Unloved CHF = buy equities

September 2, 2024 Leave a comment

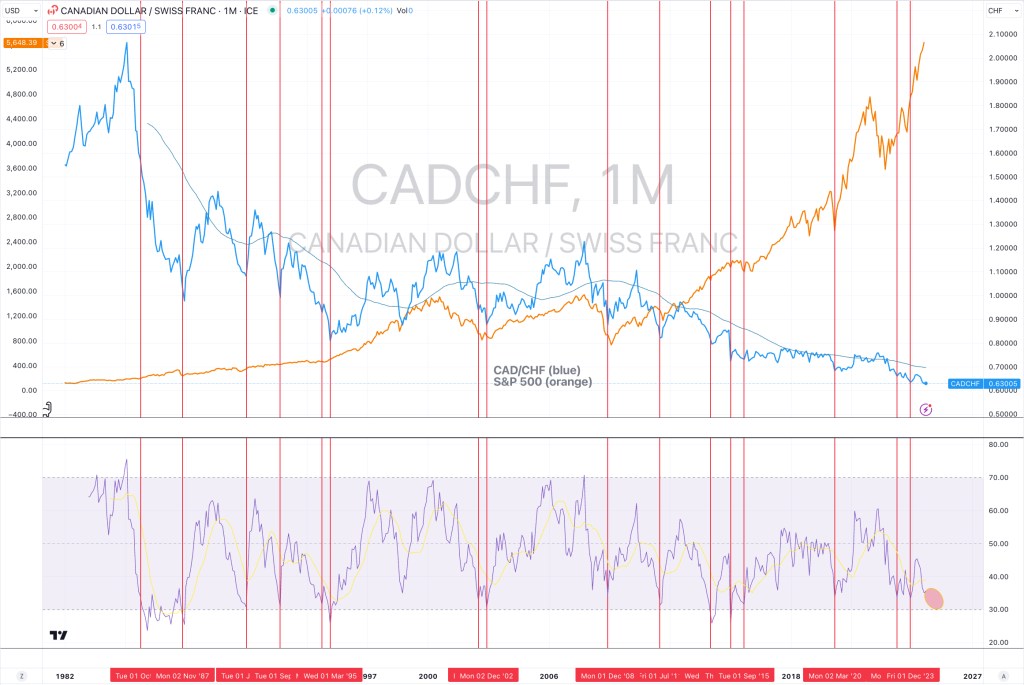

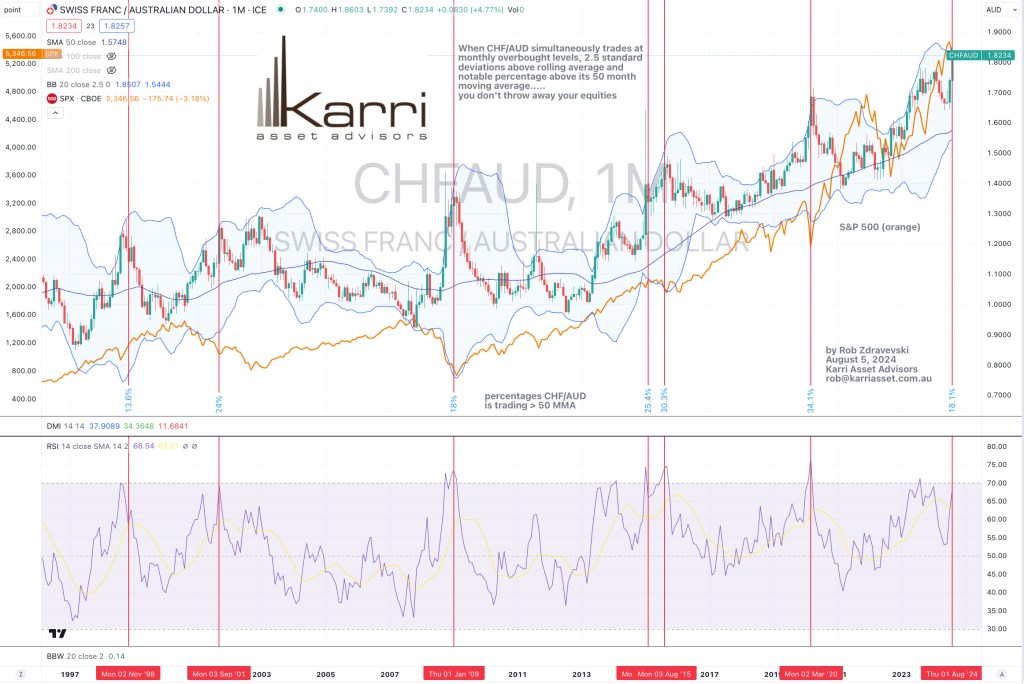

When the CAD/CHF is declining, ‘they’ are selling the Loonie and huddling into the safety of the Swissie.

This happens when ‘we’ don’t fancy a risky environment. That also means risker assets such as equities are also being aggressively disposed.

While not to be used in isolation, the study below shows 16 moments (over the past 40 years) when the CAD/CHF registered a Monthly RSI reading of less than 33.

When it does, perhaps ponder increasing your asset allocation towards equities.

The nuance is which equities (market) to buy.

Currently, it’s close but not there yet.

And remember, currencies don’t lie or tell stories.

September 2, 2024

by Rob Zdravevski

rob@karriasset.com.au