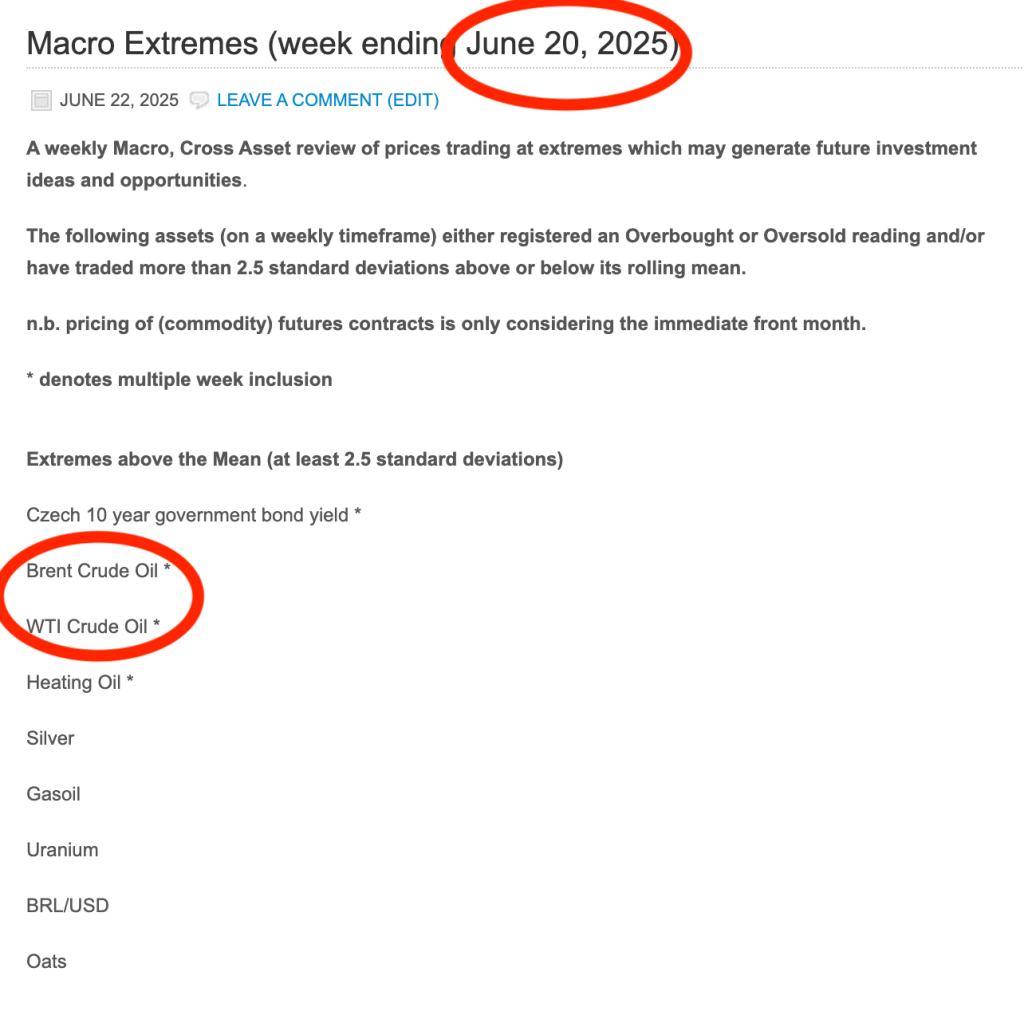

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Czech 10 year government bond yield *

Rotterdam Coal

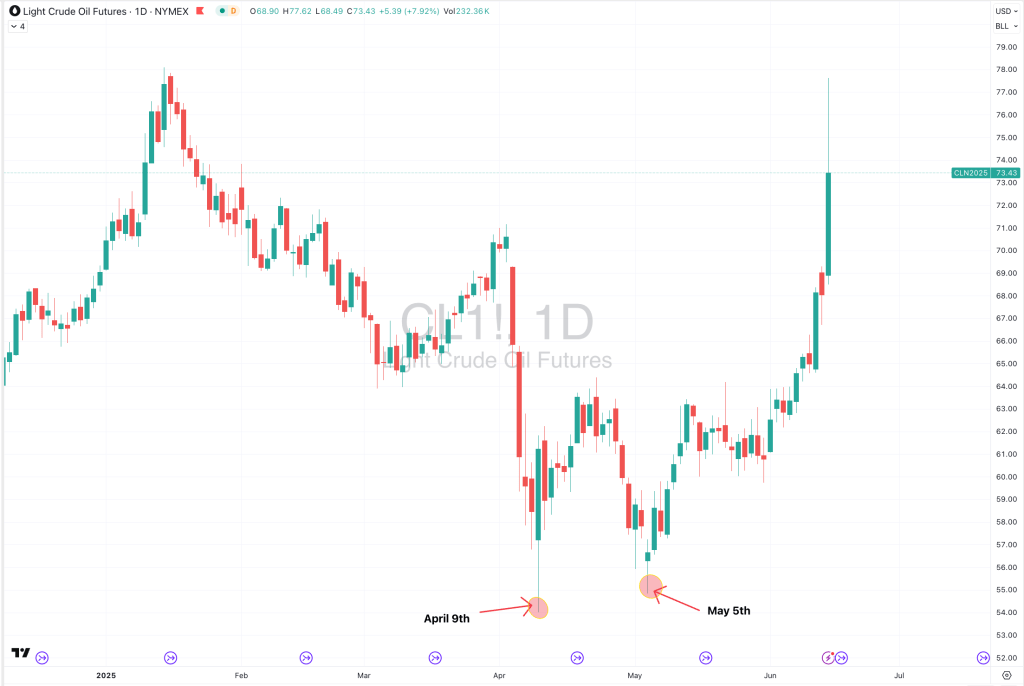

Brent Crude Oil

WTI Crude Oil

Heating Oil

Palladium

Platinum *

Silver in AUD and USD

Oats *

KOSPI *

Overbought (RSI > 70)

Gold

CHF/USD

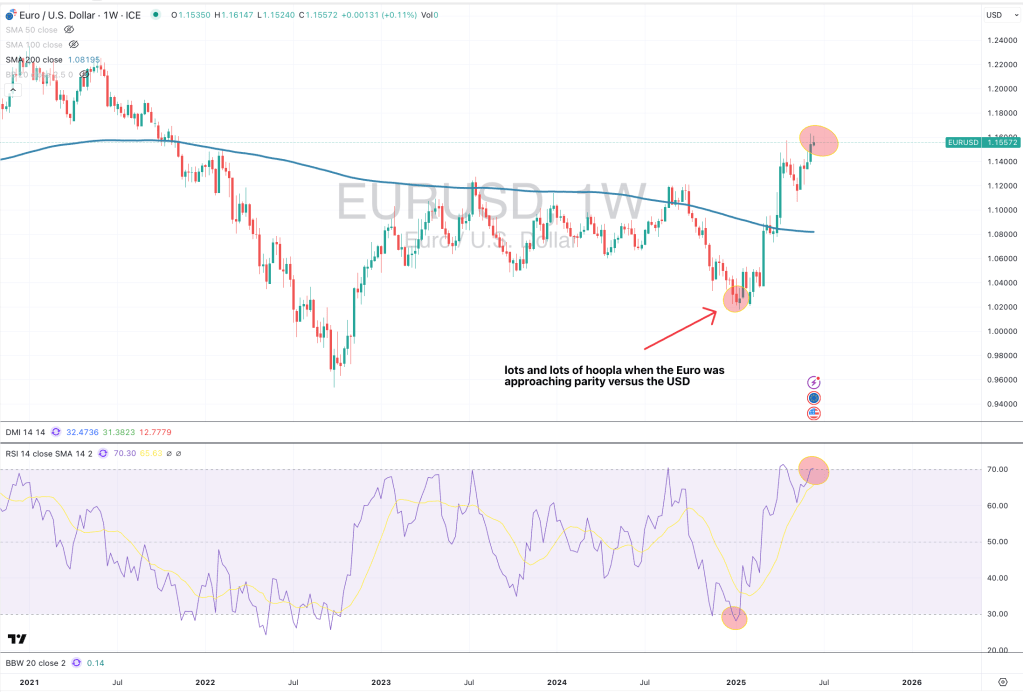

EUR/USD

GBP/USD

DKK/USD

SEK/USD

And Chile’s IPSA equity index

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

KOSPI *

Extremes below the Mean (at least 2.5 standard deviations)

Sugar #16

Oversold (RSI < 30)

Indian 10 year government bond yield *

Lithium Carbonate *

Lithium Hydroxide *

HKD/USD

And Thailand’s SET equity index

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

None

Notes & Ideas:

Government bond yields fell.

Indonesian 10 year bond yields have fallen for 4 straight weeks.

Aussie 10’s minus 2’s spread appear to be at maximum bullishness, so I look for the spread to decline. I see the same in the U.S. 10’s minus 2’s spread.

A reminder that U.S. 10’s minus U.S. 5’s recently spent time as an overbought quinella extreme.

Chilean 10’s minus 2’s are nearly overbought.

British 30 year bond yields have fallen for 3 weeks. Whilst its not a meaningful streak, I reminisce about the recent hoopla surrounding the surge in 30 year Gilts.

Danish 10’s broke their 4 week winning streak.

Japan 2’s broke their 5 week rising streak and Korean 10 year bond yield saw their 6 week climb, come to an end.

And I’m expecting U.S. real interest rates to fall and converge toward a medium term mean.

Equities were mixed with a bias towards weakness.

But not as week as the sentiment may suggest.

There were many small gainers and losers either side of last week’s close.

For example, the SOX managed to rise 1.5% for the week, even after falling 2.6% on Friday.

South Korea’s KOSPI is overbought.

While the DAX and IBEX fell and are no longer overbought. The latter broke an 8 weeks winning streak.

Norway’s OMX is nearly at an overbought quinella extreme reading.

Thailand’s SET is in a 5 week losing streak and os now oversold.

South African 40 broke its 4 week wining streak.

The All World Developed (ex USA) index is in a 5 week winning streak and has risen for 9 of the past 10 weeks, along with Canada’s TSX.

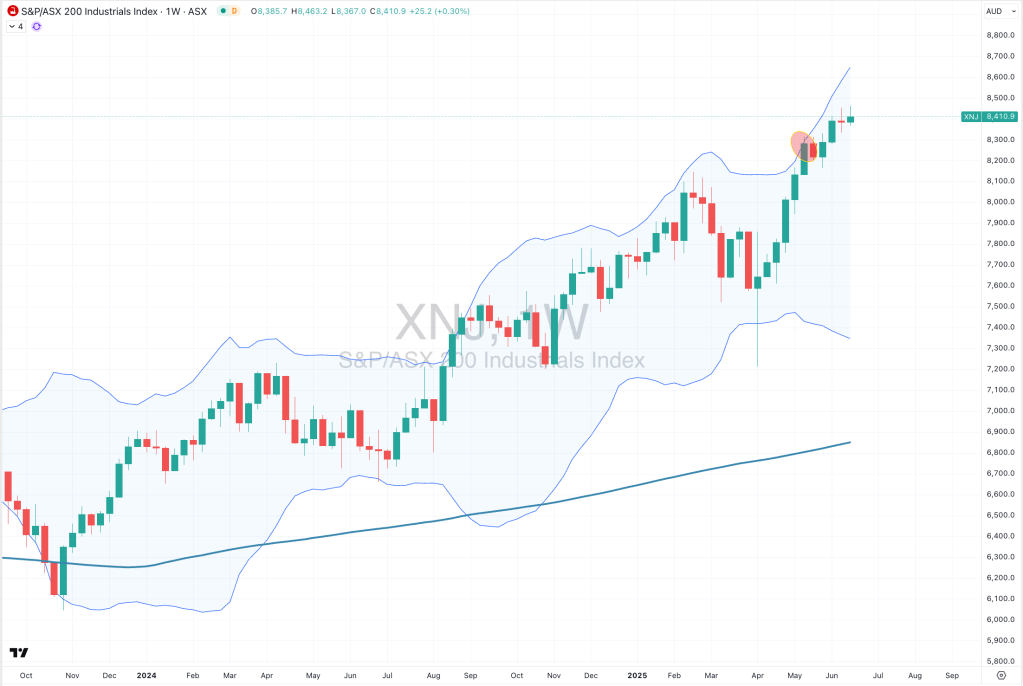

The FTSE 100, ASX Financials, ASX 200 and ASX Small Caps are in 5 week winning streaks and have risen in 8 of the past 9 weeks.

The FTSE 100 has also performed the latter feat.

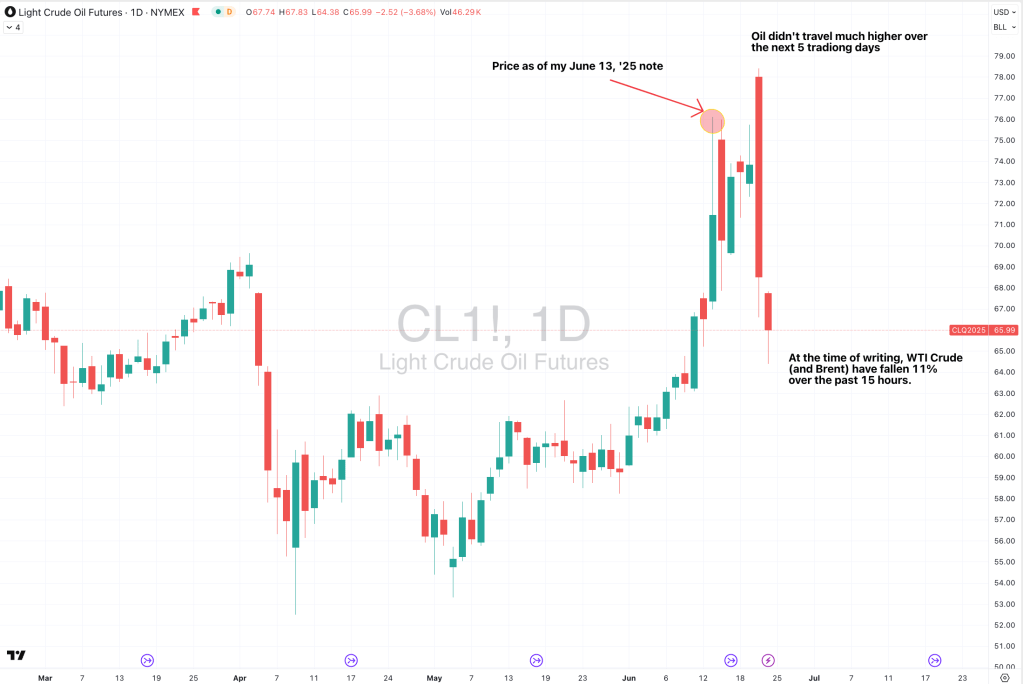

Commodities were stronger.

The big news is the surge in oil prices. Brent Crude, Heating Oil and WTI Crude have risen 17%, 17% and 19% respectively over the past fortnight.

The Baltic Dry Index has surged 40% over the past 3 weeks and to its highest closing price since last September 2024.

Silver and Gold make a return to overbought extremes.

Palladium joins Platinum being overbought, while Cattle and Steel depart that stratosphere.

The largest winners were Oils and Distillates, most gases, Gold, Platinum, Aluminium and Shipping Rates (again).

The notable losers included Cocoa, Sugar, Nickel, Orange Juice, and surprisingly, Henry Hub Natural Gas.

The Copper/Gold ratio fell to reflect a ‘risk-off’ bias.

During Friday’s trading session, Platinum initially rose 2% on Israeli/Irani tensions to then reverse and fall $100 per ounce (or 7%) to finish down 5% from the previous day’s close.

U.S. Hot Rolled Coil Steel broke its 5 week winning streak and is no longer overbought.

U.S. Gulf Urea broke its 4 week losing streak.

Sugar prices have fallen for the past 5 weeks.

Robusta Coffee is in a 7 week losing streak.

While Rice has risen for 5 straight weeks.

Currencies were active.

The Aussie fell commensurately with the ‘risk-off’ sentiment.

Loonie was mixed, again.

The Swissie was stronger as was the Euro.

The U.S. (DXY) Dollar Index is nearly oversold, after all Trump did ‘want’ a weaker Dollar,

while this week sees a host of oversold USD pairs.

And the BRL/USD is near entering an upward trend.

The larger advancers over the past week comprised of;

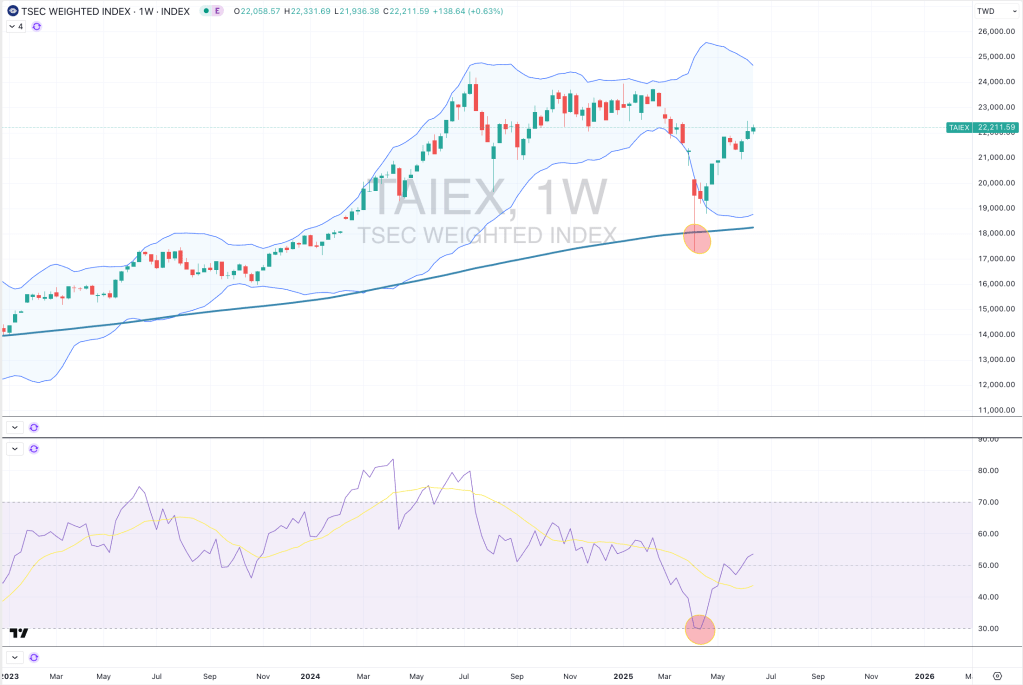

Aluminium 2.9%, Rotterdam Coal 1.8%, Bloomberg Commodity Index 1.9%, Baltic Dry Index 20.5%, Brent Crude 11.6%, WTI Crude Oil 13%, Heating Oil 10.7%, JKM LNG 4%, Lumber 3.7%, Platinum 3.8%, Gasoline 7.4%, S&P GSCI 4.3%, CRB Index 3%, Dutch TTF Gas 4.5%, Gasoil 10%, Urea Middle East 2.6%, Gold 3%, TAEIX 1.9%, KOSPI 2.9%, Oslo 2.7% and the SOX rose 1.5%.

The group of largest decliners from the week included;

Australian Coking Coal (1.5%), Cocoa (6.2%), HRC (1.8%), Arabica Coffee (2.8%), Cattle (2.9%), Natural Gas (5.4%), Nickel (2.5%), Orange Juice (3.8%), Palladium (1.7%), Sugar (2.2%), Sugar #16 (3.5%), Wheat (2%), ATX (2.1%), KBW Banks (2.6%), CAC (1.5%), DAX (3.2%), DJ Industrials (1.3%), MIB (2.9%), IBEX (2.4%), S&P SmallCaps 600 (1.3%), Nasdaq Composite (0.6%), KRE Regional Banks (3.1%), S&P MidCap 400 (1.5%), Stockholm (2.5%), Russell 2000 (1.5%), SMI (1.8%), S&P 500 (0.4%), TA35 (1.5%) and the Nasdaq Transports fell 2.5%.

June 15, 2025

By Rob Zdravevski

rob@karriasset.com.au