Macro Extremes (week ending September 5th, 2025)

September 7, 2025 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Chinese, French, British, Greek Norwegian & Swedish 10 year government bond yields *

30 year British bond yield

IEF & IEI

Australian 10 year minus U.S. 10 year bond yield spread

Italian 2 and 10 year bond yields

U.S. 10 year minus U.S. 2 year bond yield spread

U.S. 10 year minus U.S. 5 year bond yield spread *

Gold in AUD, GBP and ZAR

AUD/IDR

AUD/CAD

BOVESPA

IPC Mexico equity index

Overbought (RSI > 70)

Cattle *

Urea (Middle East) prices *

Silver in AUD & USD

Gold in CHF & EUR

Shanghai Composite Index *

Pakistan’s KSE Index *

South Korea’s KOSPI *

Czechia’s PX Index

South Africa’s SA40 *

Israel’s TA 35 Index

Canada’s TSX *

Vietnam’s VN Index *

And the ASX Small Cap Index *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

U.S. 10 year minus U.S. 5 year bond yield spread

Gold in US and CAD

CSI 300 *

Chile’s IGPA and IPSA indices *

Extremes below the Mean (at least 2.5 standard deviations)

Belgian 10 year government bond yield

U.S. 2, 3, 5, 7 and 10 year bond yields

U.S. 5 year bond yield minus 5 year breakeven inflation rate

U.S. 10 year bond yield minus Australian 10 year bond yield

U.S. 10 year bond yield minus 10 year breakeven inflation rate

U.S. 10 year bond yield divided by Australian 10 year bond yield

Australian Coking Coal

Philippines PSI equity index

Oversold (RSI < 30)

Sugar

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

U.S. 3 month bill yield *

Lumber *

Notes & Ideas:

Government bond yields fell.

Some overbought entrants this week appeared as so due to intra week highs.

U.S. corporate bond yields are nearing oversold levels.

U.S. 7 year bond yields are close to some mean reversion.

Indonesian 10 year yields rose and broke a 4 week falling streak.

U.S. 2 and 3 year yields have fallen for 4 weeks.

U.S. 3 month bill are oversold and in a 6 week losing streak.

Indian 10 year yields fell and halted their 8 week climb,

And June 2019 was the last time the U.S. 5 year real interest rate simultaneously mean reverted and registered an oversold extreme.

Equities rose mixed with a slight bias towards weakness.

This has resulted in half of last week’s overbought entrants no longer being so, this week.

A couple Chinese indices left overbought extreme territory.

Shanghai, CSI 300, KBW Banks index, ASX 200 and FCATC fell and ended their 4 week winning streak.

The following indices are in 5 week winning streaks; Bovespa, Russell 2000, TSX and the ASX Small Caps.

While the HSCEI and Hang Seng rose.

Commodities were mixed, again.

Gases, Precious Metals and Rubber were amongst the notable gainers.

Crude Oil, Coffee, Coal, Lithium, Orange Juice, Sugar, Oats and Wheat dominated the losers category.

The Copper/Gold ratio is nearing oversold levels.

Richards Bay Coal, Lumber and U.S. Gulf urea prices are in 5 week losing streaks.

Arabica Coffee, Tin and Uranium broke their 4 week winning.

Platinum has risen for 5 weeks.

Middle East Urea prices have risen for 10 weeks.

Cattle broke its 10 straight weeks of gains.

Currencies were active.

The Aussie, Euro and Swissie rose.

The CHF/USD has risen for 4 weeks.

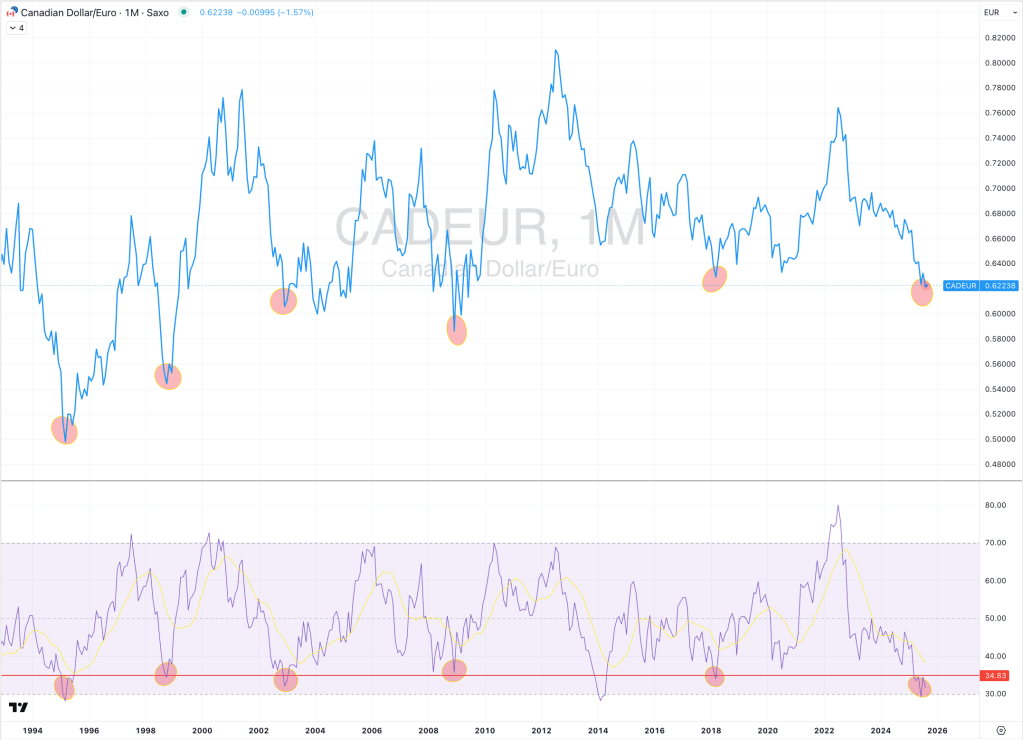

The Loonie fell.

The British Pound and Yen were slightly softer, again.

The U.S. Dollar was slightly weaker.

USD/SEK has declined for 5 weeks.

And the NZD/AUD is a 6 week losing streak.

The larger advancers over the past week comprised of;

Palm Oil 1.6%, LNG in Yen 3.9%, Natural Gas 1.7%, Silver in AUD 3%, Silver in USD 3.3%, Gold in AUD 3.8%, Gold in USD 4%, Rubber 2.9%, Gold in CHF 3.7%, Gold in EUR 3.7%, Gold in GBP 4%, Gold in CAD 4.7%, Gold in ZAR 3.7%, IBB 3.6%, KSE 3.8%, Mexico 3%, NBI 3.6%, SET 2.3%, SMI 1.5%, SOX 1.6%, IGPA 3.3%, IPSA 3.5%, XBI 6.3% and Canada’s TSX rose 1.7%.

The group of largest decliners from the week included;

Richards Bay Coal (1.8%), Brent Crude (2.9%), BDI (2.3%), Cocoa (3.1%), WTI Crude (3.3%), Arabica Coffee (3.2%), Lumber (1.5%), Lithium Carbonate (4.6%), Newcastle Coal (1.4%), Nickel (1.4%), Orange Juice (5.2%), Robusta Coffee (10.5%), Sugar (5%), Tin (2.3%), CRB Index (1.5%), Urea U.S. Gulf (1.9%), Oats (3.7%), Rice (2.3%), Soybean (2.6%), Wheat (2.8%), KBW Bank Index (1.6%), DAX (1.3%), Egypt (2.7%), FCATC (2.7%), BIST (5%) and Italy’s MIB fell 1.4%.

September 7, 2025

By Rob Zdravevski