Macro Extremes (week ending January 16, 2026)

January 18, 2026 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Chilean 10 year minus Chilean 2 year bond yield spread

Indian 10 year bond yield

S&P GSCI Index

Dutch TTF Gas

AUD/CAD *

COP/USD

CSI 300 Index *

DAX Index *

S&P Small Cap 600

FTSE 250 *

S&P Mid Cap 400 *

And Mexico’s IPC Index

Overbought (RSI > 70)

Korean 10 year government bond yields *

The Japanese bond yield curve *

Platinum *

Gold in CAUD, AD, CHF, EUR, GBP & USD

AUD/JPY *

CLP/USD *

CNH/USD *

EUR/JPY *

MYR/USD

ZAR/USD *

Austria’s ATX Index *

Indonesia’s IDX Composite Index *

Dow Jones Transports *

Egypt’s EGX Index *

Spain’s IBEX *

Brazil’s BOVESPA Index

Pakistan’s KSE Index

South Korea’s KOSPI Index *

Nasdaq Biotech Index *

Japan’s Nikkei 225

Helsinki’s OMX

Czechia’s PX Index *

South Africa’s SA40 equity index *

Switzerland’s SMI Index *

Philadelphia SOX Index *

Chile’s IGPA *

Israel’s TA35 *

Nasdaq Transports *

Canada’s TSX equity index *

FTSE 100 *

Poland’s WIG Index *

S&P Biotech Index *

ASX Small Caps

And the ASX Materials Index

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

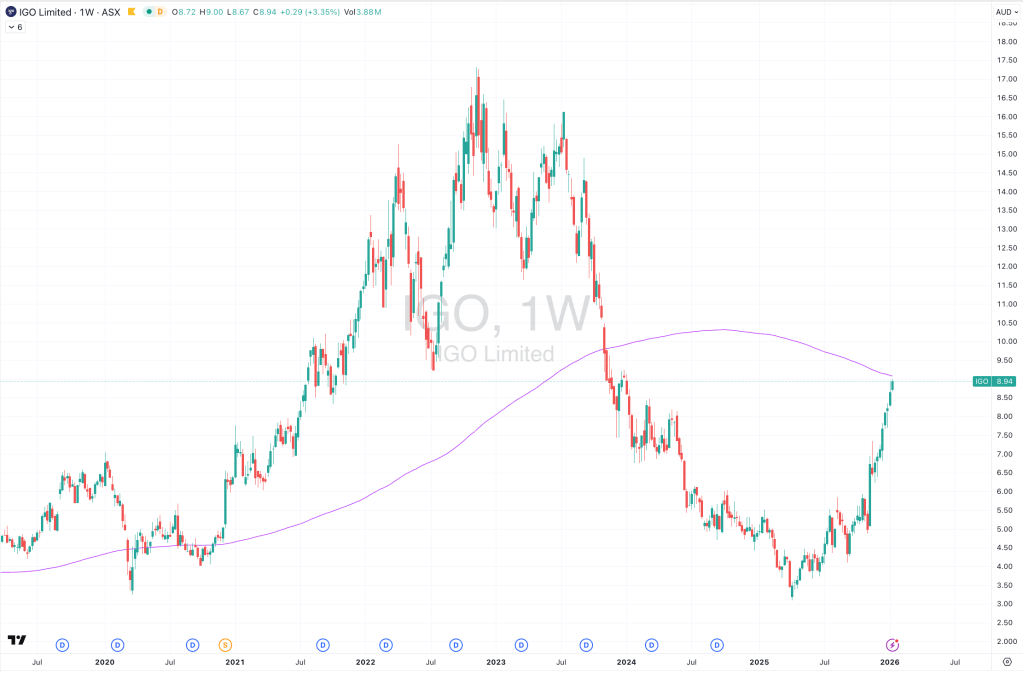

Lithium Carbonate *

Lithium Hydroxide *

Tin *

LME Aluminium *

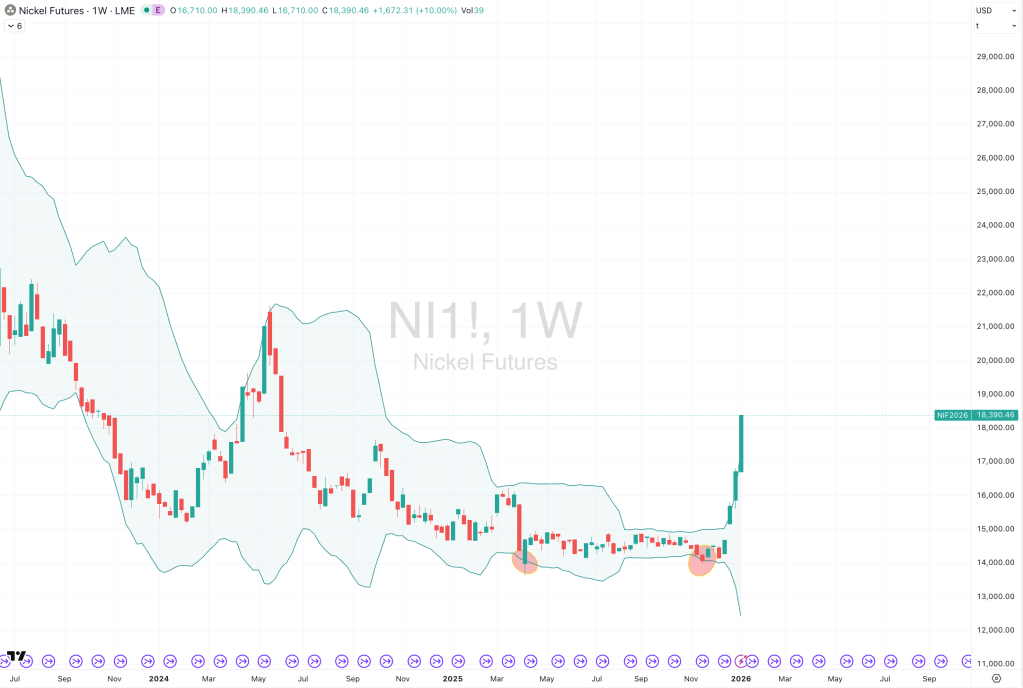

Nickel *

Silver in AUD & USD *

Shanghai Composite

All World Developed (ex USA) *

Hungary’s BUX Index *

Russell 2000 *

Taiwan’s TAEIX *

Malaysia’s KLSE Index

Norway’s OBX Index

OMX Copenhagen Index *

OMX Stockholm Index *

Singapore’s Strait Times *

Vietnam’s VN Index *

And Turkiye’s BIST Index

Extremes below the Mean (at least 2.5 standard deviations)

Corn

CAD/AUD *

Oversold (RSI < 30)

Sugar #16 *

JPY/AUD *

JPY/GBP

JPY/EUR *

NZD/AUD *

USD/CLP *

USD/ZAR *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Chilean 2 year bond yield

USD/MXN

Notes & Ideas:

Government bond yields generally eased.

Except for Euro, 5’s and 10’s along with Indian and Korean 10’s.

Japanese 10’s have climbed for 5 weeks.

Japanese 5’s have not declined for 12 weeks.

Korean 10 year and U.S. 3 year yields have risen for 4 weeks.

U.S. 5 and 10 year breakeven inflation rates are close to mean reverting while also entering a new upward trend.

U.S. 5 year yields have started a new upward trend.

And the U.S. 5 year bond minus 3 month bill spread is nearly overbought.

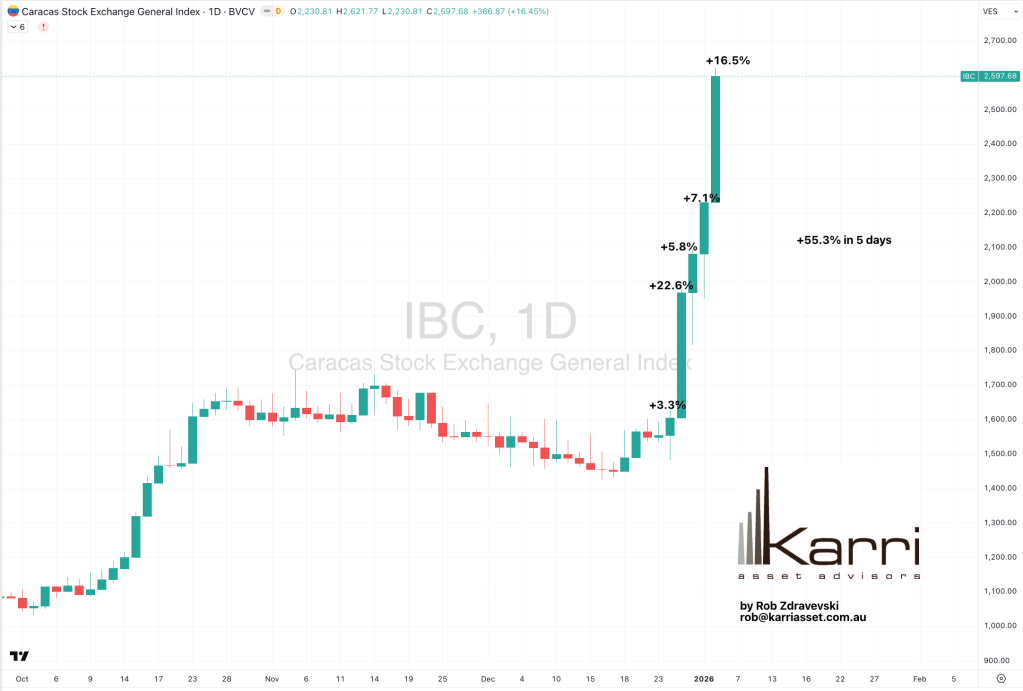

Equities had another good week.

We are now seeing many more indices registering overbought quinella’s.

The FCATC, TAIEX, OMXC, PSE, STI and KOSPI are in 4 week winning streaks. The latter has climbed 19% over that time.

The FTSE 250, OMX-H, OMX-S, SMI, SOX and Vietnam’s VN Index have risen for 5 weeks.

Poland’s WIG has climbed for 6 weeks.

The All World Developed-ex USA, Austria’s ATX, Norway’s OBX, Czechia’s PX and Spain’s IBEX have strung together 8 weeks of gains.

The Nasdaq Transports & Pakistan’s KSE have advanced for 10 consecutive weeks.

The U.S. KBW Bank and a biotech index dropped off the overbought list.

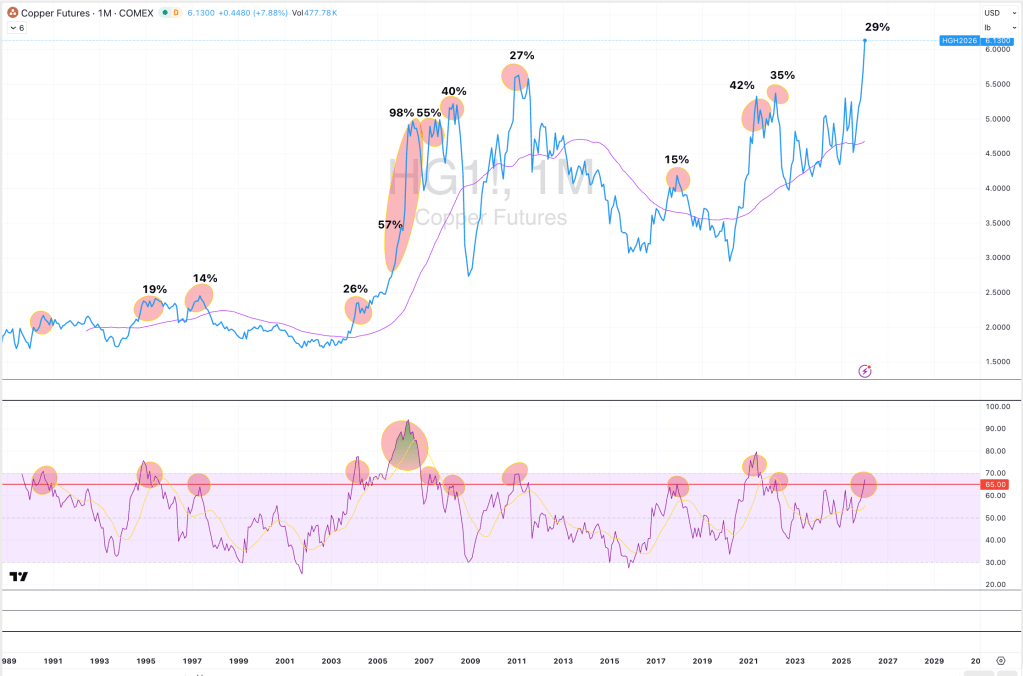

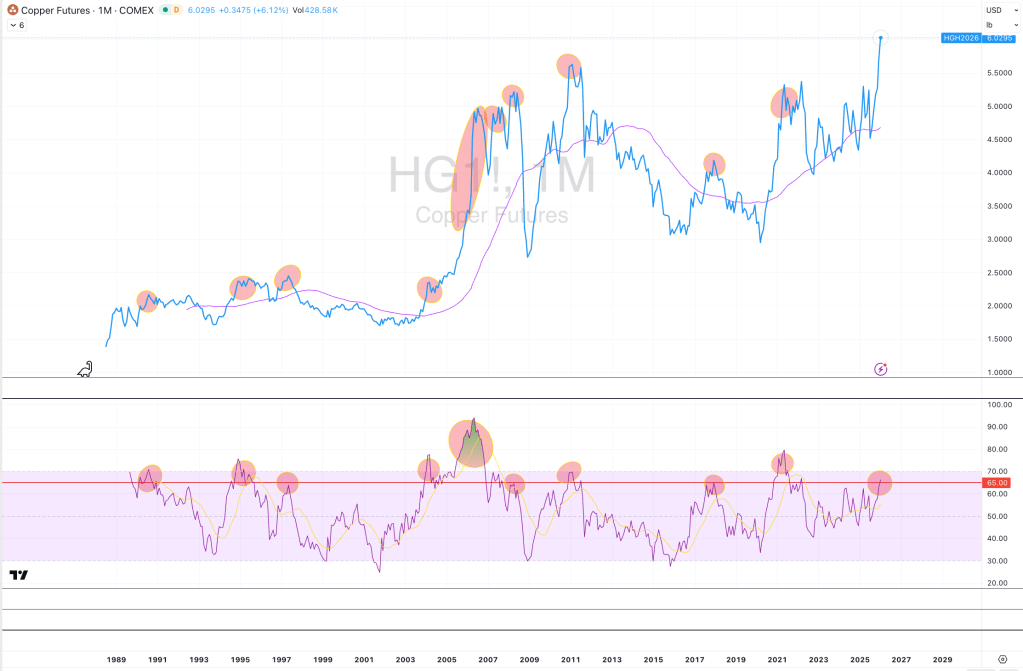

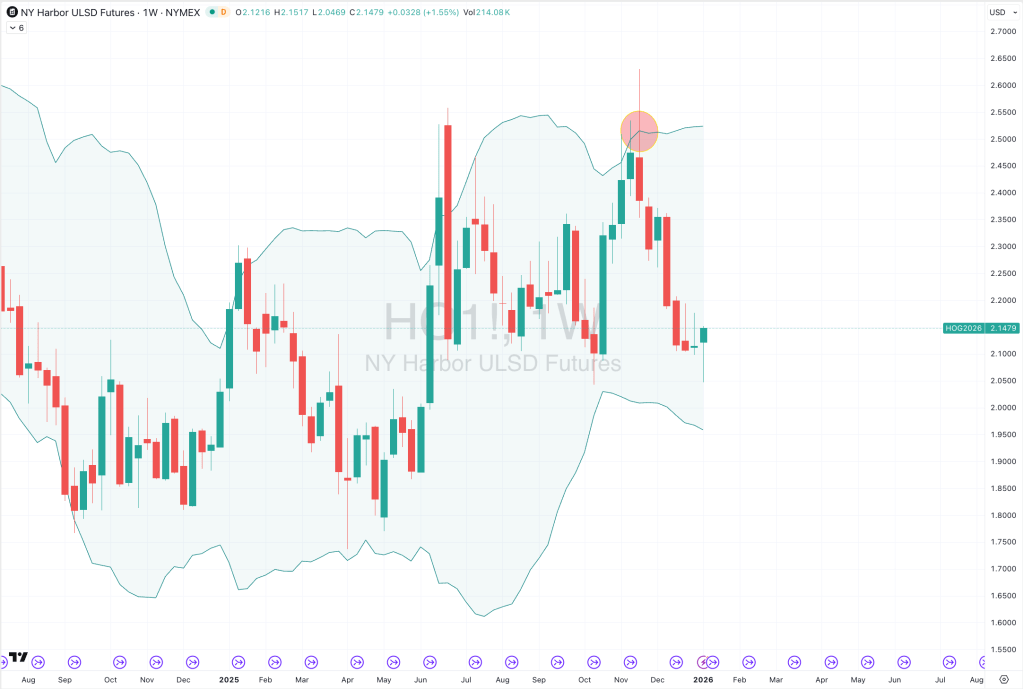

Commodities were mostly higher, again.

LNG, Lumber, Tin, Dutch Gas, Silver and Rice were the notable gainers.

Shipping Rates, Cocoa, Copper, Palladium and Corn were the notable decliners.

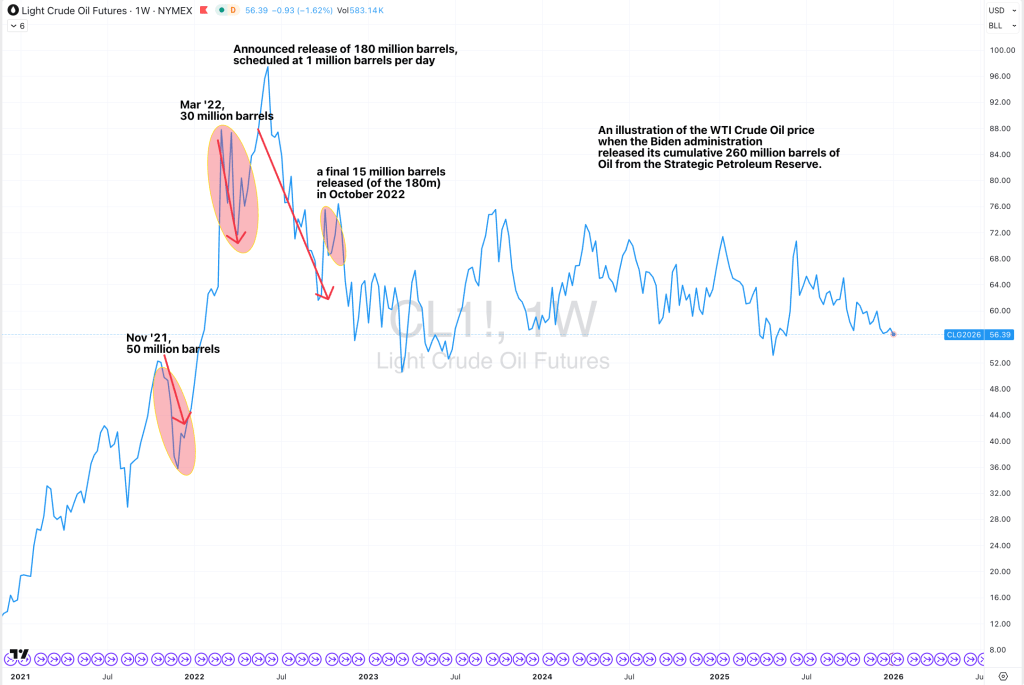

Brent and WTI Crude are in a 4 week winning streak.

Rubber fell and broke a 6 week winning streak.

The U.S. Gulf Urea price has risen for 6 weeks.

Lumber is no longer oversold.

The latter broke its 7 week winning streak.

Nickel snapped a 4 week winning streak.

Orange Juice has advanced for 6 weeks, climbing 50% over that time.

Lithium, Coking Coal, Aluminium and Tin are all registering overbought quinella’s.

Lithium Hydroxide has advanced for 5 weeks.

Rubber has climbed for 6 weeks.

Uranium’s winning streak extends to 8 weeks.

While Natural Gas has fallen for 6 weeks, declining 38% over that time.

Currencies were quieter.

While the Aussie was firmer (ex ZAR) and the AUD/EUR is in a 4 week winning streak, many of the AUD pairs departed overbought territory.

Other notable changes this week is the Yen is less oversold.

The CAD rose.

The Euro was weaker.

CHF/AUD has fallen for 4 weeks.

EUR/GBP has declined for 5 weeks.

EUR/USD is entering a new downward trend.

PHP/USD is in a 4 week losing streak.

Inversely, the USD/INR has climbed for 4 weeks.

The NZD/AUD rose and snapped a 4 week losing streak.

And, the USD has fallen against the South African Rand for 8 weeks.

The larger advancers over the past week comprised of;

Australian Coking Coal 3.6%, Lean Hogs 3.5%, Heating Oil 4.7%, JKM LNG 11.1%, Lumber 6.5%, LNG in Yen 13.6%, Lithium Carbonate 5.7%, Tin 18.8%, Newcastle Coal 4.2%, Orange Juice 2.4%, Robusta Coffee 2.5%, LME Tin 5.3%, Dutch TTF Gas 30%, Urea U.S. Gulf 2.3%, Gasoil 3.6%, Uranium 2.8%, Silver in AUD & USD 12.8%, Gold in AUD 2%, Gold in CAD 1.,9%, Gold in CHF 2.2%, Gold in EUR 2.3%, Gold in GBP 2.1%, Gold in USD 1.9%, Rice 3.4%, AD02 1.6%, AEX 2.2%, BUX 5%, IDX 1.6%, EGX 3.6%, FCATC 2.5%, HSCEI 1.9%, Hang Seng 2.3%, S&P Small Cap 600 1.7%, Russell 2000 2.1%, TAIEX 3.7%, KLSE 1.6%, Mexico 1.6%, Nikkei 225 3.8%, OBX 3.2%, OMXH 2%, OMXS 2.2%, PSE 1.8%, SA40 2%, SET 1.7%, SOX 3.8%, STI 2.2%, XFJ 1.9%, XJO 2.1%, XMJ 3.9%, XNJ 1.8%, XSO 2.1% and BIST rose 3.8%.

The group of largest decliners from the week included;

Baltic Dry Index (7.2%), Cocoa (5%), Copper (1.2%), Natural Gas (2.1%), Palladium (2.6%), Corn (4.7%), KBW Banks (1.7%), China A50 (2.2%), IBB (1.4%) and the Nasdaq Composite fell 0.7%.

January 18, 2026

By Rob Zdravevski