Cooking with (Liquid Natural) Gas

August 16, 2023 Leave a comment

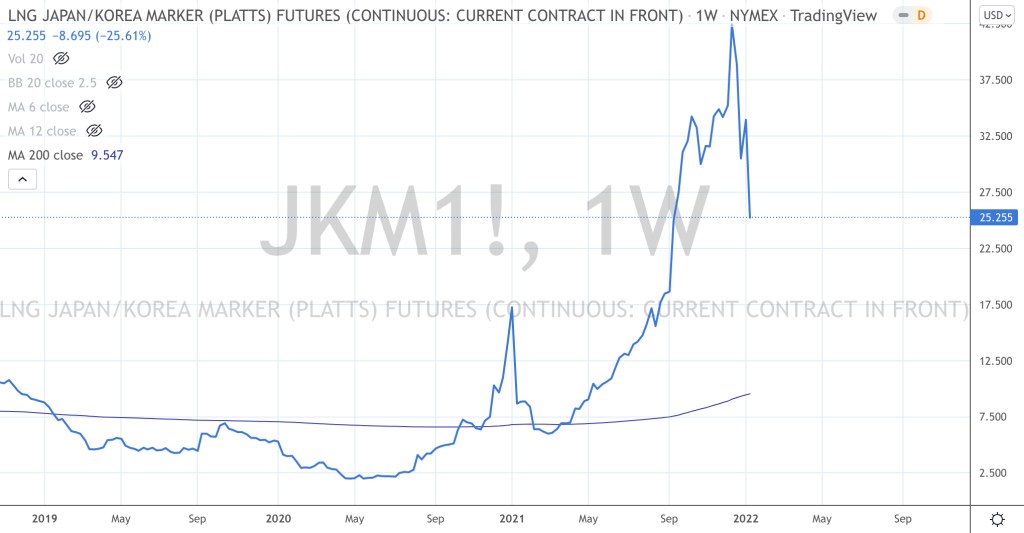

This post dated August 9, 2023, talked about the bullish price action I saw developing in LNG prices.

Since then, the Japanese Yen priced LNG contract has risen 37%.

Today, the U.S. traded (CME) LNG Japan Korea Marker “JKM” (Platts) futures contract jumped 34%.

Annoyingly, the Dutch TTF Gas contract has risen 42% over the past 13 trading days.

I say ‘annoying’ because I’d prefer prices to move in an orderly fashion.

Prices are no longer trading at extremes and cautioned is required chasing such quick moves as there are gaps below which are often ‘backed and filled’.

August 16, 2023

by Rob Zdravevski

rob@karriasset.com.au