Very First Corn Flakes Package

Due to an expected record U.S. harvest, the price of corn has fallen to levels last seen in 2010 and at prices also seen in 2008.

What a contrast when compared to the spike in prices during the 2012 drought.

The price of corn has now fallen (on a weekly basis) at least 2 standard deviations below its mean on a weekly and monthly basis which covers the past 20 years.

When I look at its price on a quarterly basis, corn have reverted to its rolling mean over a 40 year period.

Supply must have increased significantly but our work suggests that demand remains steady, if not slightly higher, especially when accounting for animal feed usage.

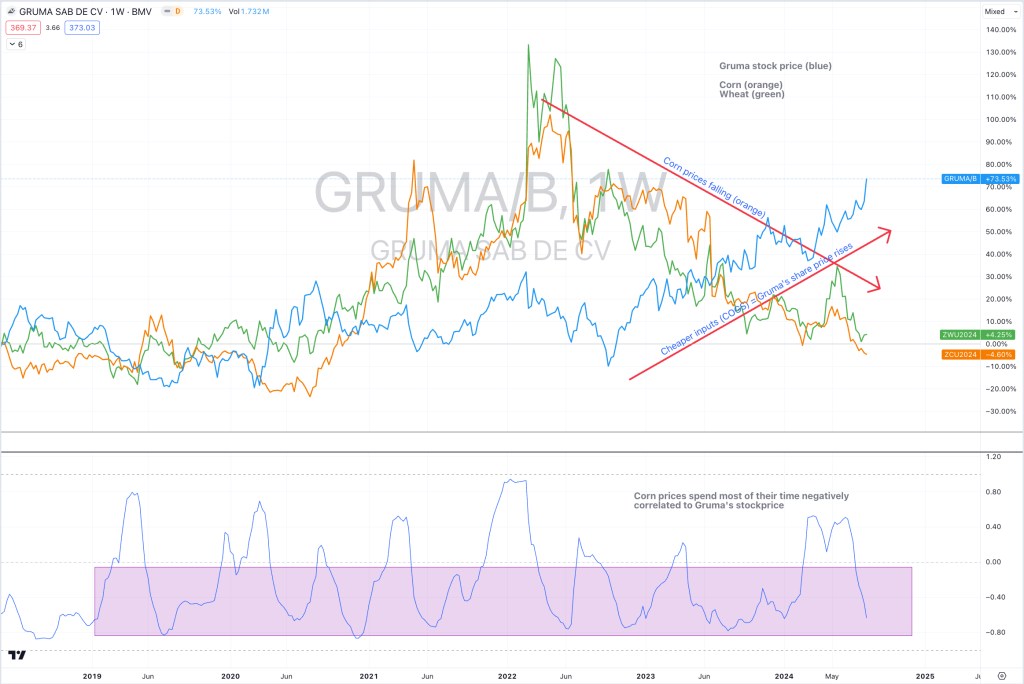

The decline in price over the past 12 months has helped the share prices of companies such as Gruma (Mexican tortilla maker), Pepsi and Kellogg, while share prices of other beverage companies, namely Coca Cola have lagged their peers and index considerably.

Did you know that corn is used as a sweetening alternative to sugar in many drinks and many foods in the form of High Fructose Corn Syrup or HFCS.

If we look to buy some actual corn itself, its current price is $4.74 per (generic) contract renders it oversold, whilst support may be found 7-9% lower surrounding the $4.30 level but let’s not split husks over it.

Further reading: Litchfield, Ruth (2008). High Fructose Corn Syrup—How sweet it is. Ames, IA: Iowa State University Extension and Outreach. Retrieved 1 March 2013.