Mmmm…..Commodities

July 22, 2023 Leave a comment

I am warming to #commodities.

Readers of my posts may note that I’ve been bearish commodities for about 15 months, which was soon after the Russian invasion of Ukraine.

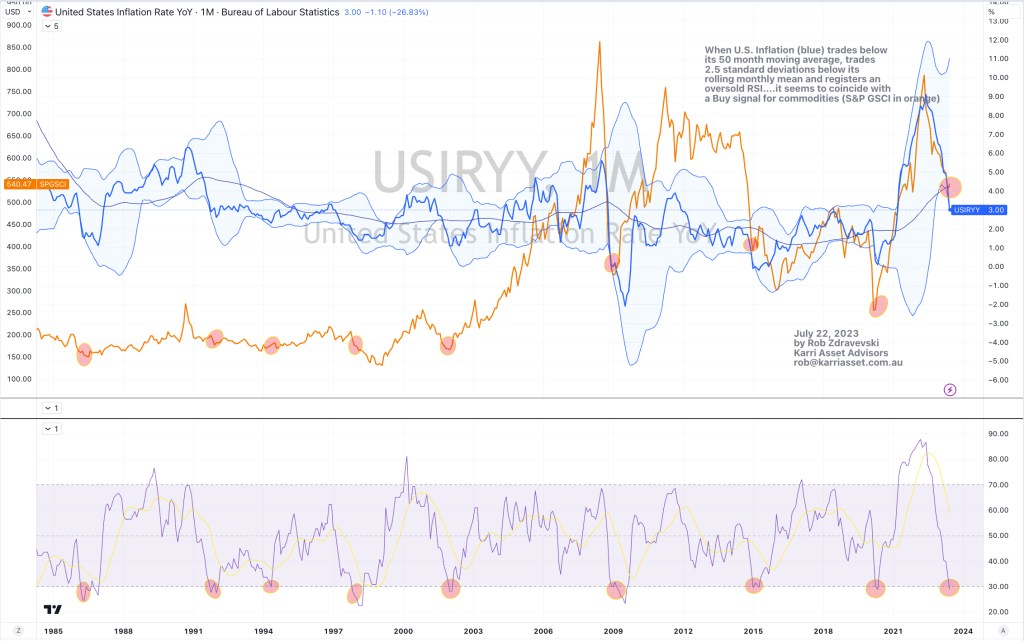

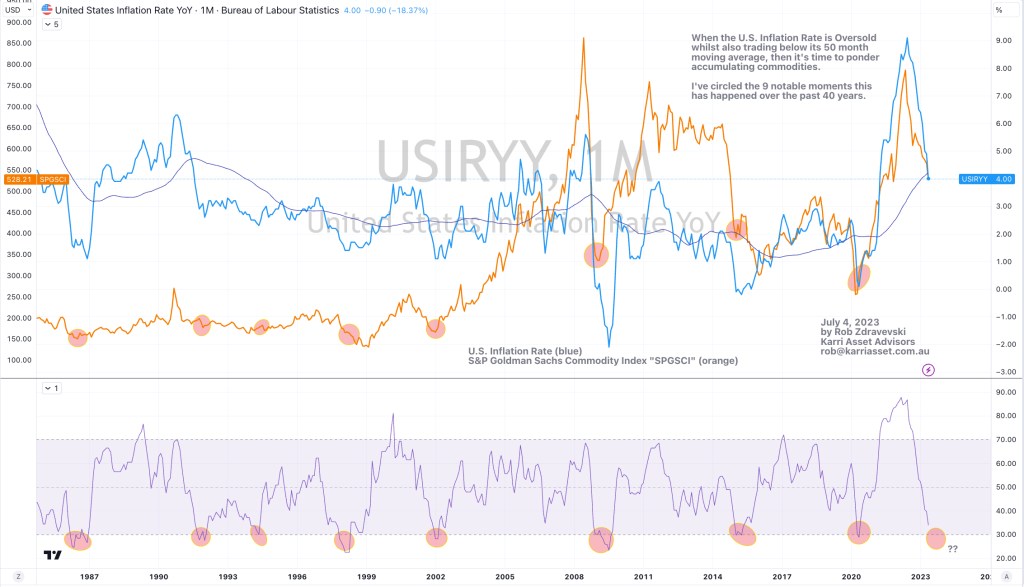

I have a host of reasons for my commodity bullishness but the study below helps paint a correlated picture to support my broader thinking.

When the U.S. Inflation Rate (blue) ventures below its 50 month moving average, it trades 2.5 standard deviations below its rolling monthly mean and also registers an oversold RSI reading….it seems to coincide with a Buy signal for commodities, with the S&P Goldman Sachs Commodity Index represented in orange.

This chart reprises one posted 6 days ago.

July 22, 2023

by Rob Zdravevski

rob@karriasset.com.au