Urea, Natural Gas and things fertiliser are nearing lows

May 2, 2024 Leave a comment

Following my pithy comment about food, calories and fertiliser,

readers can track my historical posts about this topic here,

https://lnkd.in/gJ-2rQh8

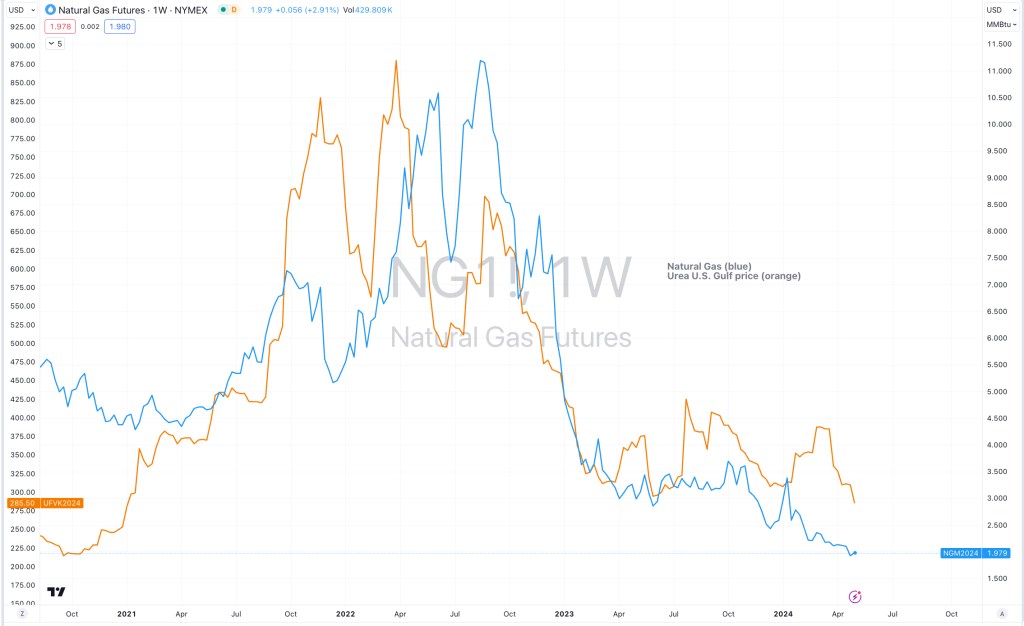

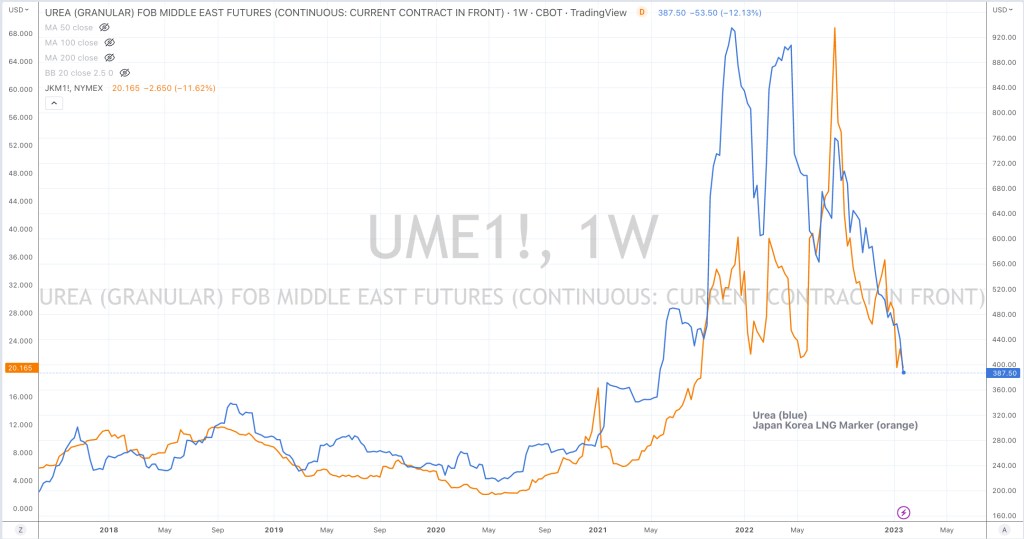

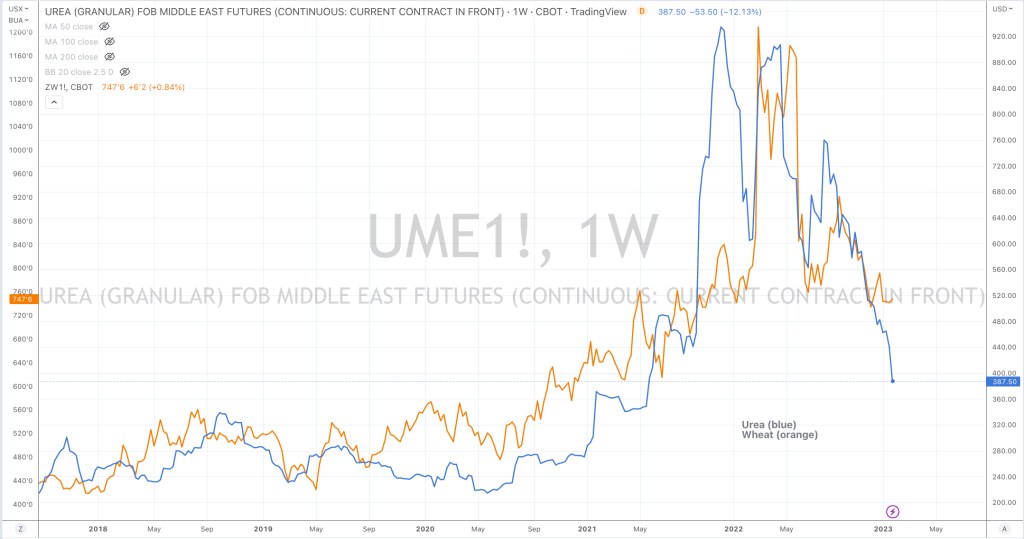

There is continuity in those posts about the relationship that fertiliser prices have with the price of Natural Gas.

The chart below is the latest illustration and update between the U.S. Gulf Urea price and the Henry Hub Natural Gas price.

May 2, 2024

by Rob Zdravevski

rob@karriasset.com.au