 100

The Overbought Quinella – Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

U.S. 10 year bond yield minus German 10 year bond yield

Coffee (Arabica)

Tin

Silver in AUD and USD

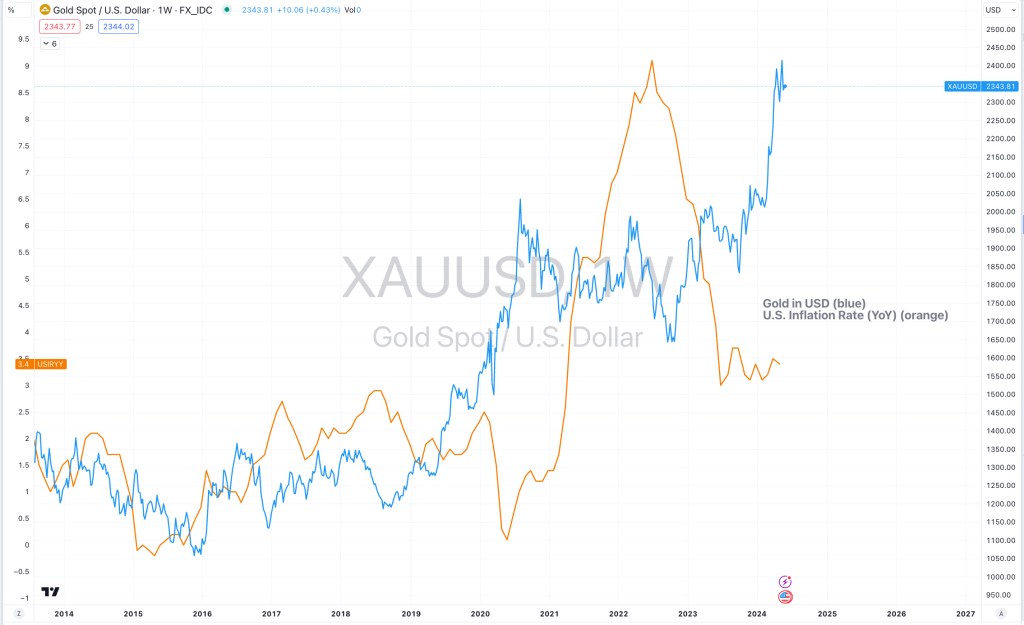

Gold in AUD, CAD, CHF, EUR, GBP, USD and ZAR

Pakistan’s KSE equity index

Extremes “below” the Mean (at least 2.5 standard deviations)

IEF

IEI

SHY

Lumber

Urea (U.S. Gulf)

Oats

EUR/USD

GBP/USD

JPY/AUD

DKK/USD

HKD/USD

KRW/USD

SEK/USD

Oversold (RSI < 30)

Australia 10 year yield minus U.S. 10 year yield

Chinese 10 year government bond yields

Australian Coking Coal

Chinese Coking Coal

Lithium Hydroxide

Shanghai Rebar

The Oversold Quinella – Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

None

Notes & Ideas:

My immediate suggestion is to compare last week’s edition to this one. Readers will note many changes.

It seemed as government bond yields rose, which is mostly true in Australia, USA, Great Britain, Japan, South Korea and New Zealand……

However, we also saw declining yields in Switzerland, Spain, Germany, France & China.

Last week, I wrote, “many yields are showing signs of breaking north of their recent sideways pattern”. This was certainly the case.

Bonds provided an equal amount of action this past week, with my spreads and bond ETF’s entering the list.

The big news in Equities was observing many indices leaving overbought territory as prices declined.

A few winner still managed to appear in this week’s list, albeit only several.

Oslo is in a 7 week winning streak, while Mexico’s main index broker its 4 week run of consecutive higher prices. The latter also posted an outside bearish reversal week.

Toronto’s TSX broke its 8 week winning streak and posted a bearish outside reversal week.

South Africa has risen for 4 weeks straight as has the TAIEX. The latter has climbed higher for 12 of the past 13 weeks.

And last week’s reference to those equity indices which posted bearish outside reversal week’s held true.

Commodities were mixed.

We saw strength in precious metals, base metals, softs and coals.

It is worthy to note that many commodities which appear in todays overbought section saw those extremes tickled earlier in the week, before easing off in the last couple days.

Iron Ore isn’t overbought.

Gold prices across various currencies remains overbought.

Interestingly, Platinum has risen 10% over the past 3 weeks while Gold’s advance (in USD) has been 8%.

Renewed media noise about the rise in oil, gold, silver and copper prices coincides with them trading at overbought extremes.

Coffee prices were amongst the largest gainers for the week, again. Robusta Coffee has risen 26% over the past 7 weeks.

While it remains oversold, China Coking broke is 7 week losing streak.

Rice broke its 6 week losing streak with a 7% rise, nearly halving the 15% decline seen during that declining trend.

Oats mostly recovered last week’s 7% decline.

Cotton has fallen for 5 straight weeks, inversely, Gasoline has risen for 5 consecutive weeks.

Cocoa has been overbought for 25 weeks, while putting together a recent 7 week winning streak.

Aluminium has risen for 7 straight weeks, rising 14% over that time.

And Lithium Hydroxide has now spent 40 consecutive weeks in weekly oversold territory, however it rose 8%.

Currencies extended last week’s activity with U.S. strength sending many reciprocals into oversold territory.

The effect of a rising USD, rendered weakest in the AUD and many others.

In its own right, the CAD was stronger.

The Yen was stronger against all, except the USD.

The Euro was weaker against everyone.

The British Pound was mixed for the week, again.

The BRL has fallen for 6 straight weeks against the USD.

And the Kiwi broke its 6 weeks of consecutive versus the Aussie.

The larger advancers over the past week comprised of;

Aluminium 1.7%, Rotterdam Coal 2.9%, Baltic Dry Index 6.2%, Cocoa 6.9%, Coffee 3.7%, JKM LNG in Yen 12.9%, Lithium 8.2%, Tin 15%, Newcastle Coal 2.7%, Orange Juice 2.6%, Palladium 5.2%, Platinum 6.5%, Shanghai Iron Ore 6.1%, Dutch TTF Gas 15.5%, Silver in AUD 3.3%, Silver in USD 1.4%, Gold in AUD 2.4%, Gold in USD 0.6%, Oats 6.1%, Rice 6.6%, Robusta Coffee 4.2%, KSE 2.8%, Oslo 1.8%, SET 1.5%, TAIEX 2%, FTSE 100 1.1%, Vietnam 1.7%, ASX Materials 2.9%, BIST 2% and the ASX Industrials rose 1.2%.

The group of largest decliners from the week included;

WTI Crude Oil (1.4%), Cotton (4.2%), Heating Oil (3.2%), Lumber (5.6%), Biodiesel (2.1%), Sugar (7%), Raw Sugar (1.7%), Urea U.S. Gulf (5.6%), Gasoil (2.7%), Urea Middle East (2.8%), Wheat (2%), Shanghai (1.6%), CSI 300 (2.6%), All Developed World ex USA (1.3%), KBW Bank Index (3.7%), China A50 (3%), DJ Industrials (2.7%), IBEX (2.1%), Indonesia (2.6%), S&P SmallCap 600 (2.9%), Russell 2000 (2.8%), Nasdaq Composite (0.5%), KRE Regional Banks (3.5%), S&P 400 Midcaps (2.9%), Mexico (2.6%), Nasdaq Biotechs (1.9%), SOX (1.5%), S&P 500 (1.6%), Nasdaq Transports (3.1%) and Toronto’s TSX fell 1.6%.

April 14, 2024

by Rob Zdravevski

rob@karriasset.com.au