Sell Gold / Buy Platinum

December 8, 2023 Leave a comment

I’ve been subtly chirping about my interest in Palladium and Platinum prices.

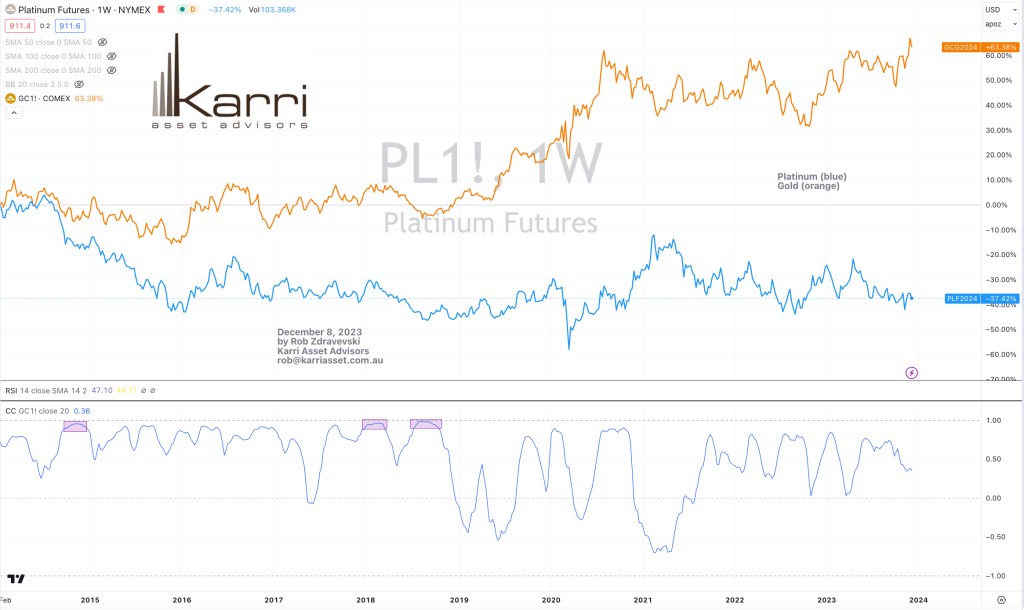

For those you like pairs trades, I see a Short Gold / Long Platinum opportunity.

While this may be sacrilege for those nutty gold bugs to read, I’m being rather objective.

The chart below shows Platinum and Gold plotted over each other while the lower study is the correlation coefficient.

Just because they are both precious metals, it doesn’t mean they move in tandem let alone correlated.

The rectangles show not too many moments when the correlation was close to 1.

Otherwise, there were many times when Platinum and Gold were negatively correlated.

December 8, 2023

by Rob Zdravevski

rob@karriasset.com.au