Anatomy of a Nickel trade

June 25, 2024 Leave a comment

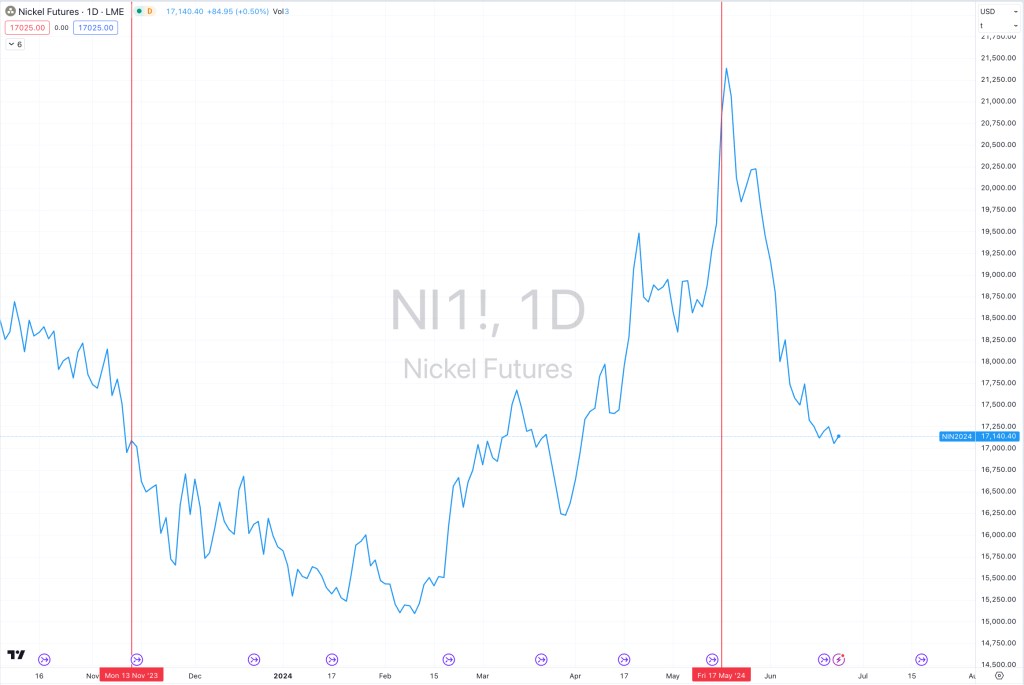

In mid-November 2023, this note implied ‘it’s not too late to buy Nickel’ when it was trading at $16,781.

On April 20, 2024, when Nickel was trading at $19,224, I wrote a note about preparing to ‘sell Nickel’ suggesting that it’ll reach somewhere around $22,075.

In mid-May, 5 months and 30% later, Nickel traded within 2.5% of that figure (at $21,500)……close enough.

It was true that Nickel’s upward trend was not exhibiting any strength.

Today, one month since that peak, the price of Nickel has declined 20% and is now trading at $17,140.

It is not giving me a buy signal yet.

June 25, 2024

by Rob Zdravevski

rob@karriasset.com.au