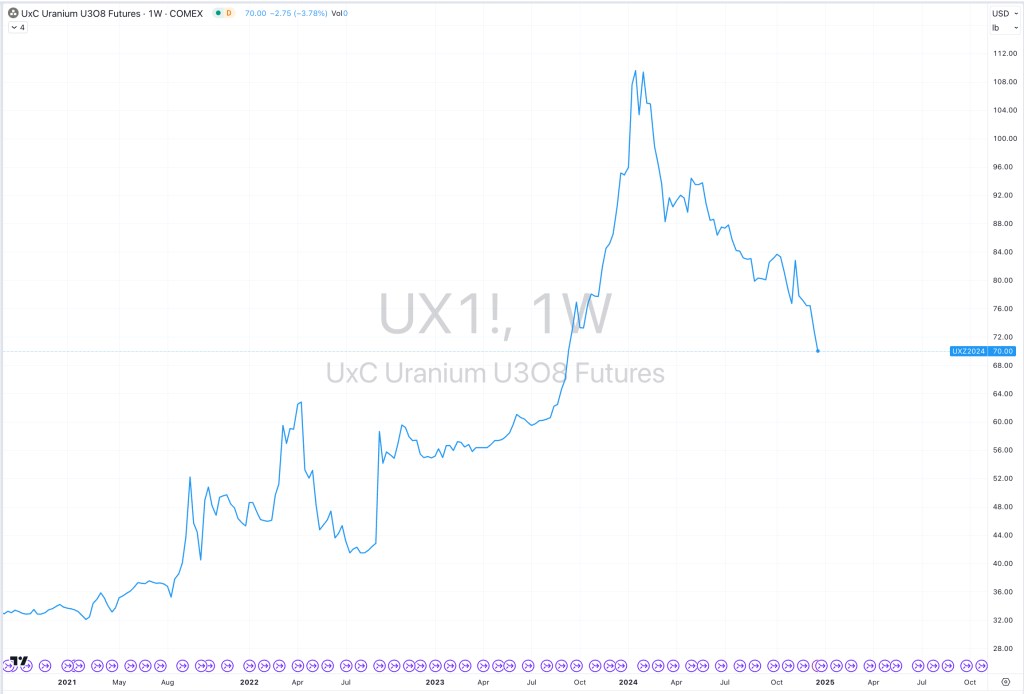

One more lower wave in Uranium

July 29, 2025 Leave a comment

It’s early but if the medium term downtrend in Uranium takes hold, I’ll look for it to trade down to the $64/$65 region (from its current $71.30).

If it picks up steam, the $55 region would represent a terrific washout.

July 29, 2025

rob@karriasset.com.au