This week and today, we are also seeing an extreme in the U.S. Dollar (DXY) Index and as a result certain currencies are exhibiting notable weakness, which I think translate into an attractive buying opportunity.

My three strategic currency ideas are;

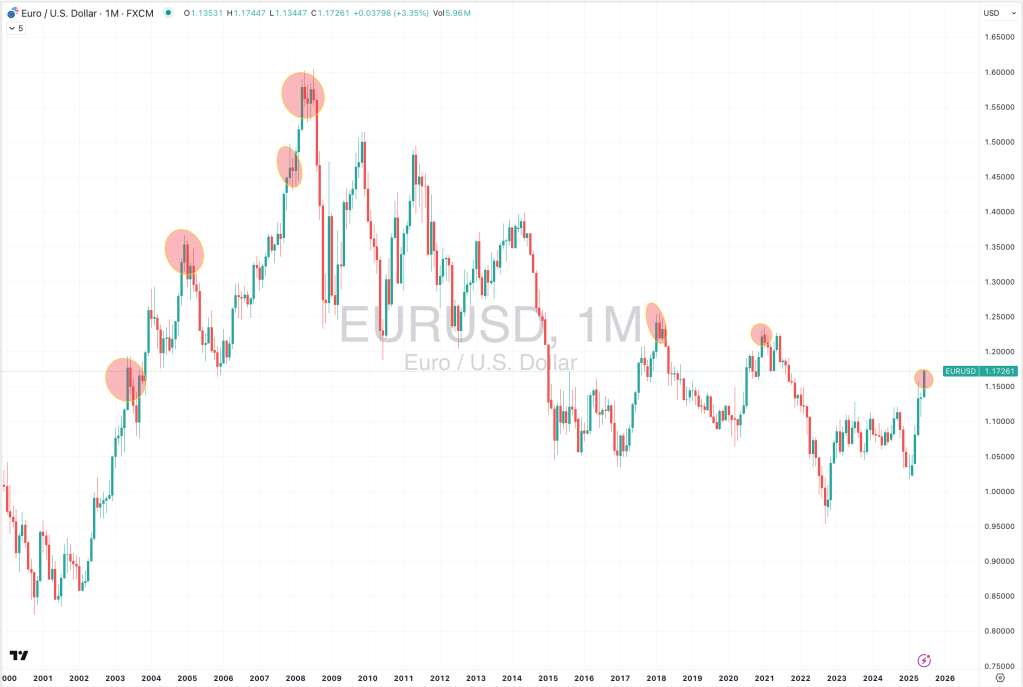

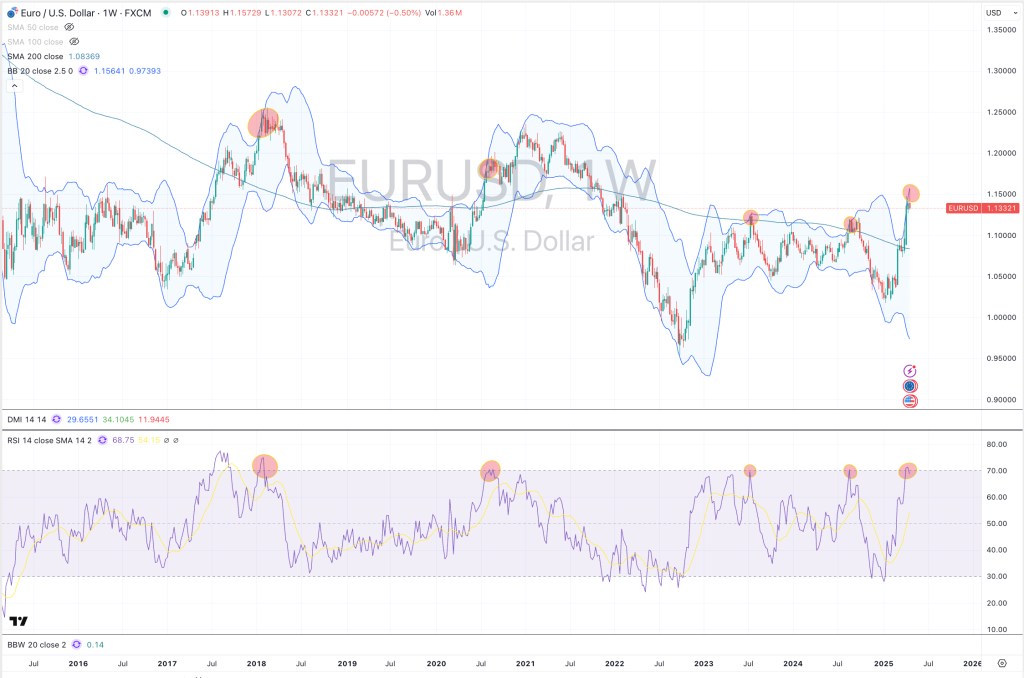

Sell USD and Buy EUR (current price is 1.1210)

– Once the Euro’s have been bought, I’m waiting for some specific stocks prices. Some on my list include SAP and ArcelorMittal.

Sell USD and Buy JPY (current price is 115.40)

– there are some Japanese equities on my buying list.

Sell USD and Buy SEK (currently 9.1130)

– Swedish equities have already rallied and benefitted from a weaker currency. The likes of Sandvik, Atlas Copco, Swedbank and Assa Abloy. The laggard is airline, SAS. This strategy is more applicable for those need to Buy Krona for corporate and business purposes.

The GBP (versus the USD) isn’t quite there. 1.3260 could be the place to buy Sterling.

November 25, 2021

by Rob Zdravevski

rob@karriasset.com.au