A weekly Macro, Cross Asset review of prices trading at extremes which may generate future investment ideas and opportunities.

The following assets (on a weekly timeframe) either registered an Overbought or Oversold reading and/or have traded more than 2.5 standard deviations above or below its rolling mean.

n.b. pricing of (commodity) futures contracts is only considering the immediate front month.

* denotes multiple week inclusion

Extremes above the Mean (at least 2.5 standard deviations)

Australian and Italian 2 year government bond yields

Australian 3 year government bond yields

Chinese, Czech, South Korean and Swedish 10 year government bond yields

AUD/SGD

AUD/THB

USD/CAD

USD/IDR *

AEX

CAC

HSCEI

And Switzerland’s SMI equity index

Overbought (RSI > 70)

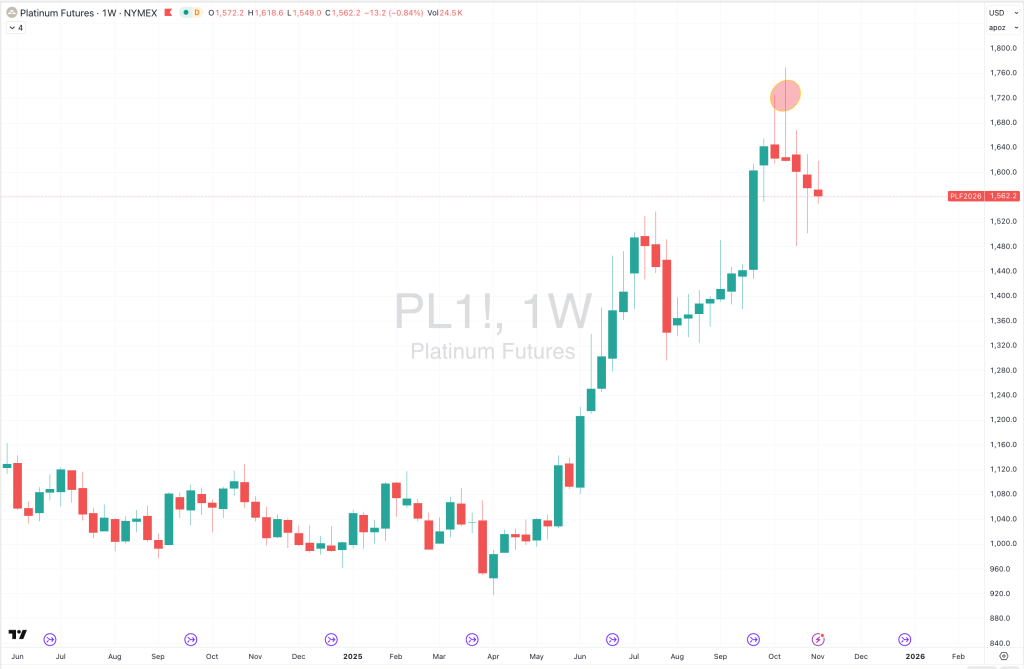

Platinum

Tin

CHF/CAD

EUR/CAD

USD/INR

Shanghai Composite Index *

CSI 300 *

All World Developed ex USA equity index

Egypt’s EGX Index

China’s FCATC *

Hang Seng Index

Spain’s IBEX *

Taiwan’s TAIEX *

Nasdaq Composite *

Malaysia’s KLSE Index

Pakistan’s KSE Index *

South Korea’s KOSPI *

Nasdaq Biotech Index

Nasdaq 100

Japan’s Nikkei 225 *

Czechia’s PX Index *

South Africa’s SA40 *

Philadelphia Semiconductor Index (SOX) *

S&P 500

Canada’s TSX *

Singapore’s Strait Times Index

Israel’s TA35

Canada’s TSX

FTSE 100

And the ASX Small Cap Index *

The Overbought Quinella (Both Overbought and Traded at > 2.5 standard deviations above the weekly mean)

Silver in AUD & USD *

Gold in AUD, CAD, CHF, EUR, GBP, USD & ZAR

S&P Biotech Index

Extremes below the Mean (at least 2.5 standard deviations)

None

Oversold (RSI < 30)

U.S. 3 month bill yield *

Richards Bay Coal *

Lithium Carbonate

Rice

CAD/CHF

NZD/AUD *

The Oversold Quinella (Both Oversold and Traded at < 2.5 standard deviations below the weekly mean)

Australian 10 year minus Australian 2 year government bond yield spread

Cocoa

Philippines PSE equity index

Notes & Ideas:

Government bond yields were generally lower.

The Japanese yield curve and Russian 10’s have risen for 4 weeks.

U.S. 2’s are approaching ‘maximum pessimism’.

And Swiss 10 year bond yields rose from near oversold territory and broke a 5 week losing streak. Incidentally, they are yielding 0.28%, while the Swiss Franc has rallied 15% against most currencies.

Equities had a terrific week.

We see several more equity indices joining the overbought ranks.

The Russell 2000 is near the same membership.

Biotech’s had a monster week as did several indices such as Taiwan’s and Korea’s.

The TAIEX and Nikkei 225 have risen for 6 weeks.

Chile’s IGPA and IPSA indices fell enough for them to no longer be overbought.

The ASX Industrials rose and snapped 5 weeks of decline.

South Africa’s SA40, the CAC and Egypts EGX have advanced for 4 weeks.

AEX, KSE, PX and SOX are in 5 week winning streaks.

While the ASX Small Caps stretches its winning streak to 9 weeks.

Commodities were busy with some broad gyrations.

Copper, Tin, Precious Metals and Lumber were amongst the notable gainers.

Oils & Distillates, Coal, Gases, Shipping Rates, Oats & Lithium dominated the losers category.

Lean Hogs and Uranium fell and they both dropped out of overbought territory.

The former broke a 7 week winning streak.

Lithium Carbonate and Cocoa return to oversold land.

While Copper rise, the Coper/Gold Ratio remains low, telling me that risk off sentiment in commodities is at odds to that of equities.

Gasoil fee and broke 4 consecutive weeks of advance.

U.S. Gulf urea prices rose and broke 9 weeks of decline.

Meanwhile, Middle Eastern urea has sunk for 6 weeks.x

Silver in AUD & USD along with Gold in AUD, CAD, CHF, and ZAR are all in a 7 week rising streak.

Platinum has risen for 9 weeks.

Rice has fallen for 5 weeks.

Cocoa has declined for 7 weeks.

And Richards Bay Coal has slumped for 10 week consecutive weeks.

Currencies were active, again.

We saw some changes with some pairs leaving and others joining the extreme list.

The Aussie rose against all except the Yen.

The Loonie fell.

The British Pound was mixed.

Yen was stronger, thus breaking a few of the losing streaks posted in last weeks edition.

Swissie/Yen fell and broke a 6 week winning streak.

The USD has fallen for 5 weeks against the South African Rand,

And the Kiwi rose against the Aussie and broke an 8 week slump.

The larger advancers over the past week comprised of;

Aluminium 2.4%, Copper 7.1%, Arabica Coffee 3.4%, Lumber 3.6%, Natural Gas 3.7%, Nickel 1.7%, Platinum 2.4%, Robusta Coffee 7.8%, Tin 8.9%, Silver in AUD 3.3%, Silver in USD 4.2%, Gold in AUD 2.5%, Gold in CAD 3.4%, Gold in CHF 3%, Gold in EUR 3%, Gold in GBP 2.8%, Gold in USD 3.4%, God in ZAR 1.8%, Shanghai Composite 1.4%, CSI 300 2%, All World Developed ex USA 2.6%, AEX 2.5%, ATX 2.2%, CAC 2.7%, DAX 2.7%, EGX 3.5%, FCATC 5.4%, MIB 1.4%, HSCEI 3.8%, Hang Seng 3.9%, IBB 7.1%, IBEX 1.5%, Russell 2000 1.9%, TAEIX 4.6%, KLSE 1.6%, KOSPI 4.8%, FTSE 250 2.4%, Nasdaq Biotechs 6.3%, Copenhagen 3.9%, Stockholm 3.2%, SMI 4.8%, SOX 4.4%, STI 3.4%, TA35 5.4%, TSX 2.4%, FTSE 100 2.2%, WIG 1.4%, XBI 5.8%, ASX Financials 3%, ASX 200 2.3%, ASX Materials 2.6%, ASX Industrials 2.8% and ASX Small Caps soared 3.9%.

The group of largest decliners from the week included;

Australian Coking Coal (1.5%), Richards Bay Coal (2.5%), Rotterdam Coal (2.3%), Brent Crude Oil (6.8%), Baltic Dry Index (15.9%), WTI Crude Oil (7.4%), Cotton (1.7%), Lean Hogs (2.5%), Heating Oil (7.5%), JKM LNG (2.3%), LNG in Yen (5.4%), Lithium Carbonate (3.5%), Orange Juice (3.2%) Palladium (1.4%), Gasoline (6.5%), S&P GSCI (2.7%), CRB Index (1.9%), Dutch TTF Gas (5.1%), Gasoil (8.4%), Middle East Urea (1.7%), Uranium (1.8%), Oats (3.2%), Rice (1.2%), IDX (2.2%), BIST (2.6%) and the KBW Banks fell 2.2%.

October 5, 2025

By Rob Zdravevski

rob@karriasset.com.au