A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Chinese & Dutch 10 year government bond yields *

IEF & TLT *

Australian 10 year minus U.S. 10 year bond yield spread *

Gold in AUD, CHF, EUR, GBP and ZAR

AUD/IDR *

AUD/CAD *

AUD/SGD

AUD/USD

And Brazil’s BOVESPA equity index *

Overbought (RSI > 70)

Urea (Middle East) prices *

Silver in USD *

Shanghai Composite Index *

CSI 300 *

China A50

China’s FCATC

Taiwan’s TAIEX

Nasdaq Composite

Pakistan’s KSE Index *

South Korea’s KOSPI *

Japan’s Nikkei 225

Czechia’s PX Index *

South Africa’s SA40 *

Chile’s IGPA and IPSA indices *

Singapore’s Strait Times

Israel’s TA 35 Index *

Canada’s TSX *

Vietnam’s VN Index *

And the ASX Small Cap Index *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

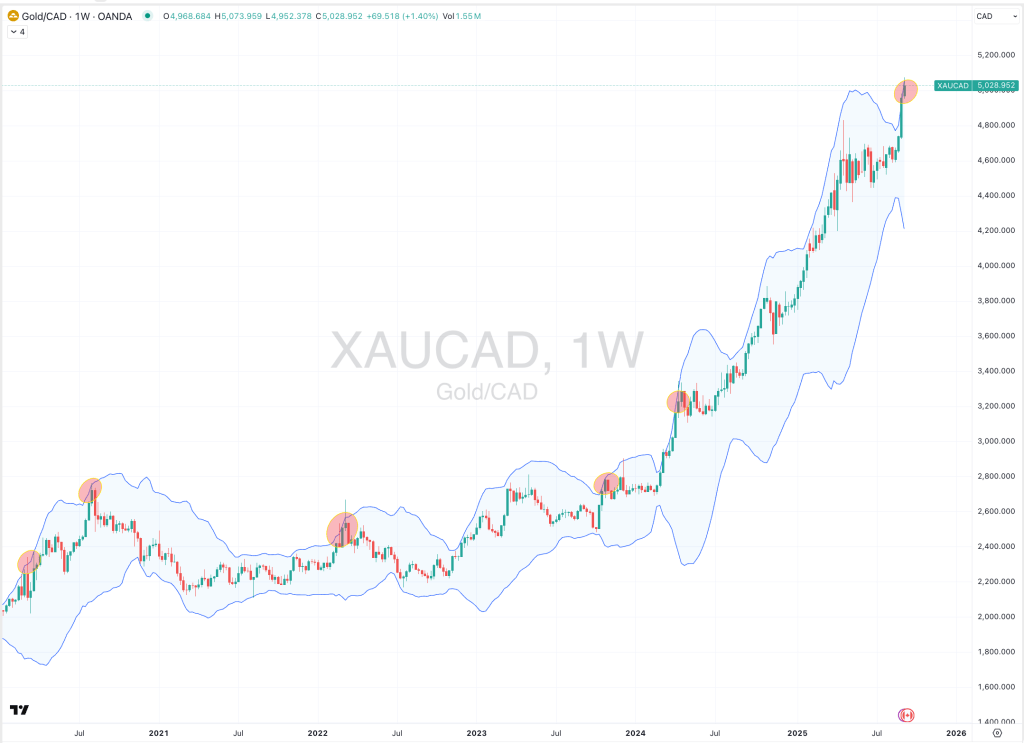

Gold in USD and CAD *

AUD/INR

IPC Mexico equity index *

Extremes below the Mean (at least 2.5 standard deviations)

New Zealand 10 year government bond yield

Australian 10 year bond yield minus its 5 year bond yield

TBT

U.S. 3, 5, 7, 10, 20 and 30 year bond yields

U.S. 10 year bond yield minus 10 year breakeven inflation rate

Newcastle Coal

AUD/THB

CAD/AUD

USD/SEK

And Philippines’ PSI equity index

Oversold (RSI < 30)

Rice

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

U.S. 3 month bill yield *

Richards Bay Coal

Lumber *

Notes & Ideas:

Government bond yields rose, except for U.S. and UK 30’s, which rose.

Last week’s overbought sovereign 10’s are no longer.

U.S. corporate bond yields (and the high yield effective yield) are a whisker from oversold levels and at are at their most oversold since December 2020.

The U.S. 5 year breakeven rate bounced out of oversold territory.

Canadian 10 year yields have fallen for 4 weeks.

U.S. 7 year bond yields mean converged.

U.S. 2 and 30 year yields rose and broke for their 4 weeks falling streak.

And the U.S 10 year minus inflation rate spread is at its most oversold level since March 2022.

Equities were firmer, again.

The overbought list grew this week with notable new entrants including the Nasdaq Composite and the Nikkei 225.

Chinese indices are crowding the overbought list too.

Amidst all the concerns surrounding tariffs, Mexico has registered an overbought quinella.

The Dow Jones Transports have fallen for 3 weeks while the Philippines PSE has slumped for 5 weeks.

The Strait Times is in a 4 week wining streak.

Bovespa fell and broke a 5 week winning streak.

The Russell 2000, TSX and ASX Small Caps have put together a 6 week winning streak.

And the S&P 500 has risen for 9 of the past 12 weeks.

Commodities were generally stronger.

Crude Oil, Aluminium, Coffee, Orange Juice, Shipping Rates and Corn were amongst the notable gainers.

Coal, Rice, Natural Gas, Cattle and Lithium Carbonate dominated the losers category.

Sugar rose from being oversold with Rice taking its place.

The Copper/Gold ratio is nearing oversold levels.

Corn, Lean Hogs, Silver in AUD & USD along with Gold in AUD, CAD, CHF, and EUR are all in a 4 week rising streak.

Platinum has risen for 6 weeks.

Cocoa has declined for 4 weeks.

Richards Bay Coal, Lumber and U.S. Gulf urea prices are in 6 week losing streaks.

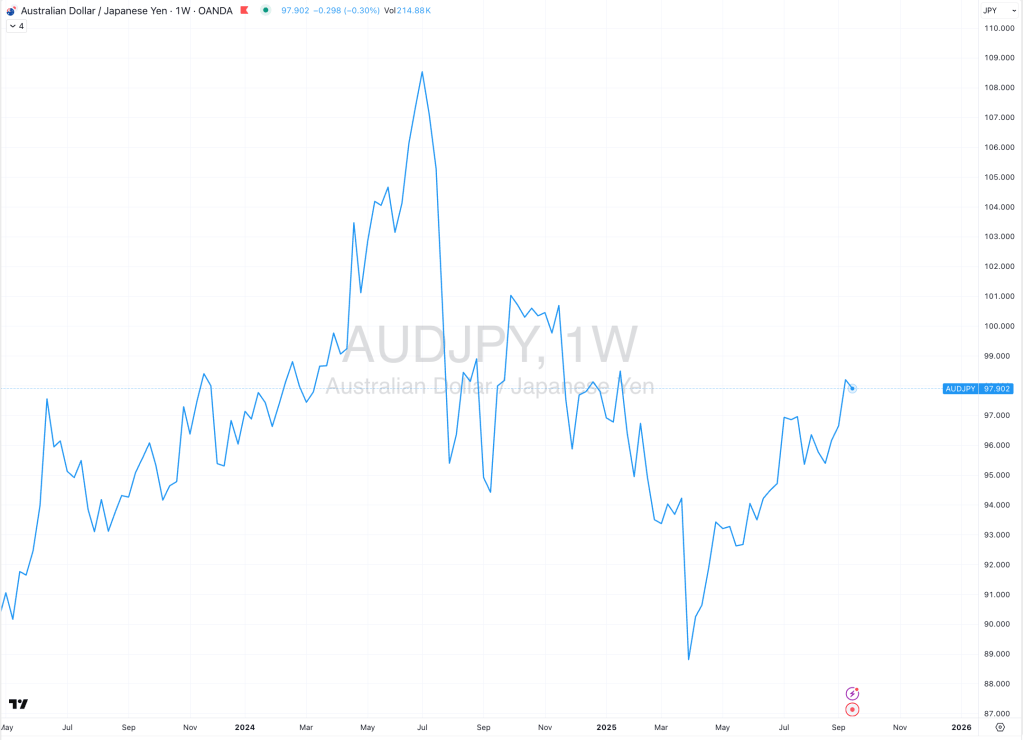

Currencies were active, again.

The Aussie rose notably.

While the Yen, Loonie and the Euro fell.

The Swissie has risen against the Yen for 4 weeks.

The CHF/USD has climbed for 5 weeks.

USD/SEK has declined for 6 weeks.

And the NZD/AUD is a 7 week losing streak.

The larger advancers over the past week comprised of;

Aluminium 3.6%, Brent Crude 2.3%, Baltic Dry Index 7.4%, WTI Crude 1.3%, Copper 2.2%, Arabica 6.2%, Orange Juice 6.2%, Palladium 10.8%, Platinum 1.8%, Robusta Coffee 6.8%, Sugar 1.5%, Tin 1.9%, Dutch TTF Gas 2.2%, Gasoil 1.8%, Silver in USD 2.9%, Gold in CAD 1.7%, Gold in USD 1.6%, Corn 2.9%, Soybeans 1.9%, Shanghai Composite 1.5%, KBW Banks 2%, CAC 2%, China A50 2.1%, FCATC 6.4%, MIB 2.3%, HSCEI 3.4%, Hang Seng 3.8%, IBEX 3.1%, TAEIX 4%, Nasdaq Composite 2%, KLSE 1.4%, KOSPI 5.9%, Mexico 2.2%, Nasdaq 100 1.9%, Nikkei 225 4.1%, Nifty 1.5%, Oslo 1.8%, Helsinki 1.5%, South Africa 3.1%, Sensex 1.5%, SET 2.3%, SOX 4.2%, TA35 1.5% and the S&P 500 rose 1.6%.

The group of largest decliners from the week included;

Richards Bay Coal (2.4%), Rotterdam Coal (2.4%), EHR (2%), Cattle (2.5%), Lithium Carbonate (2.2%), Newcastle Coal (7.5%), Natural Gas (3.5%), Rice (3.3%), BUX (1.9%), IBB (1.5%), NBI (1.6%), SMI (1.4%), IGPA (2.1%), IPSA (2.4%), BIST (3.3%) and the ASX Industrials index fell 1.3%.

September 13, 2025

By Rob Zdravevski

rob@karriasset.com.au