Copper miner, Sandfire – then there is a time to sell

April 17, 2023 Leave a comment

Today, with it’s stock price trading at $7.04, Australian copper mining company, Sandfire Resources (SFR.AX) is approaching a moment where probability tells me to sell its shares soon. *

The chart below shows 3 notable (recent) moments when Sandfire Resources stock price was trading at the upper end of various extreme measures. It is also at stretched percentages above its 200 week moving average.

In July 2022 (9 months ago), I posted a note which observed the ‘extreme’ low in its share price. The stock was trading around the A$3.80 mark then.

That original July 2022 quip was preceded this next post……

…..which mentioned the first bid BHP made for Oz Minerals and showed other stocks that created the same buy signal during that month of July 2022.

For as long as the business isn’t broken and the theme remains intact, it takes some fortitude to accumulate equity when all around you seems dire.

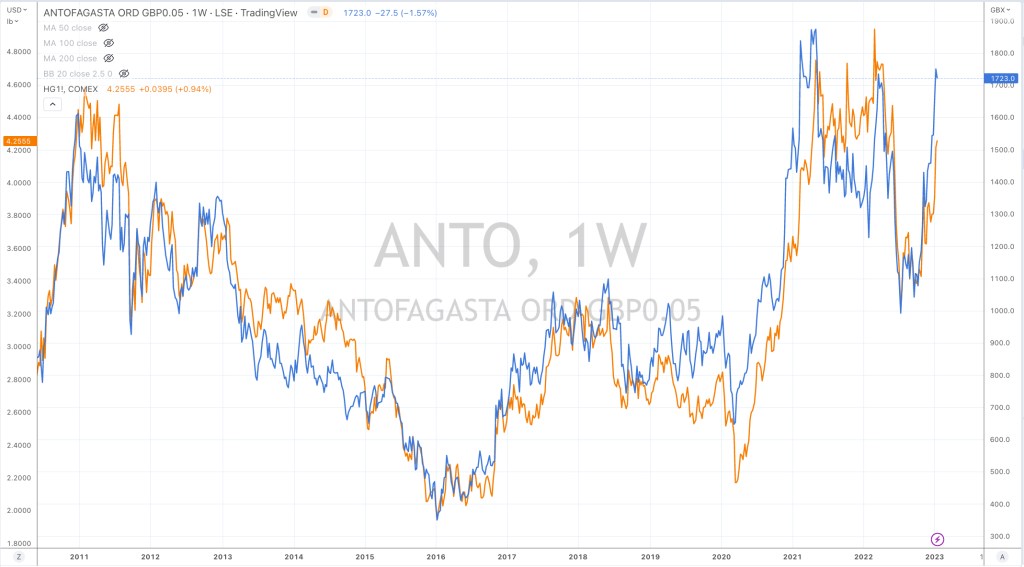

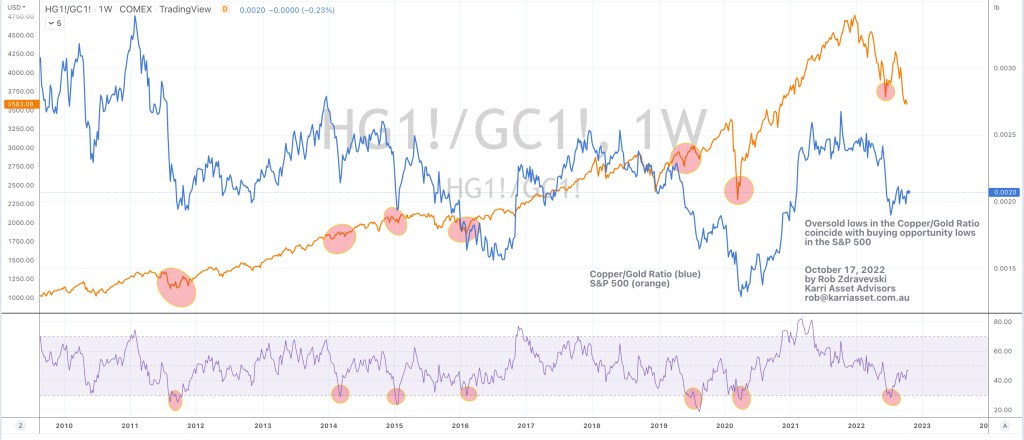

Incidentally, the stock price of Sandfire Resources correlates well with the price of Copper……and Copper correlates closely with other currencies, inflation, bond yields and gross domestic product readings.

* still not personal advice.

April 17, 2023

by Rob Zdravevski

rob@karriasset.com.au