A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Copper/Gold Ratio

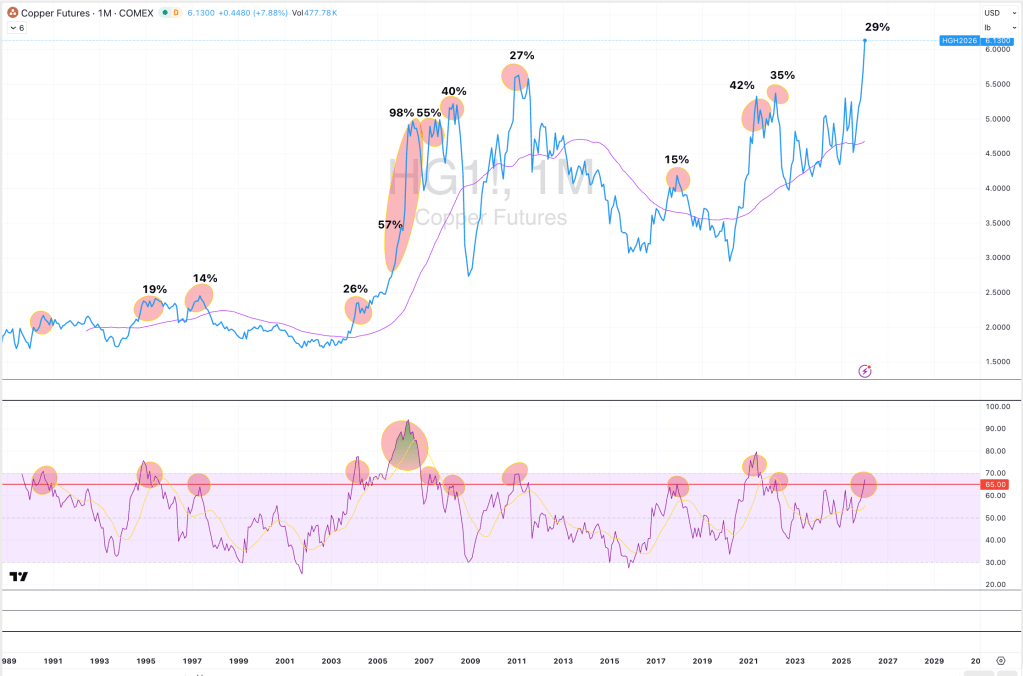

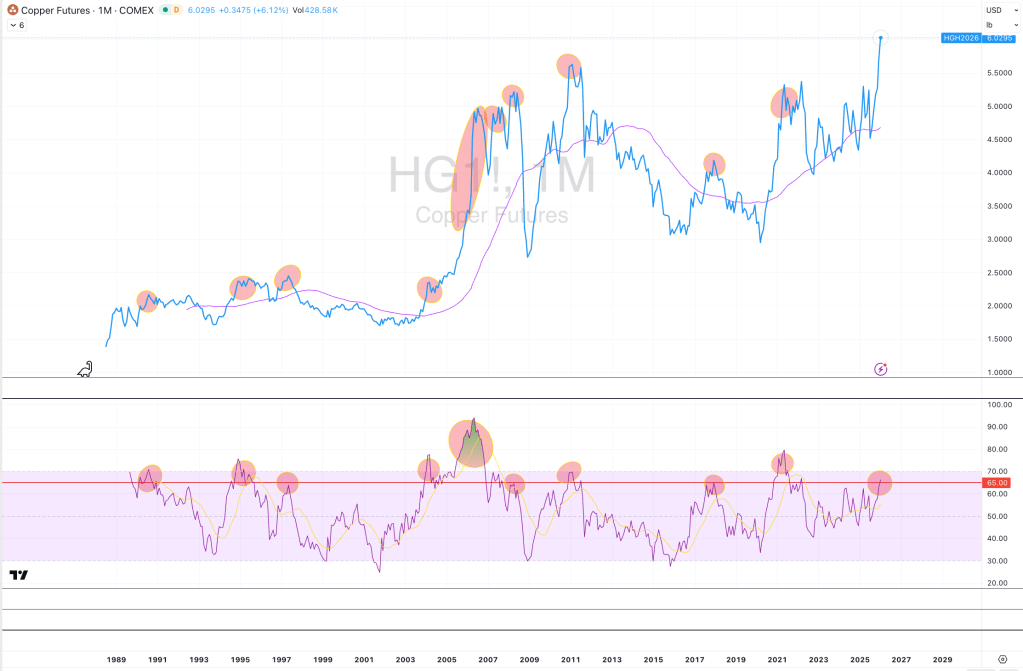

Copper

AUD/CAD

AUD/CHF

AUD/EUR

AUD/IDR

AUD/USD

Germany’s DAX

Italy’s MIB

Russell 2000

FTSE 250

S&P Midcap 400

And Türkiye’s BIST Index

Overbought (RSI > 70)

Korean 10 year government bond yields *

The Japanese bond yield curve *

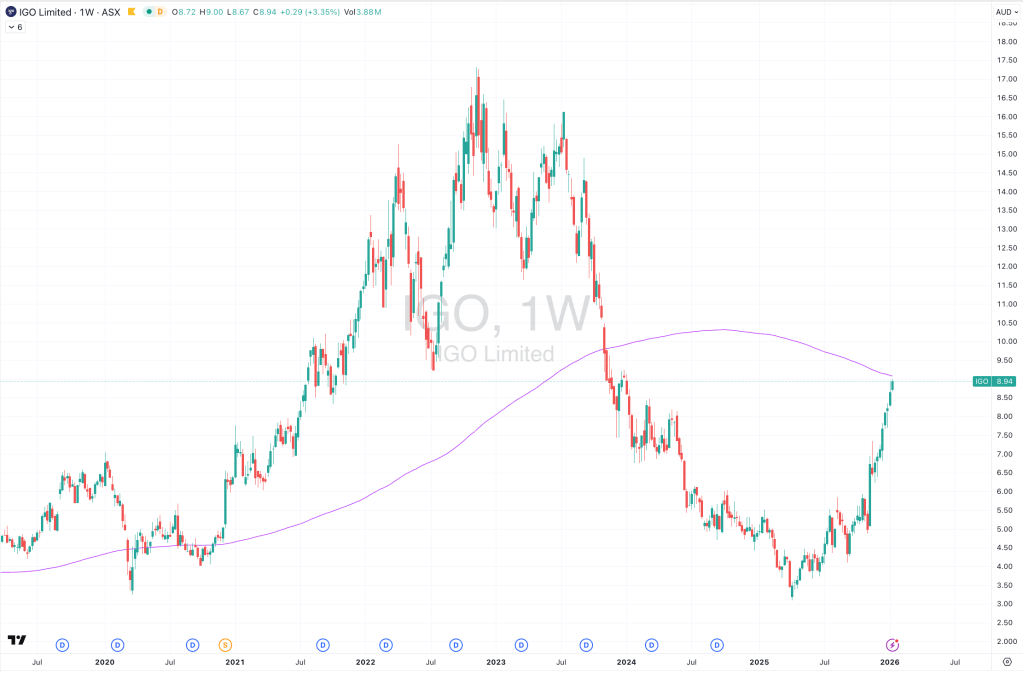

Lithium Carbonate

Tin *

LME Aluminium

Platinum

Silver in AUD & USD *

Gold in CAD, CHF, GBP & USD

AUD/JPY

CHF/JPY *

CLP/USD

CNH/USD *

EUR/JPY *

GBP/JPY *

CSI 300

Austria’s ATX Index *

U.S. KBW Bank Index *

Indonesia’s IDX Composite Index

Dow Jones Transports

Egypt’s EGX Index *

IBB Index

Spain’s IBEX *

Brazil’s BOVESPA Index

Taiwan’s TAEIX *

South Korea’s KOSPI Index *

Nasdaq Biotech Index *

OMX Helsinki Index *

OMX Stockholm Index

Czechia’s PX Index *

South Africa’s SA40 equity index *

Switzerland’s SMI Index

Philadelphia SOX Index

Chile’s IGPA *

Singapore’s Strait Times *

Israel’s TA35 *

Nasdaq Transports *

Canada’s TSX equity index *

FTSE 100 *

S&P Biotech Index *

And the ASX Materials Index

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Chilean 10 year minus Chilean 2 year bond yield spread

Australian Coking Coal

Lithium Hydroxide

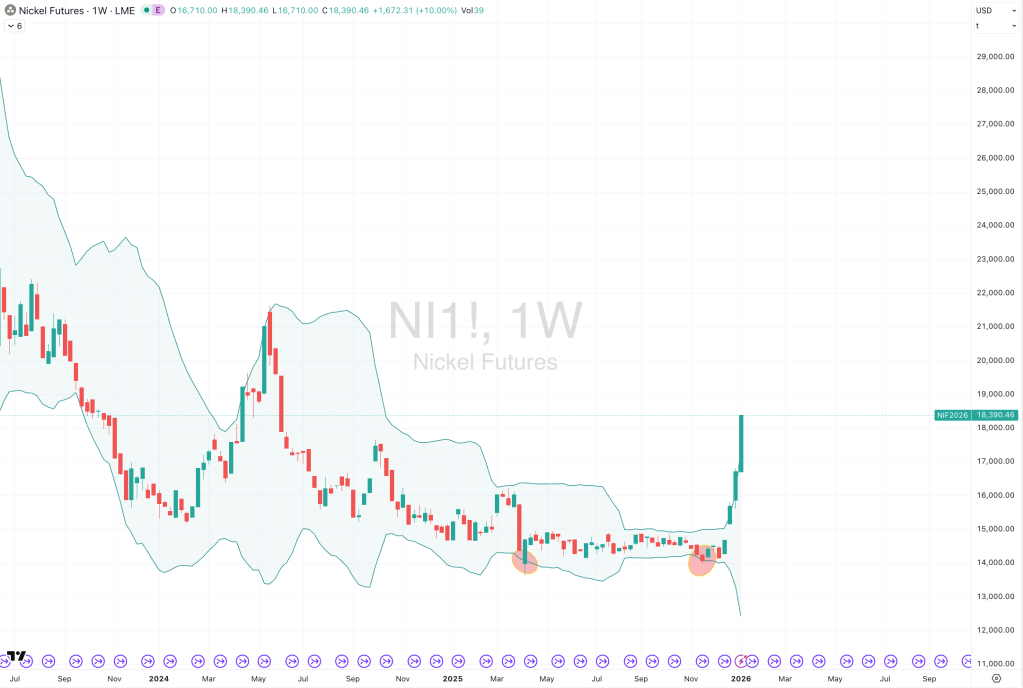

Nickel *

ZAR/USD *

Shanghai Composite

All World Developed (ex USA) *

Hungary’s BUX Index *

Pakistan’s KSE Index

OMX Copenhagen Index

Vietnam’s VN Index

Poland’s WIG Index *

Extremes below the Mean (at least 2.5 standard deviations)

CAD/AUD

EUR/AUD

Oversold (RSI < 30)

Lumber *

Sugar #16 *

JPY/AUD *

JPY/EUR

NZD/AUD *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Chilean 2 year bond yield

USD/ZAR *

Notes & Ideas:

Government bond yields generally fell.

Except for shorter duration U.S. yields, the Japanese 5 year yield which have risen for 8 weeks and the Japanese 10’s have climbed for 4 weeks.

This week saw a few more yield extremes depart.

The U.S. 2 year bond yields rose and broke 4 weeks of decline.

Danish 10 year yields fell and broke a 5 week winning streak.

Indonesian 10 year yields rose and broke 5 weeks of advance.

Turkish 10’s rose and snapped 7 weeks of weakness.

Equities had a terrific week.

It has been months since seeing this many indices in overbought territory.

Helsinki’s OMX and Vietnam’s VN Index are in 4 week winning streaks.

Poland’s WIG has risen for 5 weeks.

The All World Developed Index-ex USA, Austria’s ATX, Norway’s OBX, Czechia’s PX and Spain’s IBEX have strung together 7 weeks of gains.

Pakistan’s KSE has climbed for 9 consecutive weeks.

Commodities were mostly higher.

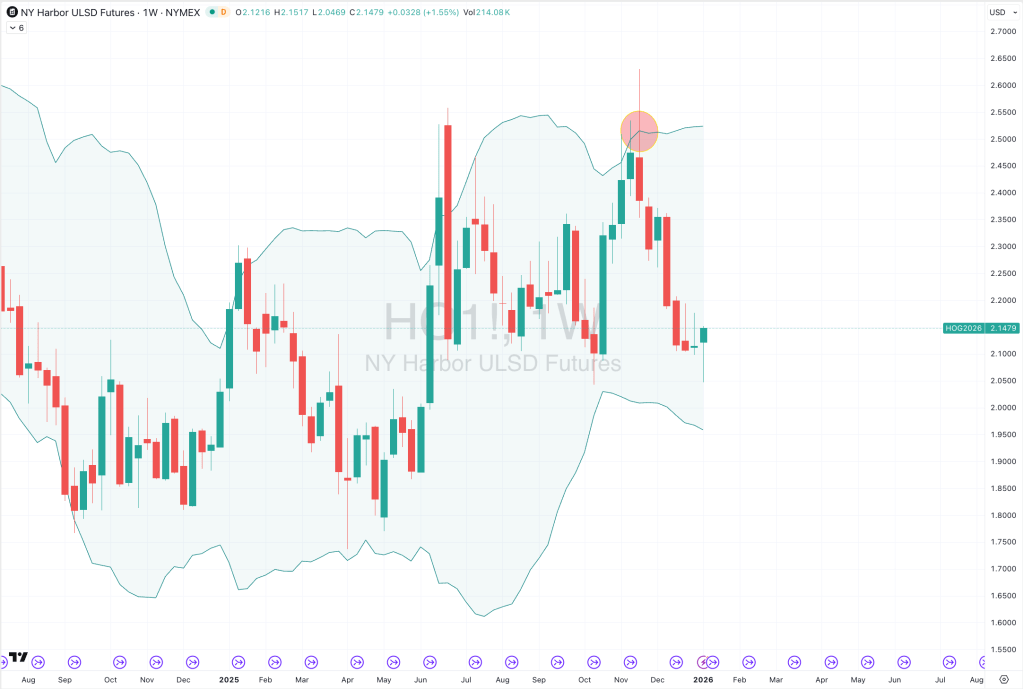

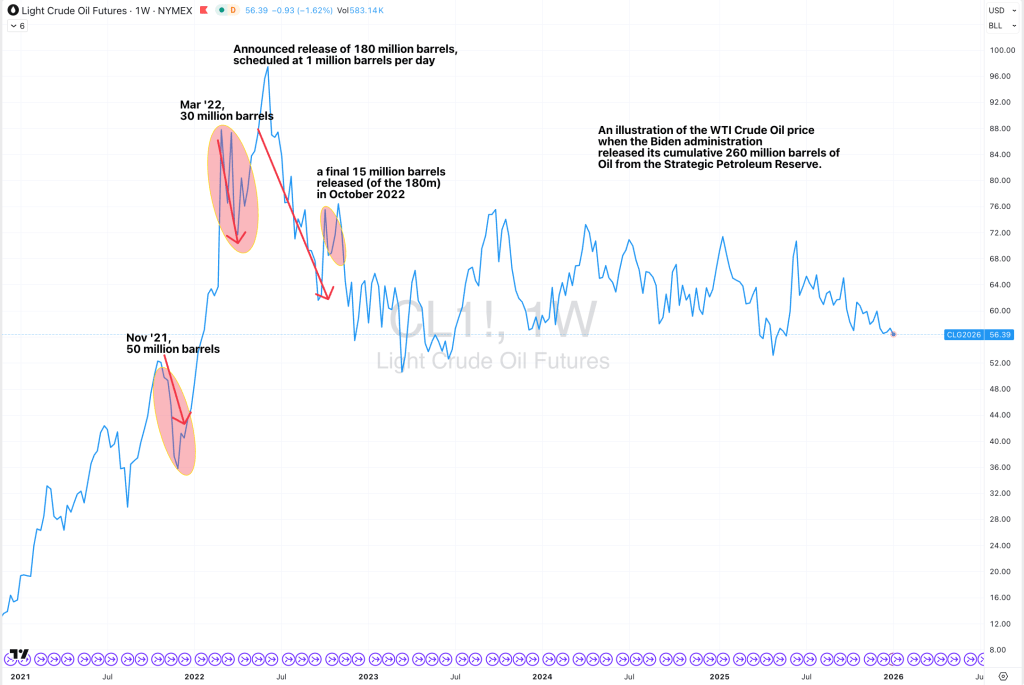

Crude, Copper, Tin, Lithium, Nickel, Palladium, Platinum, Gasoline & Gold were the notable gainers.

Shipping Rates, Cocoa, Natural Gas and LNG as priced in Yen were the notable decliners.

Lithium prices have rallied and are now overbought.

Platinum and Gild return to overbought territory.

Aluminium is overbought as priced on the LME and nearly there on the COMEX.

Richards Bay Coal & Rice are no longer oversold.

The latter broke its 7 week winning streak.

Nickel has climbed for 4 weeks, rising 22% over that time.

Orange Juice has advanced for 5 weeks, climbing 47% over that time.

Lithium Hydroxide and Rubber have also advanced for 5 weeks.

Uranium’s winning streak extends to 7 weeks.

Gasoline snapped its 4 weeks slump.

While Natural Gas has fallen for 5 weeks, declining 36% over that time.

Currencies were active.

The Aussie was stronger and appearing in the extremes.

CAD was weaker, again.

CNH/USD fell enough to break a 6 week winning streak.

GBP/EUR has risen for 4 weeks.

Overall, the British Pound was mixed.

Commodity currencies such as the Aussie and Chilean Peso are overbought.

The Yen is oversold, everywhere.

EUR/CHF rose to end 4 weeks of decline.

The Kiwi has slumped for 4 straight weeks against the Aussie.

And, the USD has fallen against the South African Rand for 7 weeks.

The larger advancers over the past week comprised of;

Australian Coking Coal 2.3%, Richards Bay Coal 2.7%, Aluminium 2.9%, Bloomberg Commodity Index 2.4%, Brent Crude Oil 4.3%, WTI Crude Oil 3.1%, Copper 3.7%, Lithium Carbonate 22.1%, Lithium Hydroxide 16.2%, Tin 12.3%, LME Aluminium 5%, Nickel 4.9%, Orange Juice 3.1%, Palladium 10.6%, Platinum 7.5%, Gasoline 4.9%, Sugar 2%, S&P GSCI 2.2%, Urea U.S. Gulf 1.7%, Gasoil 3.4%, Urea Middle East 3.7%, Silver in AUD 9.9%, Silver in USD 9.8%, Gold in AUD 4.2%, Gold in CAD 5.5%, Gold in CHF 5.3%, Gold in EUR 4.8%, Gold in GBP 4.6%, Gold in USD 4.1%, Gold in ZAR 4.1%, Corn 1.9%, Oats 1.9%, Rice 5.3%, Soybean 1.6%, Wheat 2.1%, Shanghai Composite 3.8%, CSI 300 2.8%, AD02 1.7%, AEX 2.1%, KBW Banks 2.1%, BUX 4.9%, CAC 2%, IDX 2.2%, DAX 2.9%, DJ Industrials 2.4%, DJ Transports 3.7%, FCATC 4.2%, IBB 2%, Bovespa 1.8%, S&P SmallCap 600 4.2%, Russell 2000 4.6%, TAEIX 3.2%, Nasdaq Composite 1.9%, KRE Regional Banks 3.4%, KSE 3%, KOSPI 6.4%, FTSE 250 2.8%, S&P Midcap 400 3.3%, Mexico 3%, NBI 1.9%, Nasdaq 100 2.2%, Nikkei 225 3.2%, Copenhagen 4.3%, Stockholm 3.2%, PSE 3.5%, PX 1.8%, SA40 1.7%, SOX 3.7%, IGPA 4.6%, S&P 500 1.6%, STI 1.9%, TA35 4.4%, Nasdaq Transports 4.6%, TSX 2.3%, FTSE 100 1.7%, Vietnam 4.7%, XBI 2.5%, ASX Materials 3.7%, ASX Small Caps 2.1% and Türkiye’s BIST rose 6.1%.

The group of largest decliners from the week included;

Baltic Dry Index (10.3%), Cocoa (9%), LNG in Yen (3.5%), Natural Gas (12.4%), Dutch TTF Gas (2.2%), Sensex (2.6%) and the ASX Financials fell 2.5%.

January 11, 2026

By Rob Zdravevski

rob@karriasset.com.au