I would like a reduction in interest rate please……

even though the world’s stockmarkets have risen between 25% and 50% over the past 3 years……

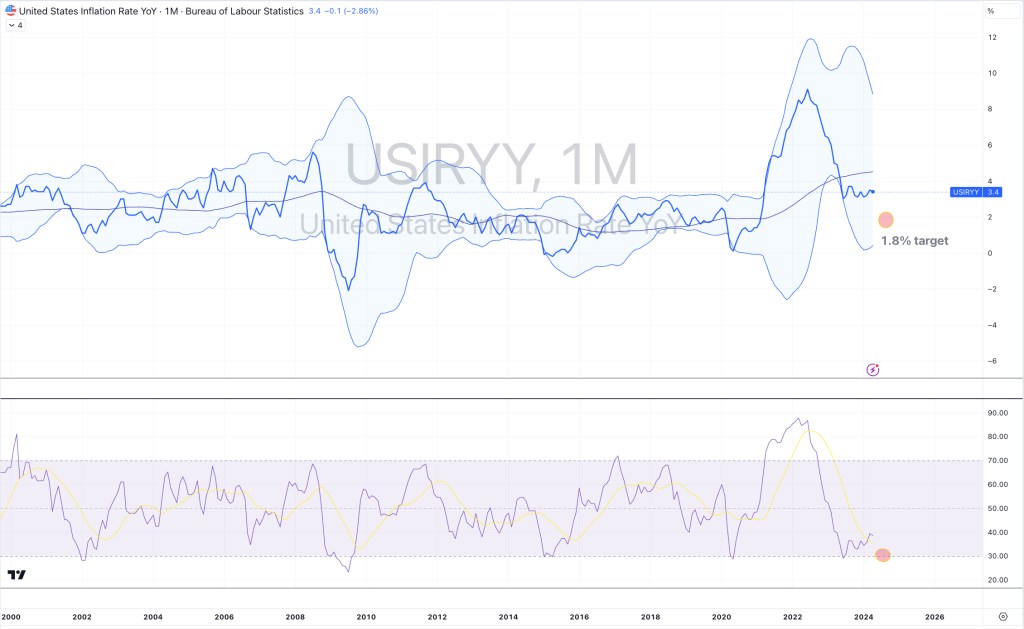

Following such wonderful investment returns, why are equity investors are so hinged on whether central banks will lower their interest rate policy or target?

This wish from ‘collective’ equity investors is most perverse.

What is the genesis and motivation behind this story-telling derived by the strategists and pundits from the investment houses?

Something must not be working well enough for ‘them’ when money is priced at 5.25%.

Are companies and individuals still too leveraged?

Perhaps corporate profits are still under pressure even following the rounds of jobs cuts and cost-cutting measures?

Or maybe, banks can’t make enough of a spread between the interest they need to pay on deposits and the amount they can loan out?

I’d argue that a fair cost of money is around 5%-6%.

And rate cuts are often used to flog a dead horse back into life……

Be careful what one wishes for.

April 11, 2024