I’m not buying Oil on the sound of cannons

June 13, 2025 Leave a comment

Why y’all chasing the oil price now?…….It’s too late.

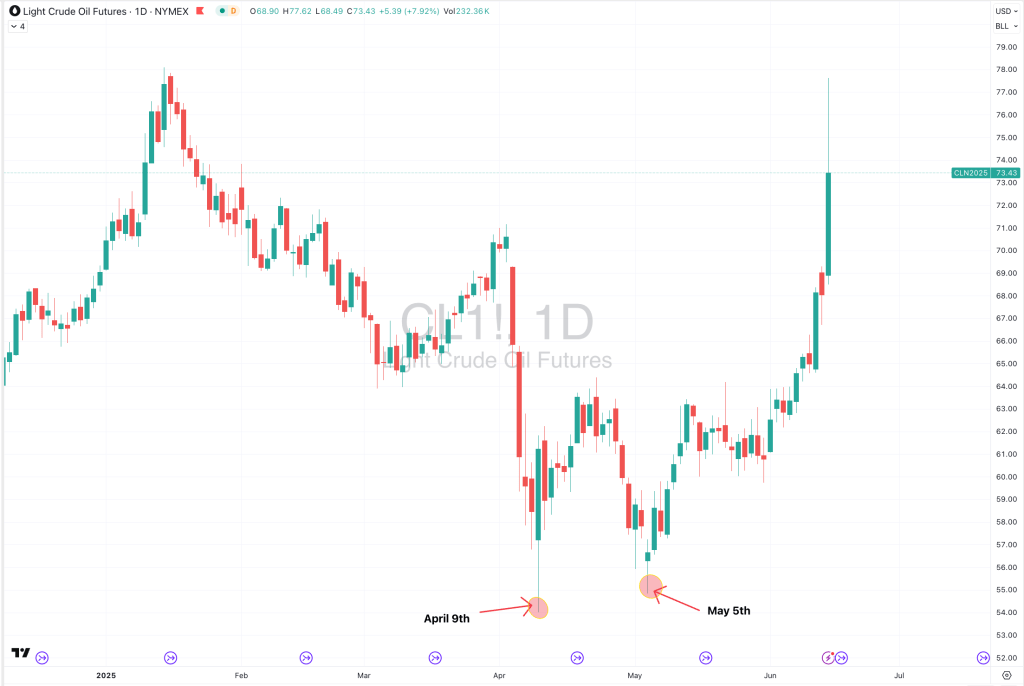

West Texas Intermediate and Brent Crude touched below $55 and $58 respectively, on 2 occasions in April and May 2025.

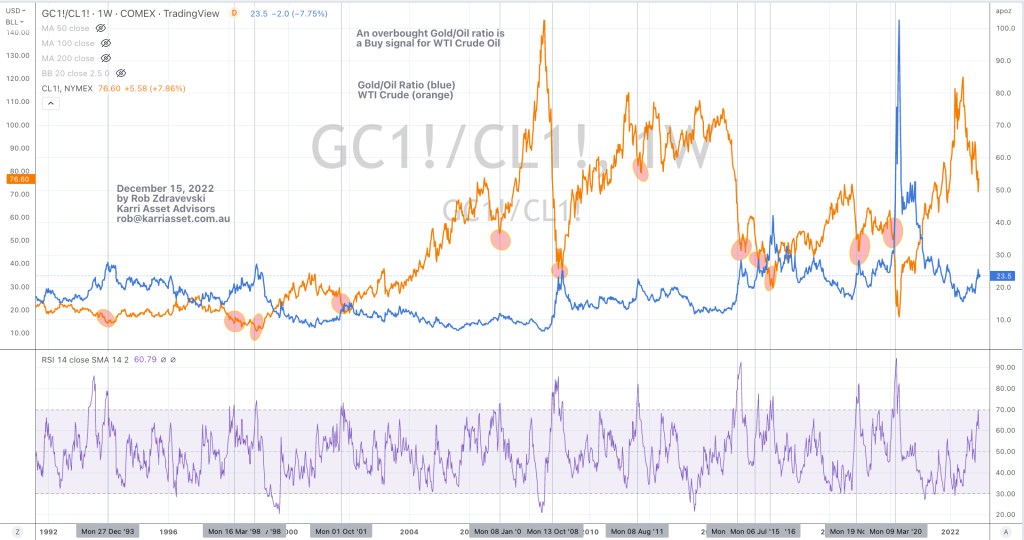

Today, somebody (hedge funds, oil traders, corporate treasury, speculators) paid $78. The odds (and probability) of being long oil have changed.

Today’s price action is clogged up in Israel’s attack on Iran.

The time for preparedness of entering the long oil trade was around these dates when I wrote about it;

April 4, 2024

“I need to respect the rising probability of $55 on WTI Crude.”

April 15, 2025

“It could coincide with #Brent Crude trading down to $58.”

May 8, 2025

“The prices of the 3 stocks mentioned (BP, Woodside and Occidental) recently all touched the prices mentioned in that September 4, 2024 note.”

Let’s wait until next time, for a new moment to buy Oil.

Send me an email if you’re interested in hiring my services.

June 13, 2025

rob@karriasset.com.au