Canada is on sale

February 1, 2025 Leave a comment

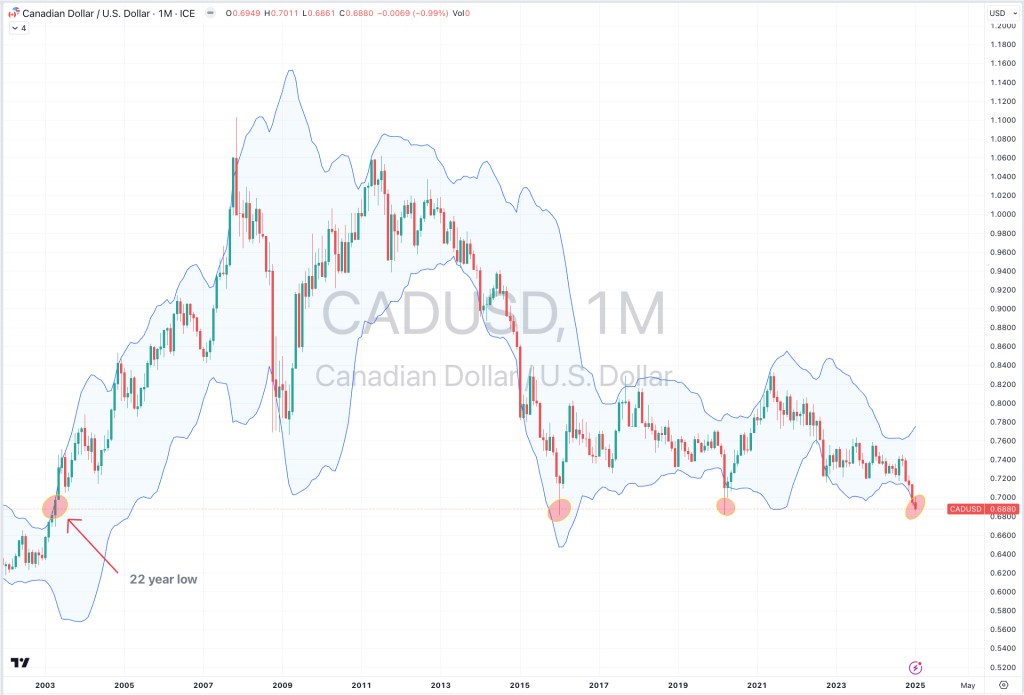

The #CAD/USD is registering a weekly oversold reading.

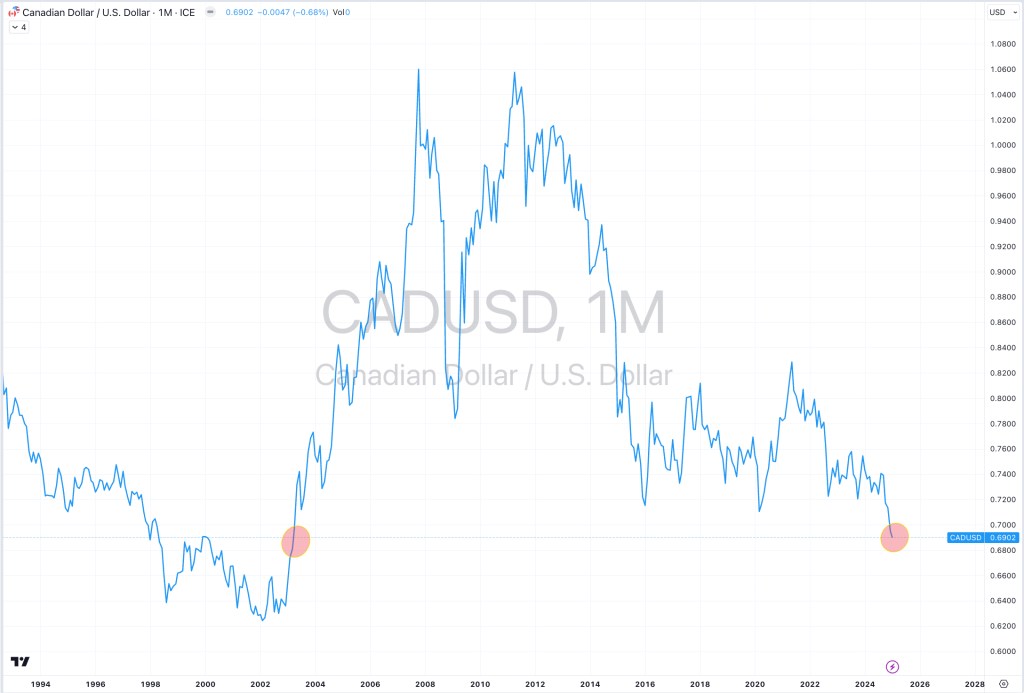

The larger picture sees the #Loonie (not withstanding the lower spike in January 2016 and March 2020) trading at its lowest against the Greenback in 22 years.

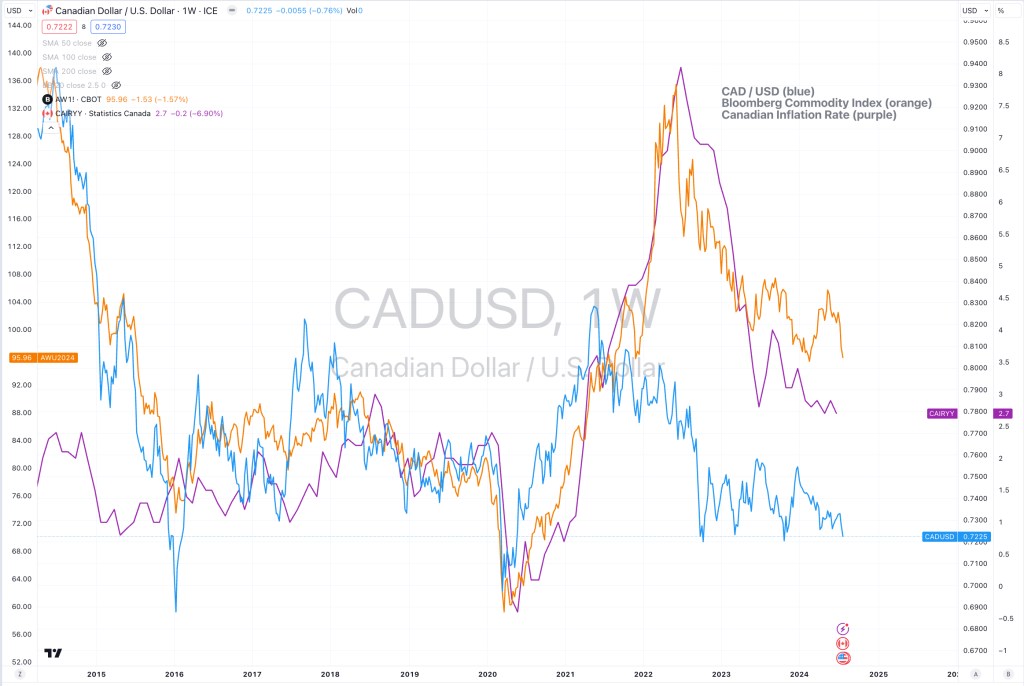

American companies would be well advised to buy up cheap Canadian assets and see if they can work their way through alleviating tariff concerns……

or perhaps Americans can buy property in Alberta, Newfoundland/Labrador, Nova Scotia or New Brunswick?

and possibly immigrate??

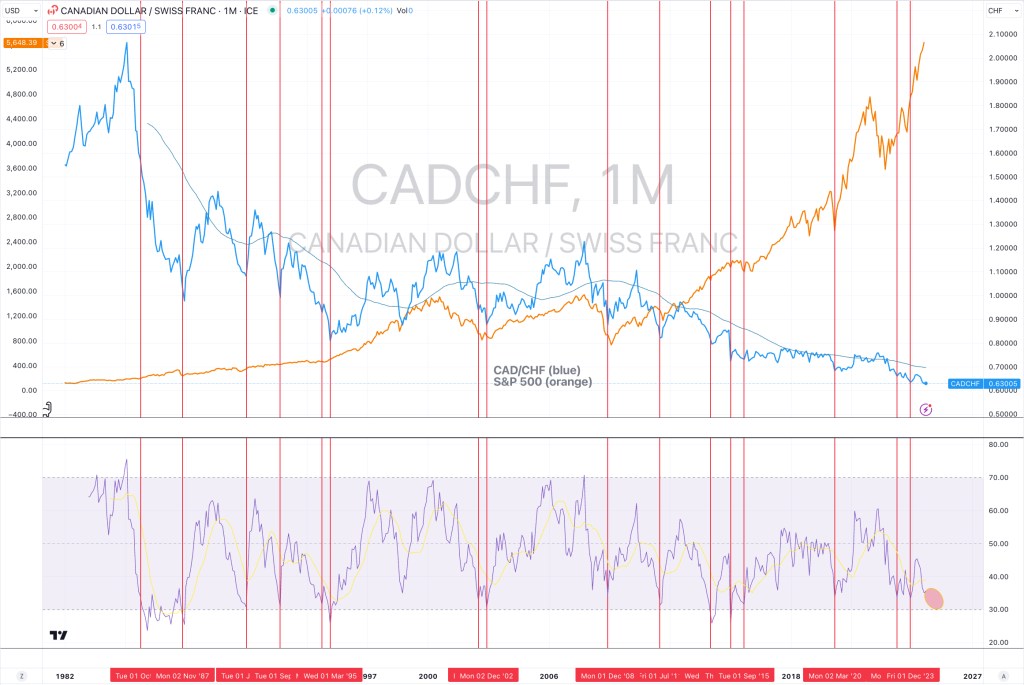

At the very least, #Canada is on sale, on a USD basis……

February 1, 2025

rob@karriasset.com.au