Watch out for the rip

November 29, 2024 Leave a comment

It’s Friday, which means the Thursday (U.S. time) edition of the American Association of Individual Investors (AAII) Survey has been released.

History of survey results link here

https://www.aaii.com/sentimentsurvey/sent_results

and the respondents are more bearish than last week’s result.

and the bullish/bearish spread is negative at (1.5%).

It’s the highest bearish reading since Nov 2, 2023, when the bullish/bearish spread was also negative.

The most recent moment that the bullish/bearish spread was negative was in the April 25, 2024 release.

I have highlighted those 2 moments in the attached S&P 500 price chart.

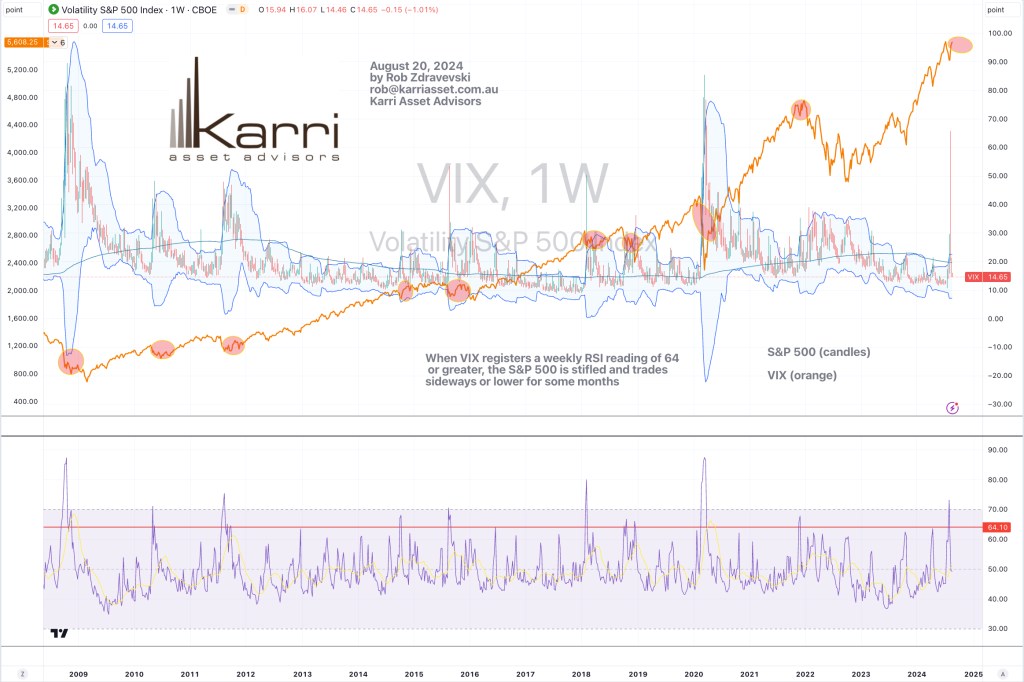

This is in keeping with my other commentary that while we are late in this particular equity ‘party’ and the VIX is subdued, it looks like equities will ‘rip’ higher.

Like any place where waves are prevalent, you need to watch out for the rips.

November 29, 2024

rob@karriasset.com.au