A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Palladium

Uranium

Shanghai Composite

Overbought (RSI > 70)

U.S. 10 year minus U.S. 5 year bond yield spread

U.S. 30 year minus U.S. 10 year bond yield spread

CHF/USD

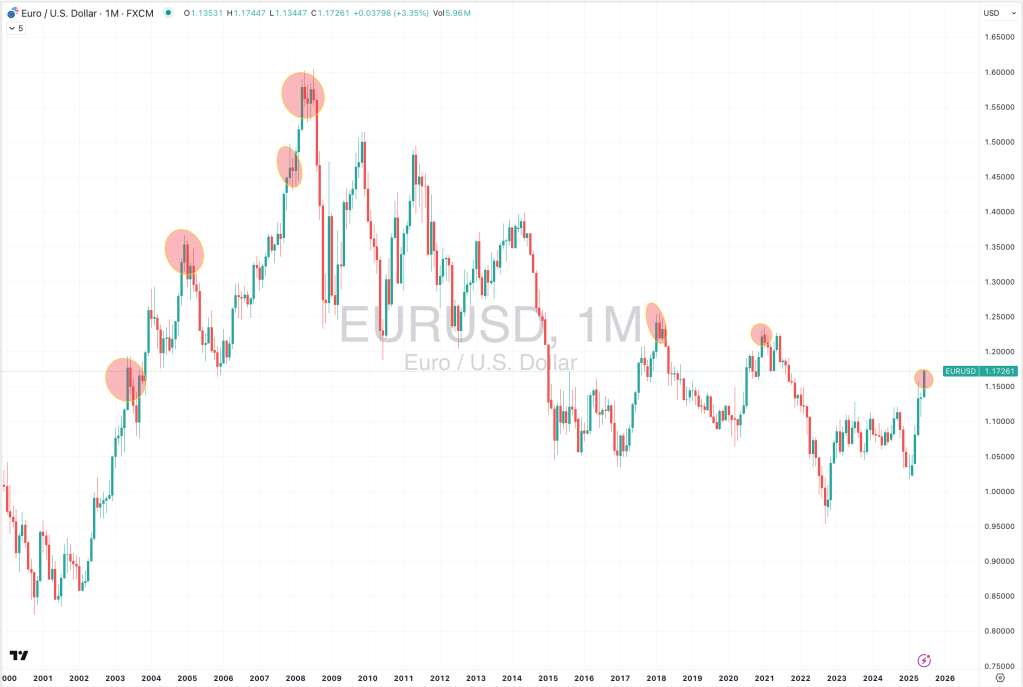

EUR/USD

GBP/USD

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Platinum *

KOSPI *

And the Tel Aviv 35 equity index

Extremes below the Mean (at least 2.5 standard deviations)

Arabica Coffee *

Oversold (RSI < 30)

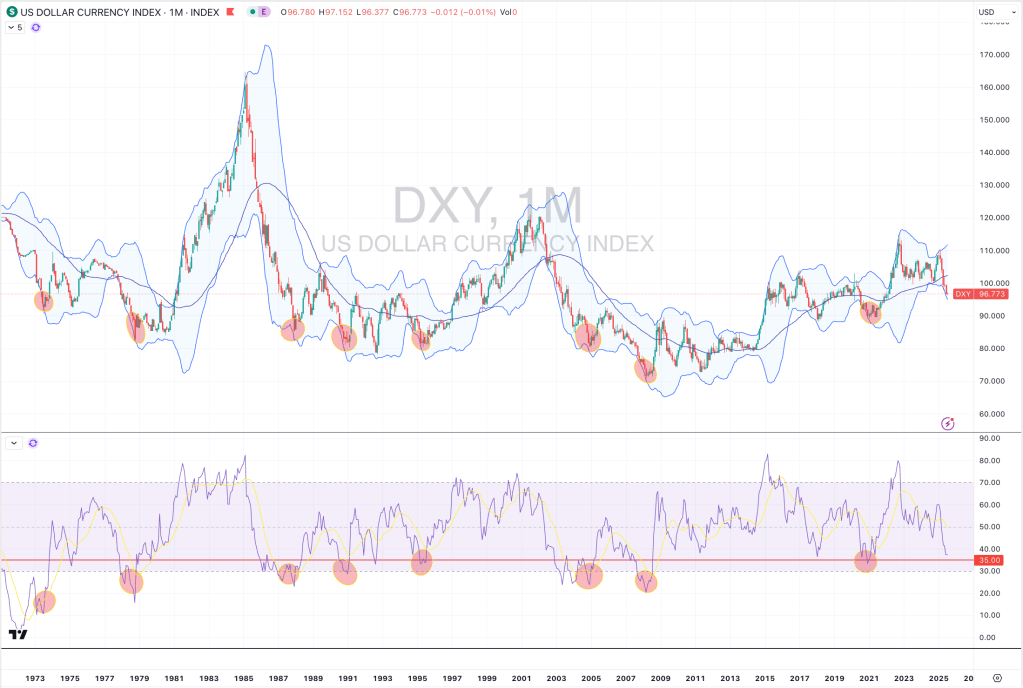

U.S. (DXY) Index

Lithium Carbonate *

Lithium Hydroxide *

CAD/CHF

CAD/EUR

HKD/USD *

USD/CHF

USD/DKK

And Thailand’s SET equity index *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Robusta Coffee *

Notes & Ideas:

Government bond yields generally fell, again, again….

Except for Japanese yields where the 5’s and 10’s broke their 4 week falling streak.

High Yield Corporates are nearing oversold territory.

U.S. 10’s minus 2’s spread appear to be a maximum bullishness.

Chilean 2 year and Russian 10 year bond yields have fallen for 5 straight weeks.

The Chinese 10’s have done so for 4 weeks.

U.S. 2 year bond yields are near longer term mean reversion,

While the U.S. 3 year yields already did so.

Equities were had a good week.

Asian indices fared well with the Shanghai Composite registering an overbought reading.

South Korea’s KOSPI has risen for 5 straight weeks.

The Philadelphia SOX index is in a 4 week winning streak.

Norway’s OMX broke its 4 week winning streak.

Indonesias IDX broke its 4 week losing streak.

Thailand’s SET index broke it 6 consecutive weeks of losses.

Commodities were mixed, again.

Oils, Distillates and Gases dominated the losers, along with the Softs.

The Copper/Gold Ratio rose notably which aligned with the ‘rick-on’ appetite seen in equities.

The Baltic Dry Index fell 10% and 24% over the past fortnight.

Gold prices fell and as such Gold Volatility mean reverted.

Tin looks like its set for a higher move as it registers a 4 week winning streak.

Platinum has also risen for 4 week straight, advancing 25% during that time.

Robusta Coffee has sunk for 9 consecutive weeks.

And Sugar is in a 7 week losing streak.

Currencies were active.

The big news is the U.S. Dollar (DXY) Index appearing in oversold territory.

And with that, comes a host of USD pairs registering extreme treading this week.

The Aussie was mixed. It was weaker versus the Europeans and stronger in Asia and the USD.

Brazil’s Real is in a 4 week winning streak vs the USD.

The Loonie was mostly weaker with the CAD/EUR in a 4 week losing streak.

The Swissie was stronger and the CHF/JPY has risen for 5 straight weeks.

EUR/JPY has climbed for 5 straight weeks.

GBP was stronger.

Yen was mixed.

PHP/USD broke its 4 week losing streak

And the USD/INR broke its 4 week winning streak.

The larger advancers over the past week comprised of;

Aluminium 1.7%, Cocoa 9.2%, Cotton 3,9%, Lumber 2%, Cattle 1.7%, Tin 3.3%, Nickel 1.5%, Palladium 9.2%, Platinum 5.8%, Uranium 2.5%, Oats 2.7%, Shanghai Composite 1.9%, CSI 300 2%, All World Developed ex USA 2.8%, ATX 1.9%, KBW Banks Index 5.6%, DAX 2.9%, Dj Industrials 3.9%, DJ Transports 4.9%, Egypt 9.1%, FCATC Index 4.5%, HSCEI 2.8%, Hang Seng 3.2%, S&P SmallCap 600 3.2%, Russell 2000 3%, TAIEX 2.4%, Nasdaq Composite 4.3%, KLSE 1.7%, KRE Regional Banks 4.4%, KSE 3.6% FTSE 250 2.7%, Mexico 2%, S&P MidCap 400 2.6%, Nasdaq 100 4.2%, Nikkei 225 4.6%, NIFTY 2.1%, Stockholm 2.4%, SENSEX 2%, SOX 6.4%, S&P 500 3.4%, STI 2.1%, TA35 2.5%, Nasdaq Transports 3.7%, WIG 3.3%, ASX Financials 1.8%, ASX Materials 1.8%.

For reference, the ASX 200 rose 0.1%.

The group of largest decliners from the week included;

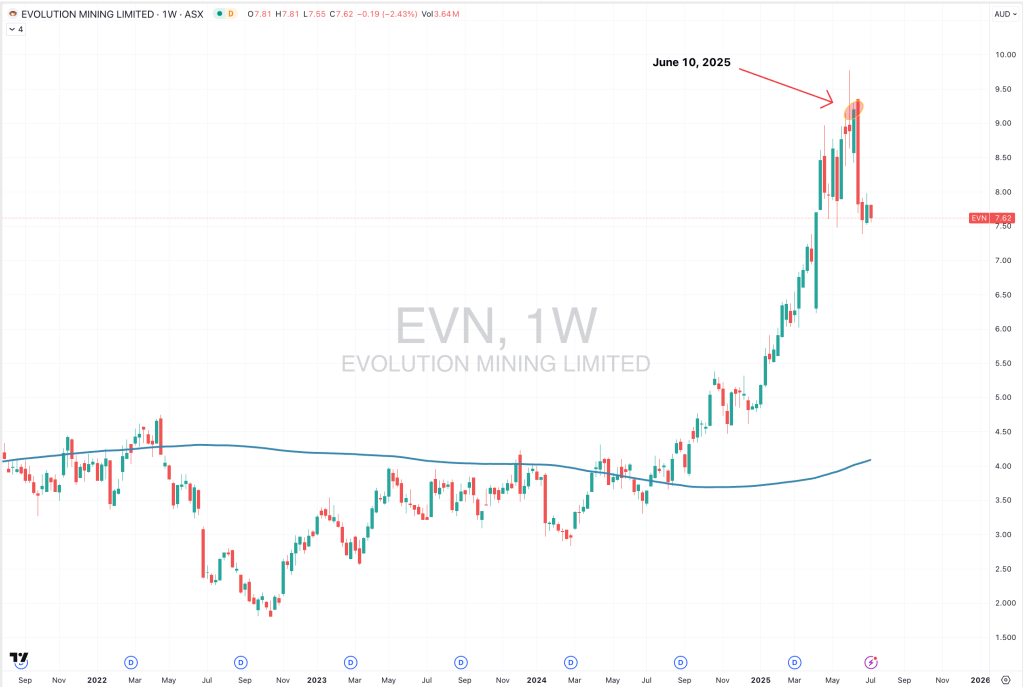

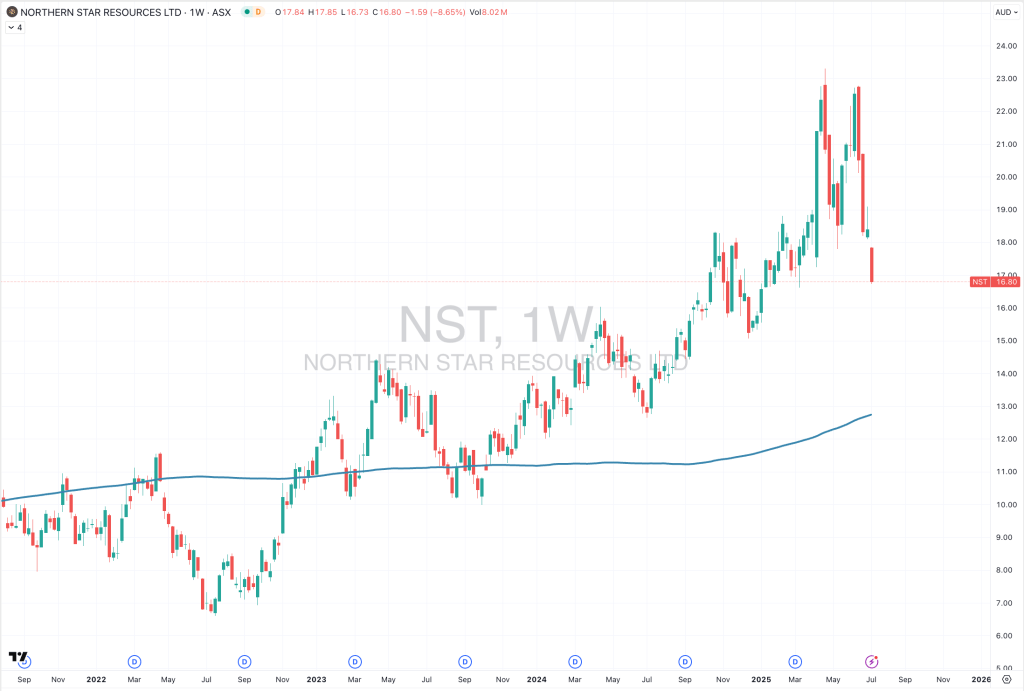

Bloomberg Commodity Index (3.6%), Brent Crude (12.1%), WTI Crude Oil (11.3%), Baltic Dry Index (10%), DXY Index (1.5%), Palm Oil (2.6%), Heating Oil (10.5%), HRC (2.4%), JKM LNG (7.4%), Arabica Coffee (3.6%), JKM LNG in Yen (13,3%), Newcastle Coal (4%), Natural Gas (6.8%), Orange Juice (3.3%), Gasoline (10.4%), Robusta Coffee (2.2%), Sugar (1.8%), S&P GSCI (6.1%), CRB Index (4.,1%), Dutch TTF Gas (14.1%), Gasoil (11%), Gold in AUD (4%), Gold in CAD (3.2%), Gold in CHF (5.1%), Gold in EUR (4.4%), Gold in GBP (4.7%), Gold in USD (2.8%), Gold in ZAR (4%), Corn (2.8%), Rice (2%), Soybeans (3.4%), Wheat (7.3%), OBX (2.2%) and the ASX Industrials fell 2.6%.

June 29, 2025

By Rob Zdravevski

rob@karriasset.com.au