A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Orange Juice

Palladium *

Shanghai Rebar Steel

CSI 300

ASX Materials Index

Overbought (RSI > 70)

Cattle *

Urea (U.S. gulf prices) *

Urea (Middle East) prices *

CHF/JPY

Hungary’s BUX Index *

Pakistan’s KSE Index *

South Korea’s KOSPI *

Czechia’s PX Index

South Africa 40 equity index *

Singapore’s Strait Times *

Tel Aviv 35 equity index *

Canada’s TSX *

Vietnam’s VN Index *

And Polands WIG equity index *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Copper

Shanghai Composite Index

Extremes below the Mean (at least 2.5 standard deviations)

None

Oversold (RSI < 30)

North European Hot Rolled Coil Steel *

Lithium Carbonate *

Lithium Hydroxide *

Robusta Coffee *

CAD/CHF

CAD/EUR

JPY/CHF

USD/CHF

JPY/EUR

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

None

Notes & Ideas:

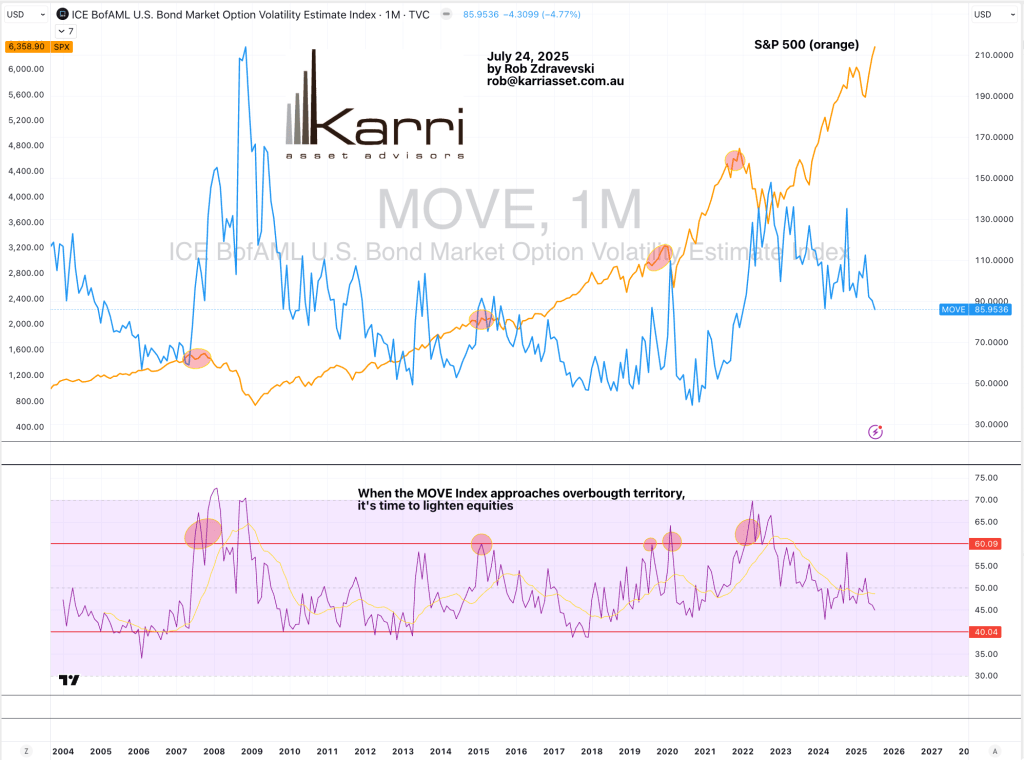

Government bond yields were mixed, again.

Australian, Spanish, Japanese, Swedish and shorter dated American yield rose,

The rest fell.

Canadian 10 year bond yields fell and broke their 4 straight weeks of advance.

Indonesian 10 year yields have fallen for 5 weeks.

Russian 10 year bonds yield has fallen for 10 straight weeks.

And the U.S. 10 year breakeven inflation rate is nearly overbought.

Equities were subdued and mostly stayed in a tight range.

The overbought brigade extend their stay for another week.

U.S. biotech and Transports has a good week as did the Nikkei 225.

The ASX Financials Index was the largest loser.

Hungary and Czechia’s main indices have risen for 4 weeks straight.

The Shanghai Composite and the CSI 400 have risen for 5 consecutive weeks.

Karachi, Stockholm, Johannesburg, Bangkok and London are also in 5 week winning streaks.

Vietnam’s VN Index has climbed for the past 6 weeks.

While the Sensex has fallen for 4 consecutive weeks.

And the Philadelphia SOX index fell and broke its 8 week winning streak.

Commodities were mixed, again, again.

Coal, Shipping Rates, Cocoa, Copper and Lean Hogs were the notable gainers.

Oil, Distillates and Gases, Palladium, Platinum, Sugar and Corn dominated the losers category.

Platinum drops out of overbought territory.

Gold price were softer.

Cocoa and Rice both rise and left oversold land.

The latter broke a 5 week falling streak.

Cattle has risen for 5 weeks.

Copper and Rubber are in 6 week winning streaks.

Urea has climbed for 7 consecutive weeks.

Robusta Coffee fell and gave up all of last weeks 4% gain.

JKM LNG has slumped for 5 straight weeks,

And Australian Coking Coal rallied following my observations in last weeks edition.

Currencies were active.

We saw several currency Pais re-enter extreme territory this week.

The Aussie rose, reversing last weeks weakness.

The Loonie was weaker.

The CHF/JPY is in a 9 week winning streak.

Overall, the U.S. (DXY) Dollar was weaker.

The Euro saw strength.

So much so, the EUR/USD is an inch from being overbought.

While the EUR/GBP and the EUR/JPY are in respective 4 and 9 week winning streaks.

The Pound Sterling was weaker,

And the Yen was mixed.

The larger advancers over the past week comprised of;

Australia Coking Coal 10.3$, Richards Bay Coal 1.9%, Aluminium 1.7%, Rotterdam Coal 2.1%, Baltic Dry Index 10%, Cocoa 6.8%, Lean Hogs 2.1%, Copper 3.2%, Lithium Hydroxide 1.8%, Tin 5.2%, Newcastle Coal 2.8%, Tin 1.8%, Rice 2%, Shanghai Composite 1.7%, CSI 300 1.7%, All Word Developed ex USA 1.8%, ATX 2%, KBW Banks 1.6%, IDX 3.2%, DJ Transports 3.2%, FCATC 3.3%, HSCEI 1.8%, HSI 2.3%, IBB biotechs 4.5%, IBEX 1.8%, S&P SmallCap 600 0.9%, Russell 2000 0.9%, S&P MidCap 400 1.4%, Mexico 1.9%, NBI biotechs 3.6%, Nikkei 4.1%, Copenhagen 3.2%, Helsinki 2.2%, Stockholm 2.3%, PSE 1.7%, S&P 500 1.5%, STI 1.7%, Nasdaq transports 4.3%, Vietnam 2.3%, XBI biotechs 1.6%, BIST 2.7% and the ASX Materials rose 2%.

The group of largest decliners from the week included;

Bloomberg Commodity Index (1.6%), WTI Crude Oil (1.4%), Heating Oil (2%), Arabica Coffee (2%), LNG in yen (5.5%), Natural Gas (12.8%), Palladium (3.7%), Platinum (2.3%), Gasoline (2.4%), Robusta Coffee (3.6%), Sugar (3.2%), Dutch TTF Gas (3.3%), Gasoil (1.5%), Corn (2.2%), Wheat (1.5%), KRE Regional banks (2.1%), SOX (1.5%), ASX 200 (1%) and the ASX Financials fee 3.9%.

July 27, 2025

By Rob Zdravevski

rob@karriasset.com.au