Macro Extremes (week ending December 5, 2025)

December 7, 2025 Leave a comment

A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Australian government bond yield curve *

Norwegian 10 year bond yields

Euro 2, 5 and 30 year bond yields

AUD/CHF

AUD/EUR

AUD/INR

CLP/USD *

Austria’s ATX equity index *

Dow Jones Transports

Nasdaq Transports

Overbought (RSI > 70)

Korean 10 year government bond yield *

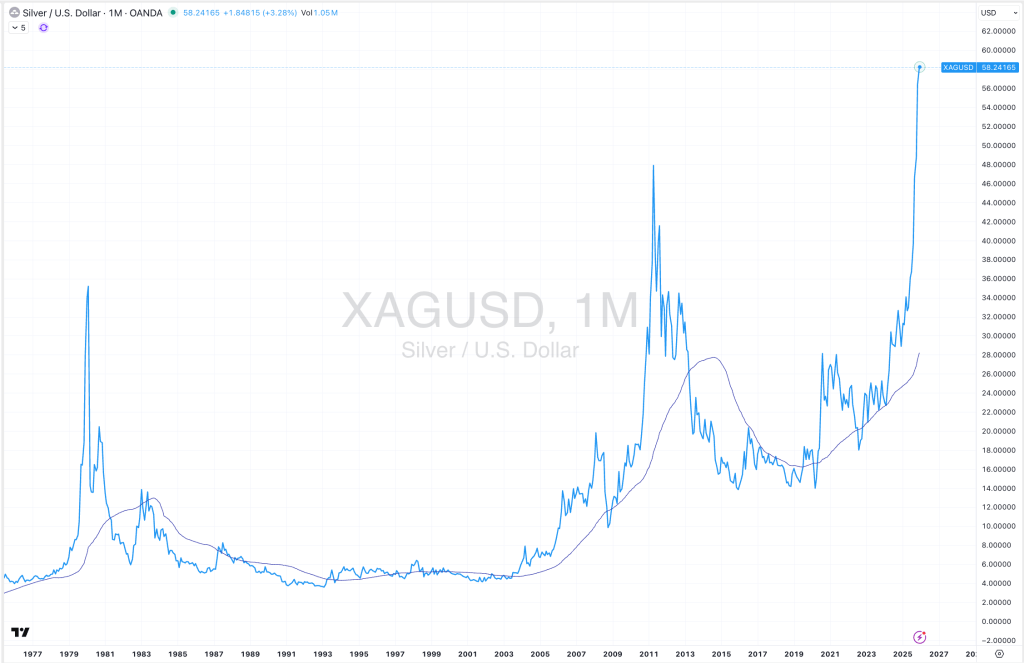

Silver

Gold in CAD, CHF, EUR, GBP & USD

AUD/JPY

CNH/USD

EUR/JPY *

GBP/JPY

Hungary’s BUX Index *

Indonesia’s IDX Composite

Egypt’s EGX Index *

IBB biotech ETF *

Pakistan’s KSE Index *

South Korea’s KOSPI *

Nasdaq Biotech Index *

Czechia’s PX Index *

South Africa’s SA40 equity index *

Chile’s IGPA *

Israel’s TA35 *

Canada’s TSX equity index *

And the S&P Biotech ETF *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Australian 10 year minus U.S. 10 year bond yield spread *

The Japanese government bond yield curve *

Swedish 10 year government bond yields

Baltic Dry Index *

Tin

MYR/USD*

USD/INR

Extremes below the Mean (at least 2.5 standard deviations)

Brazilian 10 year government bond yield

CHF/AUD

Oversold (RSI < 30)

Chilean 10 year government bonds

U.S. 10 year bond yield divided by Australian 10 year yield spread

Richards Bay Coal *

Lumber *

Lithium Hydroxide

Sugar #16 *

Rice *

JPY/AUD

NZD/AUD

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

U.S. 10 year bond yield minus Aussie 10 year bond yield spread *

Dutch TTF Gas *

Notes & Ideas:

Government bond yields rose, again.

Canadian 10’s soared.

The whole of the Australian and Japanese yield curve is overbought and the Eurozone is nearly so.

Kiwi and Japanese 10 year yields have climbed for 7 weeks,

U.S. 10 year minus Australian 10 year yield spread has fallen for 6 weeks.

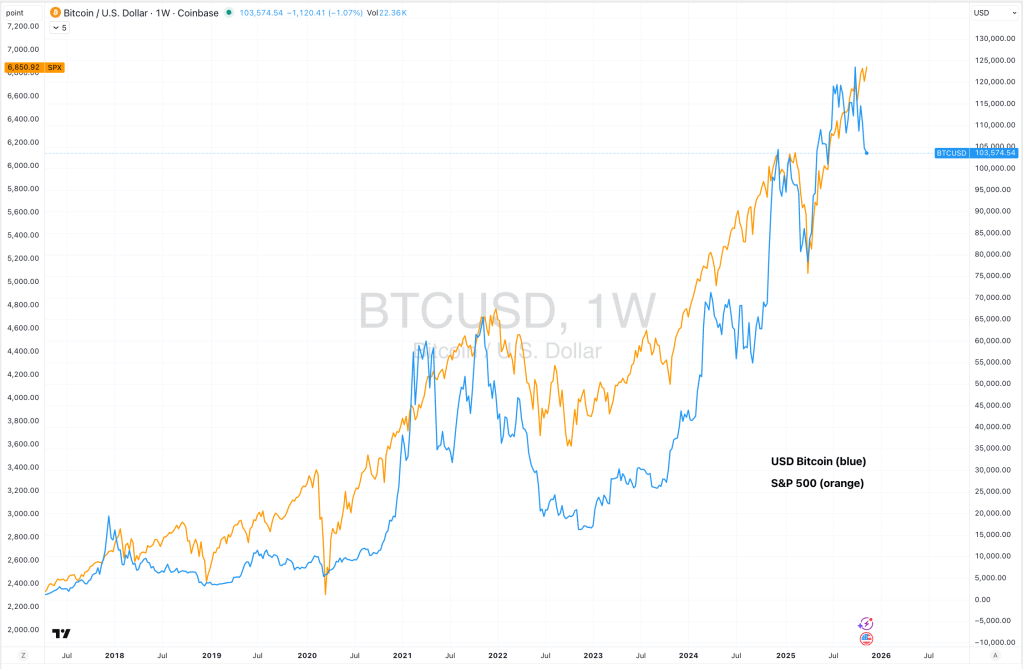

Equities moved higher, again.

Biotech’s added to its recent run higher.

Brazil’s Bovespa left overbought territory.

Vietnam, the Sensex and XBI biotech ETF have risen for 4 weeks.

Chile’s IGPA and IPSA indices are in a 8 week winning streak.

Commodities were mixed.

Shipping Rates, Silver Cocoa, Tin, Cattle and Natural Gas were the notable gainers.

Lithium, Orange Juice, Dutch TTF Gas, Sugar, Soybeans and Coffee dominated the losers category.

Soybeans fell and broke a 7 week winning streak.

Natural Gas have risen for 7 weeks and has soared 39% over that time.

Cattle & Palm Oil rose enough to leave their oversold extremes.

Richards Bay Coal is close to doing the same.

The Baltic Dry Index and Iron Ore prices have risen for 5 weeks.

The former has soared 34%in those 5 weeks.

North European Hot Rolled Coil Steel have declined for 4 weeks.

And Wheat and U.S. Gulf Urea prices have slumped for 5 weeks.

Currencies were orderly.

The Yen’s weakness sees various pairs such as against the CAD & GBP is a 4 week losing streak.

The Aussie rose, resulting in a few overbought results.

Against the Yen, the Aussie is overbought for the first time since July 2024.

The Euro was mostly weaker.

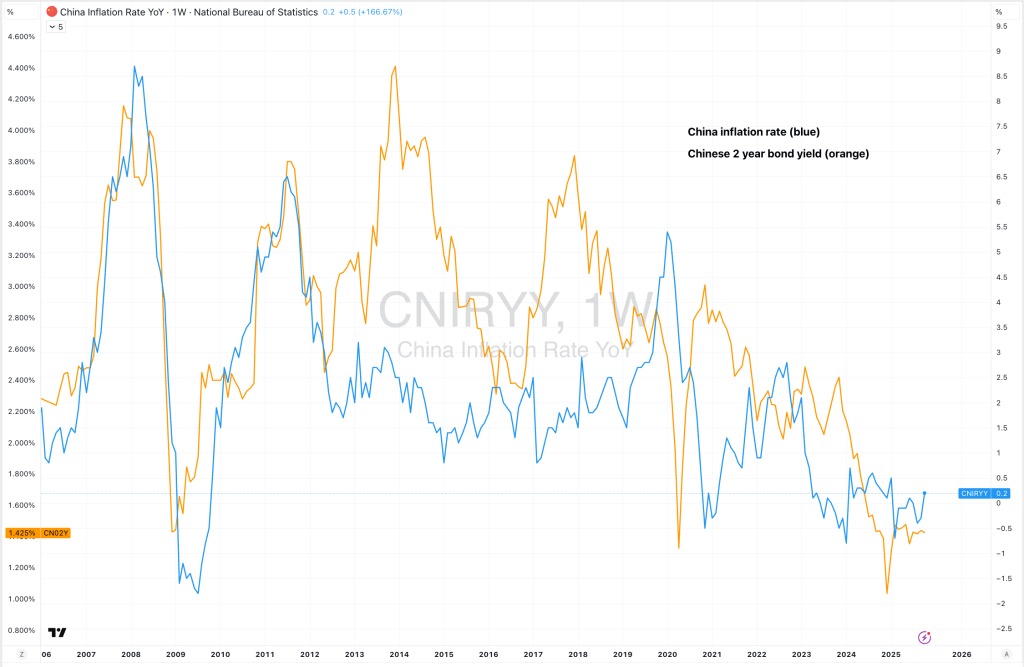

And the USD/Chinese Yuan is oversold.

The larger advancers over the past week comprised of;

Australian Coking Coal 3.8%, Aluminium 2.3%, Bloomberg Commodity Index 1.5%, Brent Crude Oil 2.2%, Baltic Dry Index 6.5%, Cocoa 3.5%, WTI Crude Oil 2.6%, Copper 3.6%, Heating Oil 2.6%, Cattle 4.3%, Tin 6%, Natural Gas 9%, SOGSCI 1.7%, Silver in USD 3.5%, Silver in AUD 2.1%, ATX 1.4%, BKX 3.2%, DJ Transports 3.6%, EGX 3.7%, IBEX 1.9%, KRE Regional Banks 2.8%, KOSPI 4.4%, Helsinki 1.7%, Stockholm 1.4%, SA40 1.5%, SOX 3.8%, TA35 3.4%, Nasdaq Transports 4.7%, Vietnam 3% and ASX Materials Index rose 3%.

The group of largest decliners from the week included;

JKM (1.9%), Arabica Coffee (1.7%), LNG in Yen (5.8%),Lithium Carbonate (4.4%), Lithium Hydroxide (5%), Newcastle Coal (1.4%), Orange Juice (6.6%), Platinum (1.5%), Robusta Coffee (5.9%), Sugar (2.7%), Sugar #16 (1.7%), Dutch TTF Gas (5.4%), Urea U.S. Gulf (4.3%), Gold in AUD (1.9%), Gold in CAD (1.7%), Gold in ZAR (1.6%), Oats (2.8%), Soybeans (2.9%), IBB (1.5%), WIG (1.7%) and ASX Industrials Index fell 1.6%.

December 7, 2025

By Rob Zdravevski