Not quite yet on Uranium

April 21, 2025 Leave a comment

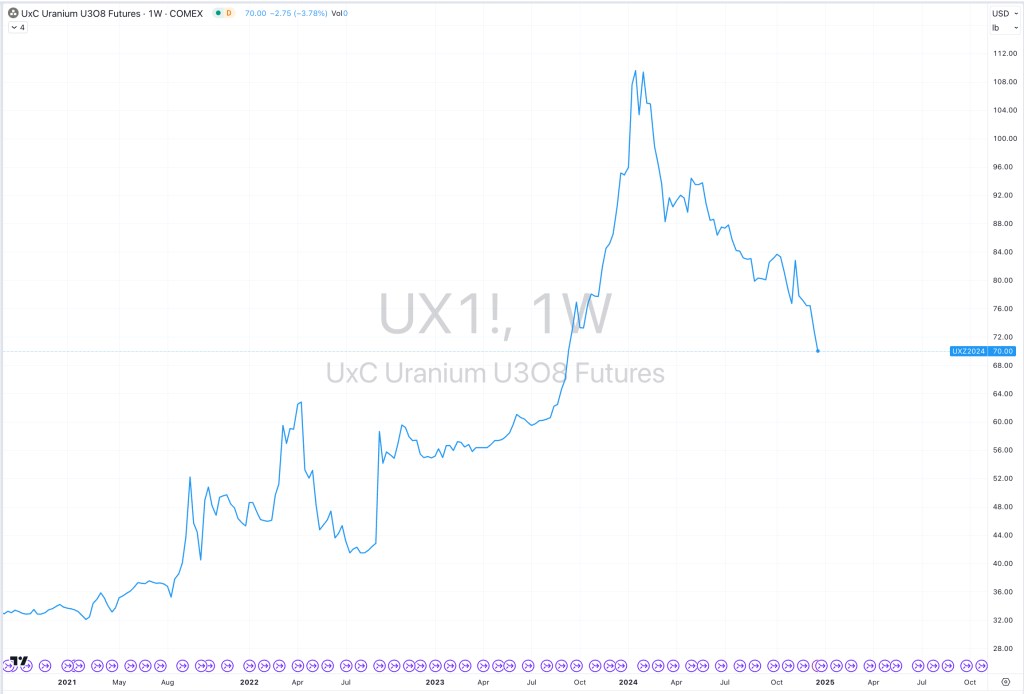

A year ago, I wrote about my interest in re-entering the uranium trade.

“I’ll look to add to uranium price “trackers” such as the #Sprott Physical Uranium Trust at C$20.50 and Yellow Cake plc at 450p”

The circle in the attached chart shows the price of date of the Sprott Physical Uranium Trust on that April 10, 2024 call.

Both securities have now reached those levels but I am yet to pull the trigger on any buying.

April 21, 2025

rob@karriasset.com.au