Today, the price of Natural Gas reached my $5 target, having halved from its (exuberant) $10 peak, only 2 months ago.

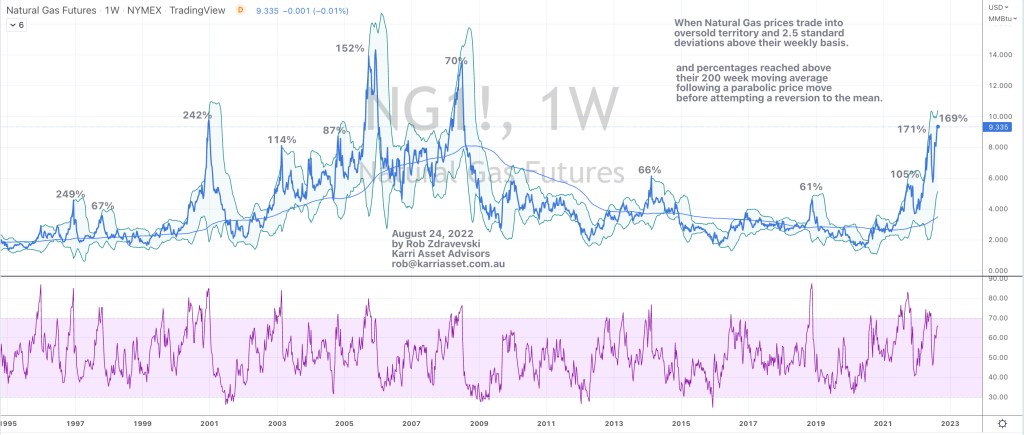

My series of posts commenced on June 7th, 2022 when I called Natural Gas the ‘mother of all peaks’.

https://lnkd.in/dAY–5aP

In mid-late August 2022, I started to publish my views that the price of Henry Hub Natural gas would halve.

I warned of the risks chasing parabolic price moves in Natural Gas in this post.

https://lnkd.in/dDrqzSxr

On August 25th, 2022, 2 days following the peak and the original post, I made my $5 price target call and cryptically cited that it would have a negative affect of the stockmarket.

https://lnkd.in/dWbHANU5

The S&P 500 closed at 4,199 on August 25th 2022.

Today, the S&P 500 closed at 3,753.

Even after this week’s 4.7% advance, the S&P has declined 10.6% over the past 2 months.

Then, this next note was written when Natural Gas reached its half way point at $7.50

https://lnkd.in/dDrqzSxr

On Sept 23rd, (a month into this trade), I refined the timing of when I expect to see my $5 target reached.

I said, “I see $5 in Natural Gas being reached in the last days of October or into the first 10 days of November 2022.”

https://lnkd.in/dFknc56p

And this decline in Natural Gas (and pending moves across the energy complex) should have correlating effects to energy stocks and inflation, or rather deflationary effects.

In early September, I wrote about the correlation of the U.S. Natural Gas price with the Australian inflation rate

https://lnkd.in/dDrqzSxr

A few days ago, I added these comments along the same thinking.

https://lnkd.in/ditshZgv

https://lnkd.in/g3gCn4HZ

And highlighted the massive declines amongst the previously rampaging ‘other’ gas prices.

https://lnkd.in/dbff-YCS

Today, the price of Natural Gas reached my $5 target.

What’s next for the Natural Gas price?

I would expect a bounce over the next week or so before the weakness resumes.

Statistically, NG has declined for 8 weeks consecutive weeks. A streak that is hasn’t seen since for 10 years.

Natural Gas saw a 6 week declining streak in mid 2014 when it fell from $4.26 to $2.94.

A 7 week losing streak in 2010 and a 9 week streak of weekly declines in the 1st quarter of 2012.

Commodities, currencies, equities and bond yield seldom string together more than 7 consecutive weeks of one-way travel.

However, the downtrend across a few timeframes remains intact.

$4.76 – $4.80 is a major support for the Natural Gas price.

A decisive break below that, pending my other indicator work may increase probability of a visit of to $3.38 – $3.44 region.

$4.20 would be a more plausible bottom.

October 22, 2022

by Rob Zdravevski

rob@karriasset.com.au