More about commodities

January 15, 2024 Leave a comment

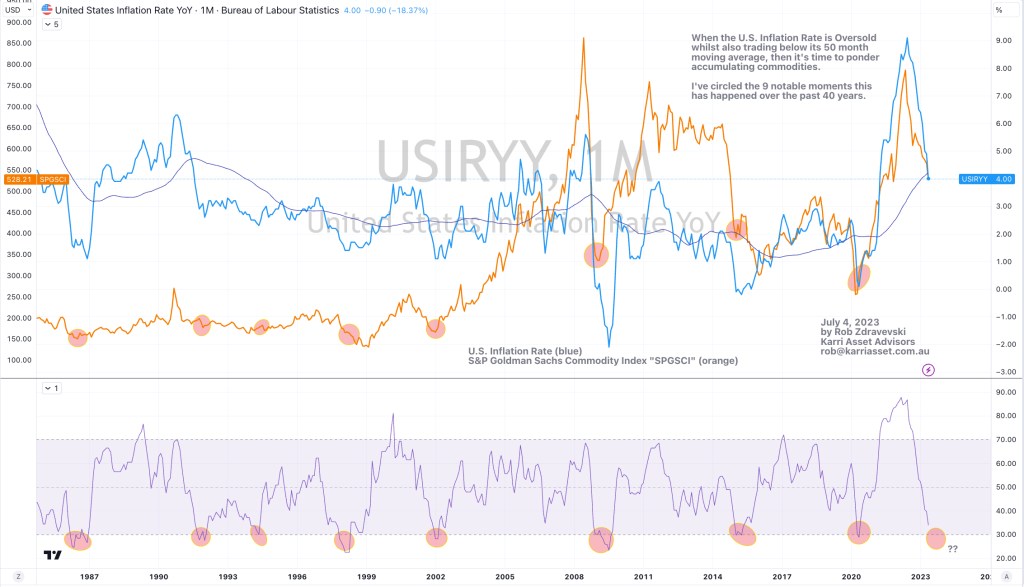

Here are the 9 occurrences over the past 40 years when the U.S. Inflation Rate/S&P GSCI spread was registering a monthly RSI reading of 32 or below.

It coincided with reasonable moments to buy commodities, as illustrated by the orange line which represents the S&P Goldman Sachs Commodity Index (SPGSCI).

I made a similar reference in a note published 2 months ago.

January 15, 2024

by Rob Zdravevski

rob@karriasset.com.au