It’s time to trim German equity exposure

January 23, 2025 Leave a comment

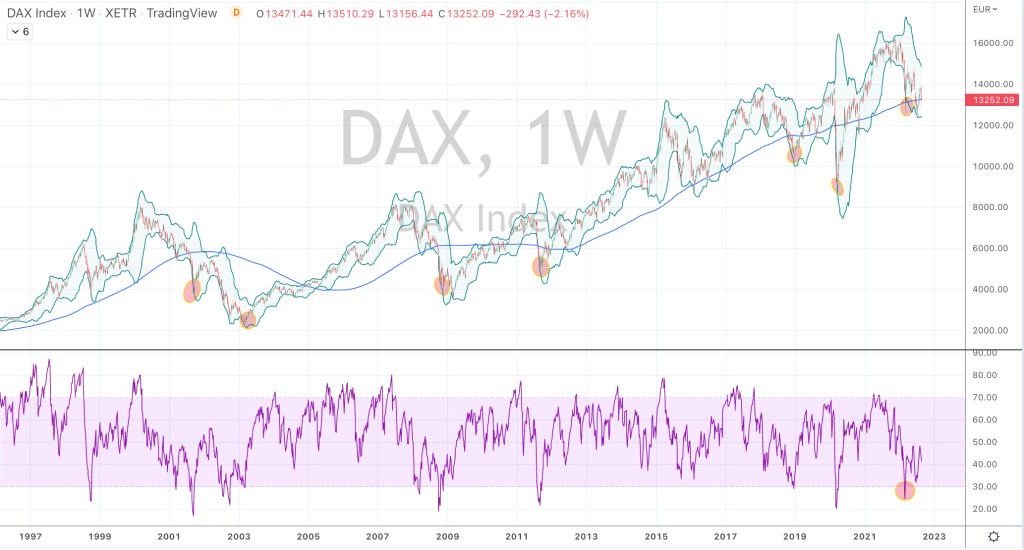

Here at the moments when Germany’s #DAX Index has registered a monthly overbought reading.

While there is more behind my analysis, this simple study suggests that those who allocate capital into #German equities might be dummkopf or perhaps foolish, if they haven’t got one foot out of the door.

January 23, 2025

rob@karriasset.com.au