The timing involved when buying bonds and fixed income

May 30, 2023 Leave a comment

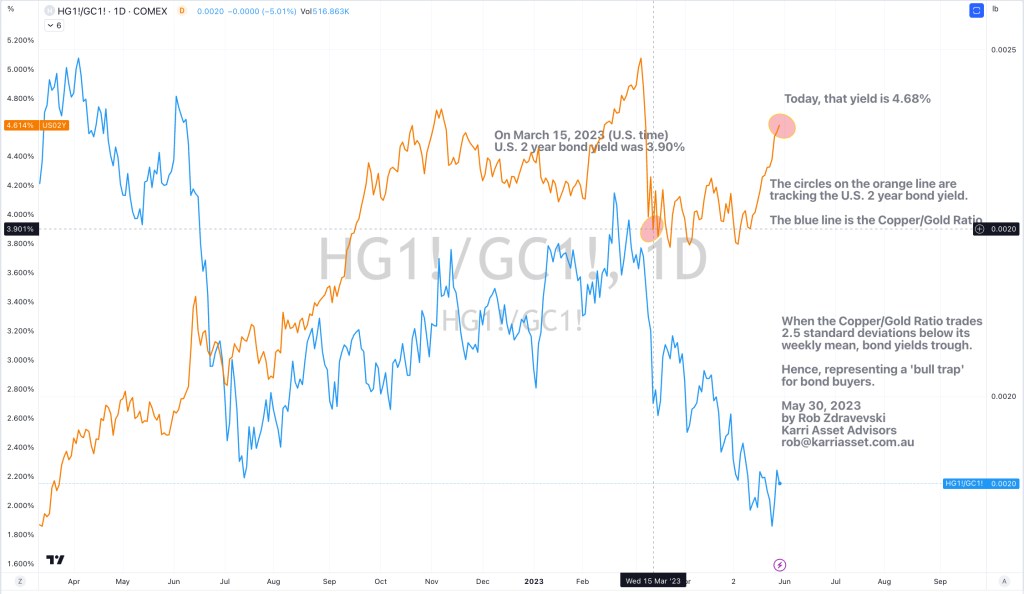

In this note on March 16, 2023 (March 15, U.S. time), I suggested that shorter-term interest rates would start to rise when the Copper/Gold Ratio trades 2.5 standard deviations below its weekly mean and implies a poor moment of timing for those buying bonds.

As a follow up, the chart below shows what has happened to the U.S. 2 year bond yield since then.

Having risen from 3.9% to 4.68%, that extreme standard deviation low in the Copper/Gold Ratio did represent a ‘bull trap’ for bond buyers.

May 30, 2023

by Rob Zdravevski

Karri Asset Advisors

rob@karriasset.com.au