Understanding risk/adjusted – Australian Banks

March 23, 2023 Leave a comment

Indeed, there are times when to sell Australian bank shares.

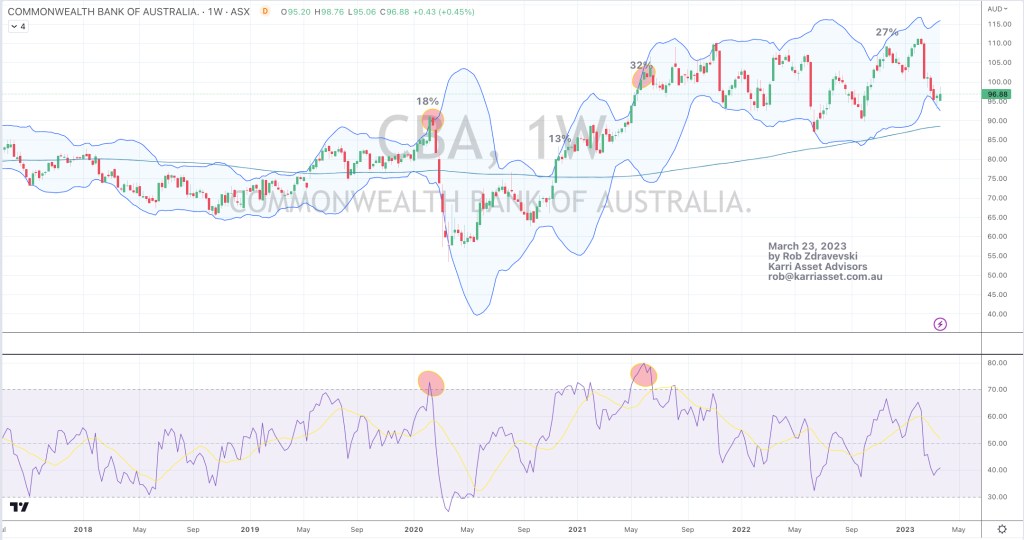

This study below shows moments when the stock price in Commonwealth Bank of Australia (CBA) was stretched.

Ignoring such signals means investors are leaving money ‘at risk’ when probability suggests valuations are full or lower prices beckon.

Irrespective that Australian banks have always traded at a premium to their global peers, resting on the mantra that ‘you can’t go wrong owning the banks’ is false.

And finding solace, that ‘at least I’m receiving my dividends’ is not addressing the risk being taken for such a return.

CBA”s stock price is now trading at the same price as March 2015 (that’s 8 years ago) while Westpac is trading at the same price as 2008, 2010 and 2012.

March 23, 2023

by Rob Zdravevski

rob@karriasset.com.au