Dr Copper says…..

January 13, 2026 Leave a comment

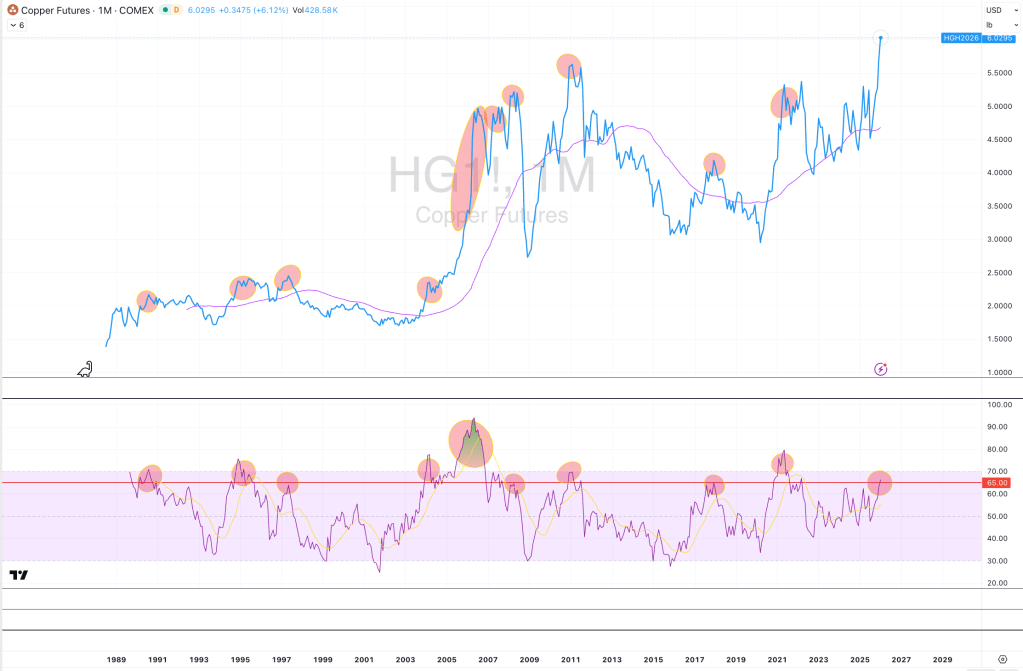

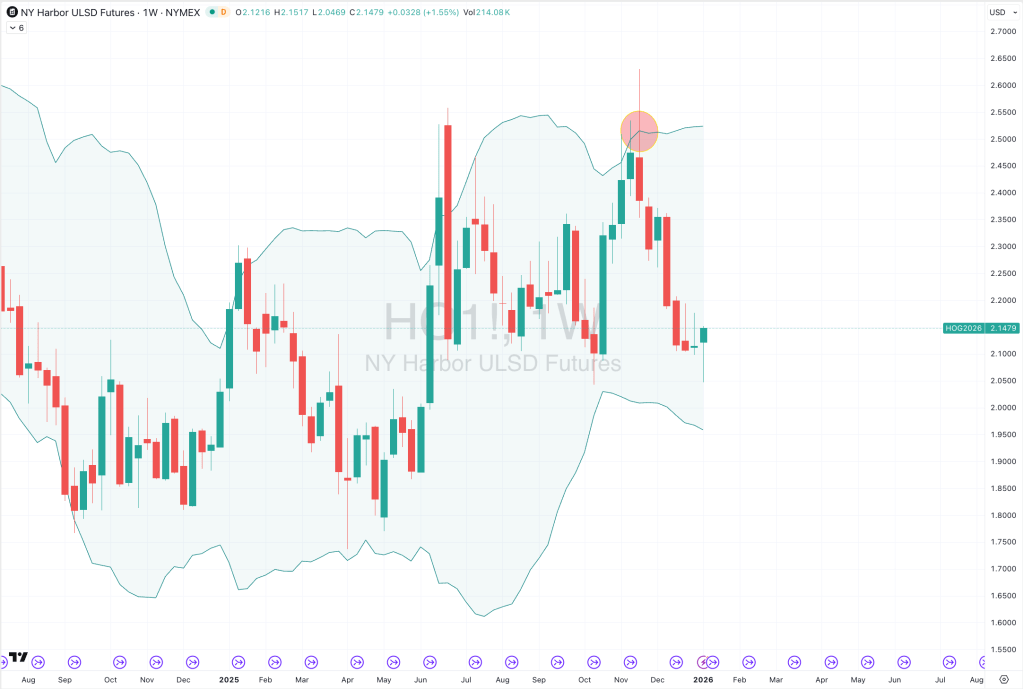

I don’t think it’s the best time to buy (or chase) Copper when the circles start appearing.

January 13, 2026

rob@karriasset.com.au

#meanreversion

#parabolas

Trying to hear what's not being said

January 13, 2026 Leave a comment

I don’t think it’s the best time to buy (or chase) Copper when the circles start appearing.

January 13, 2026

rob@karriasset.com.au

#meanreversion

#parabolas

January 13, 2026 Leave a comment

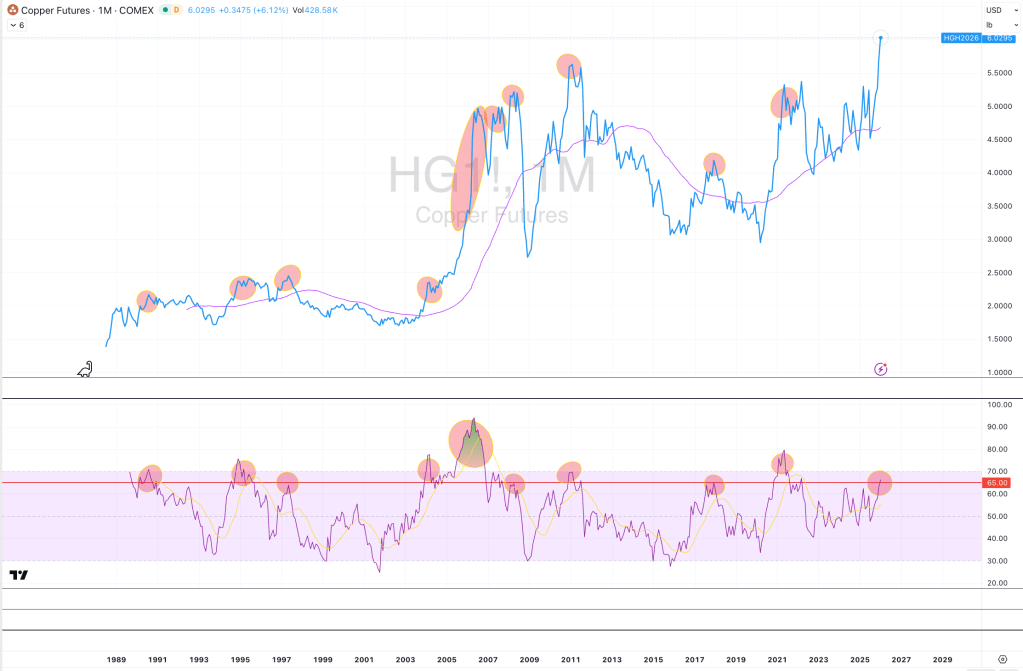

A year ago, I wrote about the oversold extremes seen in Nickel and Lithium.

Those extremes were illustrating my contrarian interest in ‘buying straw hats in winter’.

Then, “nobody” wanted to own lithium or nickel related securities.

There are also several articles in my archive featuring ASX listed Lithium and Nickel producer, IGO Group, where I warn of its overbought and oversold extremes.

Now, my weekly Macro Extremes publication lists Lithium (Carbonate & Hydroxide) and Nickel as being in overbought territory.

And today, IGO Group is completing a reversion up to a longer term mean.

It looks like we are getting to upper end of this bounce, particularly when various stocks have nearly trebled from their recent lows.

January 13, 2026

rob@karriasset.com.au

January 13, 2026 Leave a comment

Who is ‘short’ Silver?

Nobody !

January 13, 2026

rob@karriasset.com.au

January 11, 2026 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Copper/Gold Ratio

Copper

AUD/CAD

AUD/CHF

AUD/EUR

AUD/IDR

AUD/USD

Germany’s DAX

Italy’s MIB

Russell 2000

FTSE 250

S&P Midcap 400

And Türkiye’s BIST Index

Overbought (RSI > 70)

Korean 10 year government bond yields *

The Japanese bond yield curve *

Lithium Carbonate

Tin *

LME Aluminium

Platinum

Silver in AUD & USD *

Gold in CAD, CHF, GBP & USD

AUD/JPY

CHF/JPY *

CLP/USD

CNH/USD *

EUR/JPY *

GBP/JPY *

CSI 300

Austria’s ATX Index *

U.S. KBW Bank Index *

Indonesia’s IDX Composite Index

Dow Jones Transports

Egypt’s EGX Index *

IBB Index

Spain’s IBEX *

Brazil’s BOVESPA Index

Taiwan’s TAEIX *

South Korea’s KOSPI Index *

Nasdaq Biotech Index *

OMX Helsinki Index *

OMX Stockholm Index

Czechia’s PX Index *

South Africa’s SA40 equity index *

Switzerland’s SMI Index

Philadelphia SOX Index

Chile’s IGPA *

Singapore’s Strait Times *

Israel’s TA35 *

Nasdaq Transports *

Canada’s TSX equity index *

FTSE 100 *

S&P Biotech Index *

And the ASX Materials Index

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Chilean 10 year minus Chilean 2 year bond yield spread

Australian Coking Coal

Lithium Hydroxide

Nickel *

ZAR/USD *

Shanghai Composite

All World Developed (ex USA) *

Hungary’s BUX Index *

Pakistan’s KSE Index

OMX Copenhagen Index

Vietnam’s VN Index

Poland’s WIG Index *

Extremes below the Mean (at least 2.5 standard deviations)

CAD/AUD

EUR/AUD

Oversold (RSI < 30)

Lumber *

Sugar #16 *

JPY/AUD *

JPY/EUR

NZD/AUD *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Chilean 2 year bond yield

USD/ZAR *

Notes & Ideas:

Government bond yields generally fell.

Except for shorter duration U.S. yields, the Japanese 5 year yield which have risen for 8 weeks and the Japanese 10’s have climbed for 4 weeks.

This week saw a few more yield extremes depart.

The U.S. 2 year bond yields rose and broke 4 weeks of decline.

Danish 10 year yields fell and broke a 5 week winning streak.

Indonesian 10 year yields rose and broke 5 weeks of advance.

Turkish 10’s rose and snapped 7 weeks of weakness.

Equities had a terrific week.

It has been months since seeing this many indices in overbought territory.

Helsinki’s OMX and Vietnam’s VN Index are in 4 week winning streaks.

Poland’s WIG has risen for 5 weeks.

The All World Developed Index-ex USA, Austria’s ATX, Norway’s OBX, Czechia’s PX and Spain’s IBEX have strung together 7 weeks of gains.

Pakistan’s KSE has climbed for 9 consecutive weeks.

Commodities were mostly higher.

Crude, Copper, Tin, Lithium, Nickel, Palladium, Platinum, Gasoline & Gold were the notable gainers.

Shipping Rates, Cocoa, Natural Gas and LNG as priced in Yen were the notable decliners.

Lithium prices have rallied and are now overbought.

Platinum and Gild return to overbought territory.

Aluminium is overbought as priced on the LME and nearly there on the COMEX.

Richards Bay Coal & Rice are no longer oversold.

The latter broke its 7 week winning streak.

Nickel has climbed for 4 weeks, rising 22% over that time.

Orange Juice has advanced for 5 weeks, climbing 47% over that time.

Lithium Hydroxide and Rubber have also advanced for 5 weeks.

Uranium’s winning streak extends to 7 weeks.

Gasoline snapped its 4 weeks slump.

While Natural Gas has fallen for 5 weeks, declining 36% over that time.

Currencies were active.

The Aussie was stronger and appearing in the extremes.

CAD was weaker, again.

CNH/USD fell enough to break a 6 week winning streak.

GBP/EUR has risen for 4 weeks.

Overall, the British Pound was mixed.

Commodity currencies such as the Aussie and Chilean Peso are overbought.

The Yen is oversold, everywhere.

EUR/CHF rose to end 4 weeks of decline.

The Kiwi has slumped for 4 straight weeks against the Aussie.

And, the USD has fallen against the South African Rand for 7 weeks.

The larger advancers over the past week comprised of;

Australian Coking Coal 2.3%, Richards Bay Coal 2.7%, Aluminium 2.9%, Bloomberg Commodity Index 2.4%, Brent Crude Oil 4.3%, WTI Crude Oil 3.1%, Copper 3.7%, Lithium Carbonate 22.1%, Lithium Hydroxide 16.2%, Tin 12.3%, LME Aluminium 5%, Nickel 4.9%, Orange Juice 3.1%, Palladium 10.6%, Platinum 7.5%, Gasoline 4.9%, Sugar 2%, S&P GSCI 2.2%, Urea U.S. Gulf 1.7%, Gasoil 3.4%, Urea Middle East 3.7%, Silver in AUD 9.9%, Silver in USD 9.8%, Gold in AUD 4.2%, Gold in CAD 5.5%, Gold in CHF 5.3%, Gold in EUR 4.8%, Gold in GBP 4.6%, Gold in USD 4.1%, Gold in ZAR 4.1%, Corn 1.9%, Oats 1.9%, Rice 5.3%, Soybean 1.6%, Wheat 2.1%, Shanghai Composite 3.8%, CSI 300 2.8%, AD02 1.7%, AEX 2.1%, KBW Banks 2.1%, BUX 4.9%, CAC 2%, IDX 2.2%, DAX 2.9%, DJ Industrials 2.4%, DJ Transports 3.7%, FCATC 4.2%, IBB 2%, Bovespa 1.8%, S&P SmallCap 600 4.2%, Russell 2000 4.6%, TAEIX 3.2%, Nasdaq Composite 1.9%, KRE Regional Banks 3.4%, KSE 3%, KOSPI 6.4%, FTSE 250 2.8%, S&P Midcap 400 3.3%, Mexico 3%, NBI 1.9%, Nasdaq 100 2.2%, Nikkei 225 3.2%, Copenhagen 4.3%, Stockholm 3.2%, PSE 3.5%, PX 1.8%, SA40 1.7%, SOX 3.7%, IGPA 4.6%, S&P 500 1.6%, STI 1.9%, TA35 4.4%, Nasdaq Transports 4.6%, TSX 2.3%, FTSE 100 1.7%, Vietnam 4.7%, XBI 2.5%, ASX Materials 3.7%, ASX Small Caps 2.1% and Türkiye’s BIST rose 6.1%.

The group of largest decliners from the week included;

Baltic Dry Index (10.3%), Cocoa (9%), LNG in Yen (3.5%), Natural Gas (12.4%), Dutch TTF Gas (2.2%), Sensex (2.6%) and the ASX Financials fell 2.5%.

January 11, 2026

By Rob Zdravevski

January 9, 2026 Leave a comment

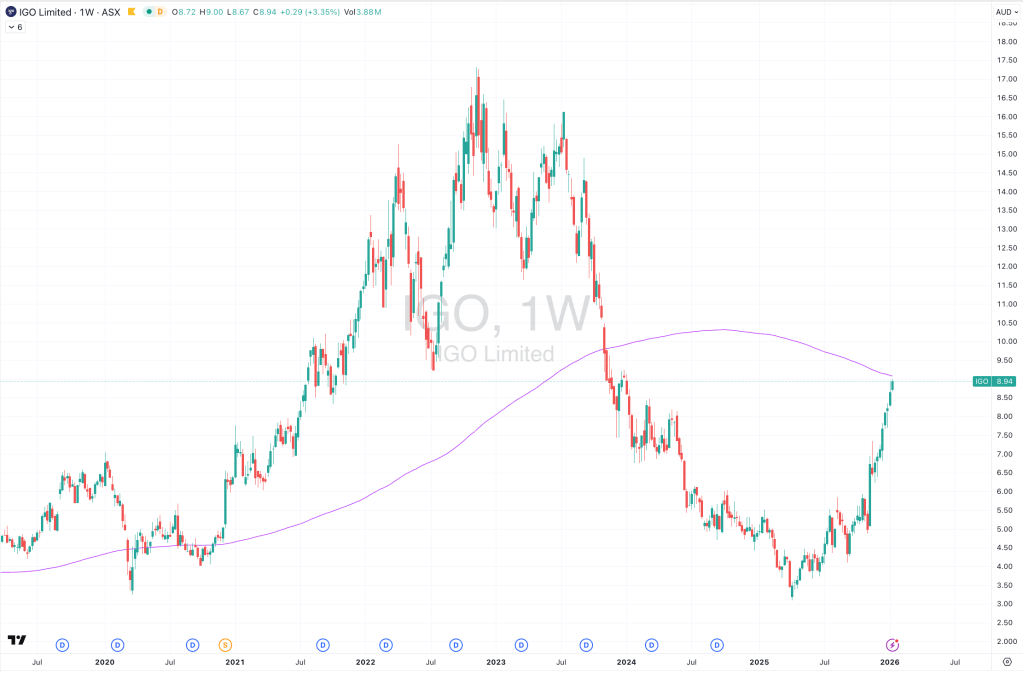

Once upon a time (in my Macro Extremes publication for the week ending November 14, 2025),

Heating Oil appeared in the overbought extreme category…..

The chart below shows you the 15% decline since then.

January 9, 2026

rob@karriasset.com.au

January 7, 2026 Leave a comment

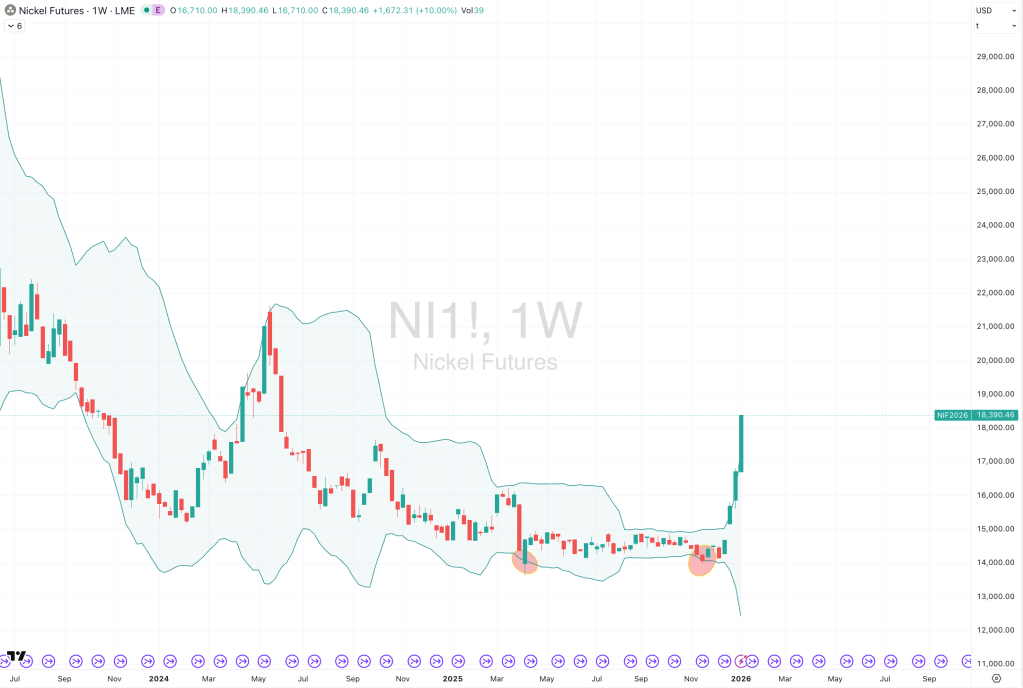

The circles in the study below are 2 moments when the price of Nickel was out of favour, unloved and trading at one of my ‘extremes’.

Those moments were highlighted in many presentations that I conducted in 2025 with investors, corporations and investment banks.

Any of the attendees would recall me using the line that buying Nickel was akin to “buying straw hats in winter”.

Today, the news outlets are posting headlines telling us that #Nickel has rallied.

There is a little bit to go, but it’s too late for now.

January 7, 2026

rob@karriasset.com.au

January 7, 2026 Leave a comment

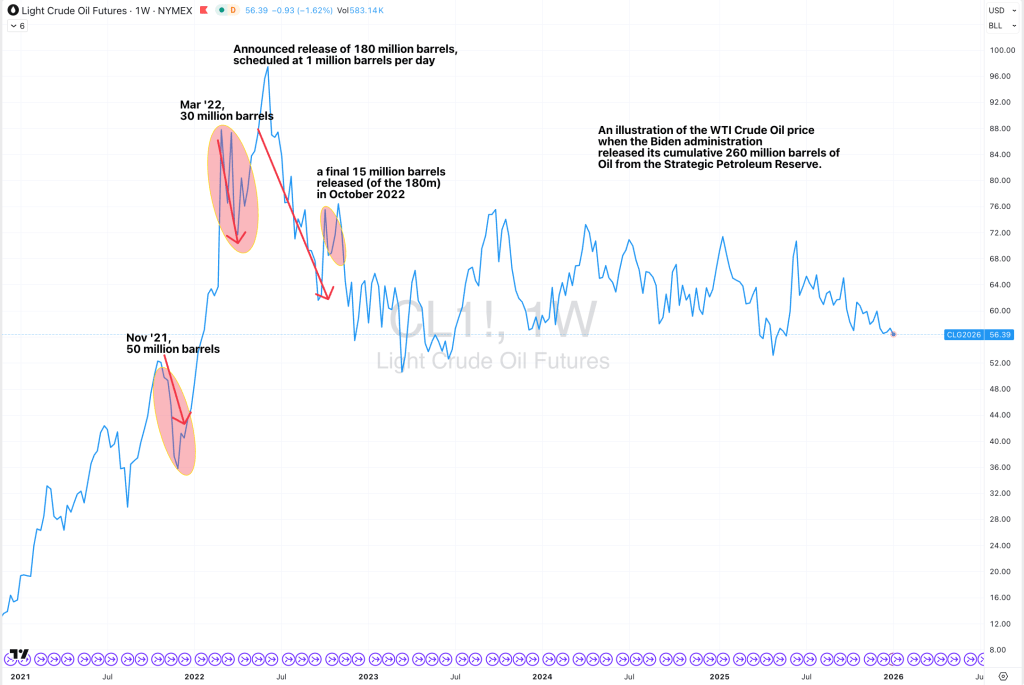

Between November 2021 and October 2022, the Biden administration announced that 260 million barrels of Oil would be released from the Strategic Petroleum Reserve.

Then, the mid-term elections were held in November 2022.

Now, there are 50 million barrels of Venezuelan “heavy sour” Oil (not light sweet, although the SPR holds both) bound for the U.S.

Later, they’ll send another 100 million barrels or so.

And sometime before November 2026, in time for the mid-term elections, (whether the oil arrives or not), the headline will read something like, “Trump replenishes the SPR which Biden sold off”.

January 7, 2026

rob@karriasset.com.au

January 6, 2026 Leave a comment

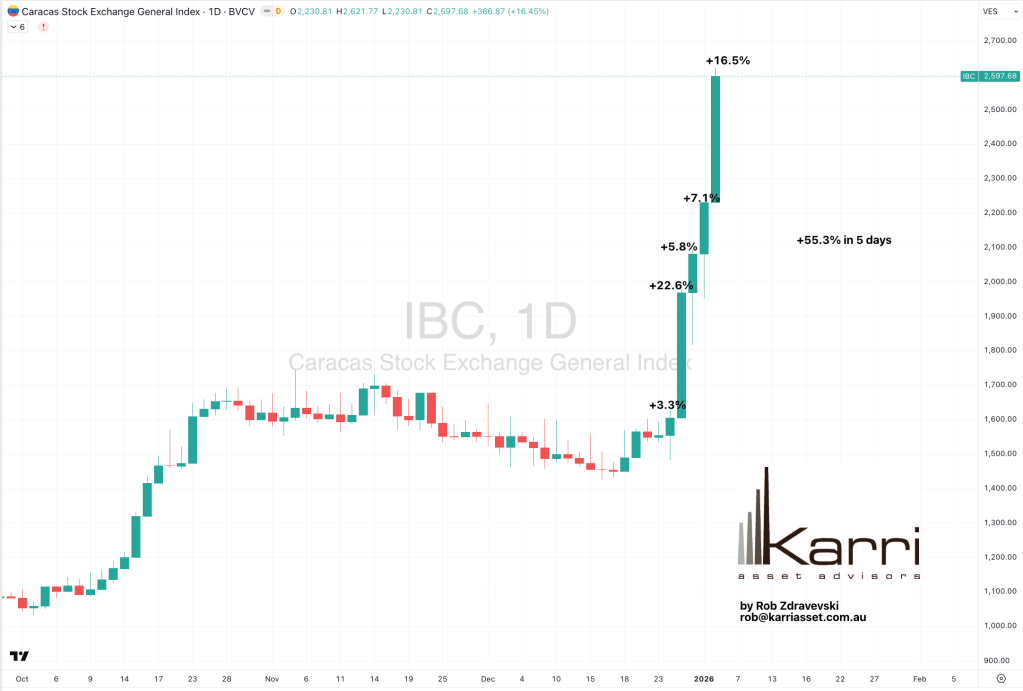

The Caracas General Index rose 16.5% in Monday’s trade…..

but it has risen 55% over the past 5 days.

#frontrunning

#votingmachine

January 6, 2026

rob@karriasset.com.au

January 4, 2026 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Austrian 10 year bond yields

U.S. 10 year minus U.S. 2 year bond yield spread

Overbought (RSI > 70)

Australian 2, 3 and 5 year bond yield

Australian 10 year minus U.S. 10 year bond yield spread *

Danish & Korean 10 year government bond yields *

European 20 and 30 year bond yields

The Japanese bond yield curve

Silver in AUD & USD *

CHF/JPY *

EUR/JPY *

GBP/JPY *

MYR/USD *

All World Developed ex USA index

Austria’s ATX Index

U.S. KBW Bank Index *

Hungary’s BUX Index *

Indonesia’s IDX Composite Index

Egypt’s EGX Index *

Spain’s IBEX *

Taiwan’s TAEIX

Malaysia’s KLSE Index

Pakistan’s KSE Index

South Korea’s KOSPI Index

Nasdaq Biotech Index *

OMX Helsinki Index *

Czechia’s PX Index *

South Africa’s SA40 equity index *

Chile’s IGPA *

Singapore’s Strait Times *

Israel’s TA35 *

Nasdaq Transports *

Canada’s TSX equity index *

FTSE 100

S&P Biotech Index

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Lithium Hydroxide

Nickel

CNH/USD *

ZAR/USD

Poland’s WIG Index

Extremes below the Mean (at least 2.5 standard deviations)

None

Oversold (RSI < 30)

U.S. 10 year minus the Australian 10 year bond yield spread *

U.S. 10 year bond yield divided by Australian 10 year yield spread *

Richards Bay Coal *

Lumber *

Sugar #16 *

Rice *

JPY/AUD *

JPY/CAD

NZD/AUD *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

USD/CNH

USD/ZAR

Notes & Ideas:

Government bond yields generally rose.

U.S. 2 year bond yields have fallen for 4 weeks.

Danish 10 year yields have climbed for 5 weeks.

Brazilian 10 year yields fell and snapped a 4 week rise.

Japanese 2 and 5 year bond yields have risen for 7 weeks straight.

Indonesian 10 year yields have fallen for 5 weeks.

Turkish 10’s have sunken for 7 weeks.

Equities were mixed to mostly higher.

Malaysia’s KLSE fell and broke a 4 week winning streak.

Poland’s WIG has risen for 4 weeks.

The Russell 2000 and South Africa 40 have climbed for 4 weeks.

The All World Developed Index, Austria’s ATX, Spain’s IBEX, Norway’s OBX, Czechia’s PX, South Africa’s SA40, Israel’s TA-35, and the ASX Financials are in 6 week winning streaks.

KBW Bank Index, ASX Financials and DJ Transports fell and broke a 5 week winning streak.

Pakistan’s KSE has climbed for 8 consecutive weeks.

Commodities were also mixed.

Coffee, Cattle, Lithium Hydroxide, Nickel, and Orange Juice were the notable gainers.

Palladium, Platinum, Gold, Corn, oats, Rice and Tin were the notable decliners.

None of the precious metals are overbought, this week.

Orange Juice has advanced for 4 weeks, climbing 44% over that time.

Uranium’s winning streak extends to 6 weeks.

Gasoline has slumped for 4 weeks.

Lithium Hydroxide has moved into overbought territory.

Silver in AUD broke its 7 week winning streak.

Rice has fallen for 7 straight weeks.

Currencies were quieter.

The Aussie was mostly weaker.

AUD/JPY, MYR/USD and GBP/USD fell and broke their 5 week winning streaks.

CAD was lower.

CAD/JPY and GBP/JPY fell and broke a 7 week advance.

EUR/CHF has declined for the past 4 weeks.

THB/USD fell and broke its 6 week climb.

Inversely, the USD has fallen against the South African Rand for 6 weeks.

And the USD/Chinese Yuan is oversold.

The larger advancers over the past week comprised of;

Copper/Gold Ratio 2.5%, Arabica Coffee 2%, Cattle 2.8%, Lithium Hydroxide 15.4%, Aluminium 1.9%, Nickel 6.5%, Orange Juice 4.3%, Robusta Coffee 2.5%, Dutch TTF Gas 3.9%, AEX 2.8%, ATX 2%, IDX 2.5%, FCATC 3.4%, MIB 1.7%, HSCEI 2.9%, Hang Seng 2%, IBEX 1.9%, TAEIX 2.8%, KSE 3.9%, KOSPI 4.4%, OBX 1.8%, OMX-H 2%, SOX 2.2%, TA35 2.6%, VN Index 3.2%, WIG 3.5% and BIST rose 1.8%.

The group of largest decliners from the week included;

Bloomberg Commodity Index (2.6%), Palm Oil (2.4%), Copper (2.5%), Lumber (3.4%), Lithium Carbonate (9.3%), Tin (5.2%), Newcastle Coal (2.8%), Natural Gas (6.7%), Palladium (16.4%), Platinum (14.2%), Sugar (3.8%), Silver in AUD (7.9%), Silver in USD (8.2%), Gold in AUD (4.2%), Gold in CAD (4%), Gold in CHF (4.1%), Gold in EUR (4%), Gold in GBP (4.2%), Gold in USD (4.4%), Gold in ZAR (5.3%), Corn (2.8%), Oats (3.3%), Rice (4.2%), Soybean (2.5%), Wheat (2.4%), IBB (1.8%), S&P SmallCap 600 (1.4%), Nasdaq Composite (1.5%), KRE (1.9%), Mexico (2.3%), NBI (1.8%), S&P 600 (1.4%) and XBI fell 2.8%.

January 4, 2026

By Rob Zdravevski

December 31, 2025 Leave a comment

As I write, the price of Silver is trading at US$71.33.

My work suggests that it trades down to ~US$47, at which point I’ll assess if US$38-US$40 is on the cards.

I have similar directional views for Gold.

December 31, 2025

rob@karriasset.com.au