A rare moment for the SOX

March 5, 2025 Leave a comment

Trying to hear what's not being said

January 30, 2025 Leave a comment

At the time of writing (mid-morning during Thursday’s trading session on Jan 30, ’25), ASML shares are only up 1.6% for the week, even after rising 10% in the past 2 days.

ASML won’t be of interest to me until the stock trades down to EUR 415.

And says alot of what I think is ahead for the semiconductor darlings.

January 30, 2025

rob@karriasset.com.au

December 2, 2024 Leave a comment

7 months ago, I wrote a note making an early call that the Intel CEO should leave.

I said ‘it will be good for the stock price’….and for the company.

The press release is calling it a ‘retirement’.

It’s better to retire than to be fired.

Ask Carly Fiorina.

But it may be more political which many may refuse to acknowledge.

As mentioned in my April 29, 2024 note…..there was/is much reliance on Biden administration providing Intel with ‘funding’ ….while incoming President Trump may kill the CHIPS Act and likely delete the Inflation Reduction Act (IRA).

They are also good reasons for Pat Gelsinger to resign.

December 2, 2024

rob@karriasset.com.au

August 5, 2024 Leave a comment

I often mention mean reversion (or convergence) in my posts.

Here is a monthly chart of the Philadelphia Semiconductor Index (SOX).

I think we’ll see it somewhere near 4,000 points.

Perhaps we’ll see ASML trade down to EUR 415 and AMD to $64.50….

August 5, 2024

by Rob Zdravevski

rob@karriasset.com.au

April 29, 2024 Leave a comment

I think Intel CEO, Pat Gelsinger is on the ropes.

I’ve watched his various media interviews and listened to Intel quarterly earnings calls. Tone and posture has changed over the past 2 years and not for the better.

Coupled with Intel’s woeful stock performance since his appointment as CEO in February 2021, using the word’s “A.I.” and “Data Centres” can only do so much for the stock price.

Intel had 5 rounds of job cuts in 2023.

It just won $8.5 billion in U.S. Federal subsidies from the $52 billion CHIPS Act Congress passed last year and was promised to receive $11 billion in loans.

Regarding the funds available within the CHIPS Act, CEO Pat Gelsinger said he is counting on additional federal funding this year for defense-related semiconductor projects. And he said he hopes for a second CHIPS Act to reverse the long erosion of domestic technology manufacturing.

“We’ll need at least a CHIPS 2 to finish that job,” Gelsinger said.

https://www.govtech.com/workforce/intel-wins-8-5b-in-federal-chip-factory-subsidies

Its an early call, but a change in CEO will be good for the stock price.

by Rob Zdravevski

April 29, 2024

rob@karriasset.com.au

December 23, 2023 Leave a comment

Reprising my Microsoft #msft note from a month ago, I’m positing that the stock may trade down to the $290 region (+/- $15) by the end of Q1 2024.

Accordingly, we coud see Nvidia #nvda trade down to $307 into the 2nd quarter of 2024.

That would be a decline of 37% from today’s price.

That would give the Nasdaq 100 a bit of a jolt.

December 23, 2023

by Rob Zdravevski

rob@karriasset.com.au

October 12, 2022 Leave a comment

Additional tension between China, the United States and the importance of Taiwan Semiconductor Manufacturing Company may signal the end, at least when it comes to the plunge in stock prices of affected or related semiconductor companies.

Today’s news is as close to a crescendo of threats as may be possible, without the next step being actual action.

This heightened angst may signal we are nearing the end of the tough talk but it’s a reminder that he deeper reason for many stoushes involving the United States are about trade and economics.

Will China actually take over TSMC?

This post I wrote in February 2022 put TSMC’s importance in perspective.

This post also written in February 2022 posed a put option trade idea should things become a little more ‘hairy’.

Since late February, shares in TSMC have fallen 50% and those options have risen 4-fold.

Was Pelosi’s visit to Taiwan worth it?

Since Nancy Pelosi arrival on Taiwan soil on August 2nd, 2022, the SOX Index has fallen 27%.

Good one Nance !

All of that in 2 months but I think hubby, Paul’s call option buying of Nvidia in the days prior to you announcing the trip to Taiwan haven’t worked out either (presuming he’s still holding them) as that stock has tanked 39% since your visit.

Is Biden’s decision on Friday October 7th, 2022 to ban semiconductor (and equipment) exports to China wise?

Since then (in 3 trading sessions) the shares in LAM Research, Applied Materials, Intel, AMD, Nvidia, KLA Corp, ASML and TSM have fallen 19%, 14%, 8%, 15%, 12%, 15%, 13% and 15% respectively.

Biden is still help bent on his pre-mid term election strategy of being tough on China and invoking massive domestic spending (the opposite to Obama, whom Biden blames for their mid-term mauling in 2014) but he causing higher inflation by ‘de-globalising’ relations which have traditionally assisted the United States and various nationalism and protectionist measures are adding to global tensions.

I don’t think Biden realises the job losses and investment losses he is about to cause with these export bans, let alone the investment losses being caused.

For some perspective, notwithstanding overvaluations and possible slowing product demand, since is price peak in November 2021, Nvidia has seen its shares fall 65% and its market capitalisation has declined by $554 billion.

That is the same amount of money if you wiped out the entire market capitalisation of Australia’s largest 4 banks, BHP, Rio Tinto, Wesfarmers and Woolworths or 50% of the total market capitalisation of companies listed on the Australian Stock Exchange (ASX).

October 12, 2022

by Rob Zdravevski

rob@karriasset.com.au

October 11, 2022 Leave a comment

Many are watching the great semiconductor shake-out.

The warnings of fervour and a peak where evident 15 months ago.

Speculators were playing in rarefied air when the SOX Index was flying between 3,400 and 4,000.

Today, it’s trading at 2,275.

Nvidia is one but not the only proxy for calling an end of the decline.

Seeing NVDA shares trade at $105-$108 may be a point to heighten my awareness to some form of exacerbation or trough in share prices of various semiconductor stocks.

October 11, 2022

by Rob Zdravevski

rob@karriasset.com.au

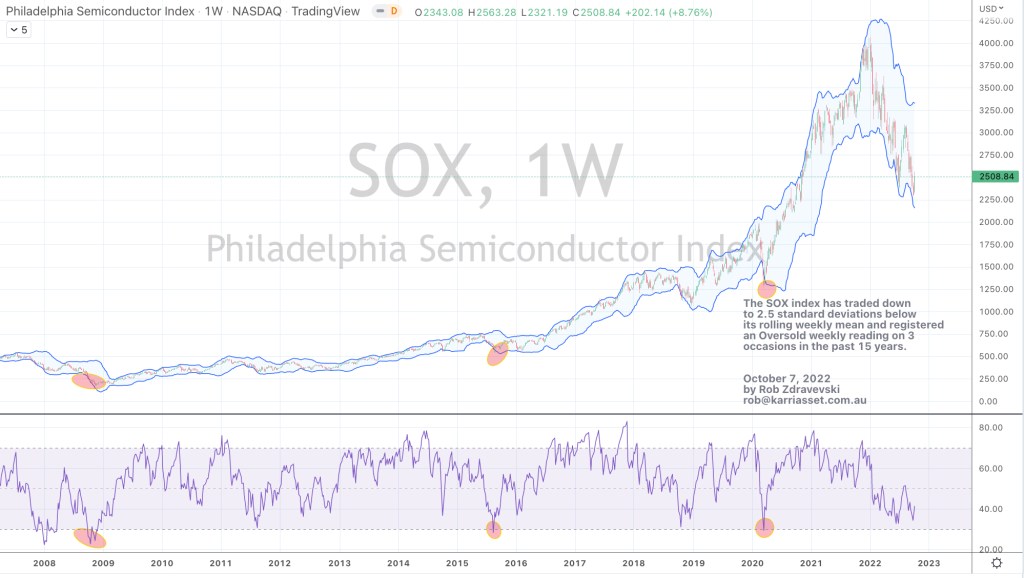

October 7, 2022 Leave a comment

The SOX index has traded down to 2.5 standard deviations below its rolling weekly mean and registered

an Oversold weekly reading on 3 occasions in the past 15 years.

I’m awaiting a 4th occurrence

October 7, 2022

by Rob Zdravevski

rob@karriasset.com.au

September 24, 2022 Leave a comment

This week, the Philadelphia Semiconductor Index (SOX) mean reverted to its 200 week moving average for only the 4th time in the past 10 years.

I’ll re-iterate that a 200 week moving average is notable. It’s a 4 year rolling mean.

Extra work is required to determining where this downtrend ends, which has seen this index nearly halve in only 9 months.

However, if you think semiconductors are no longer relevant and the theme has no longevity, then this wouldn’t be of interest.

September 24, 2022

by Rob Zdravevski

rob@karriasset.com.au