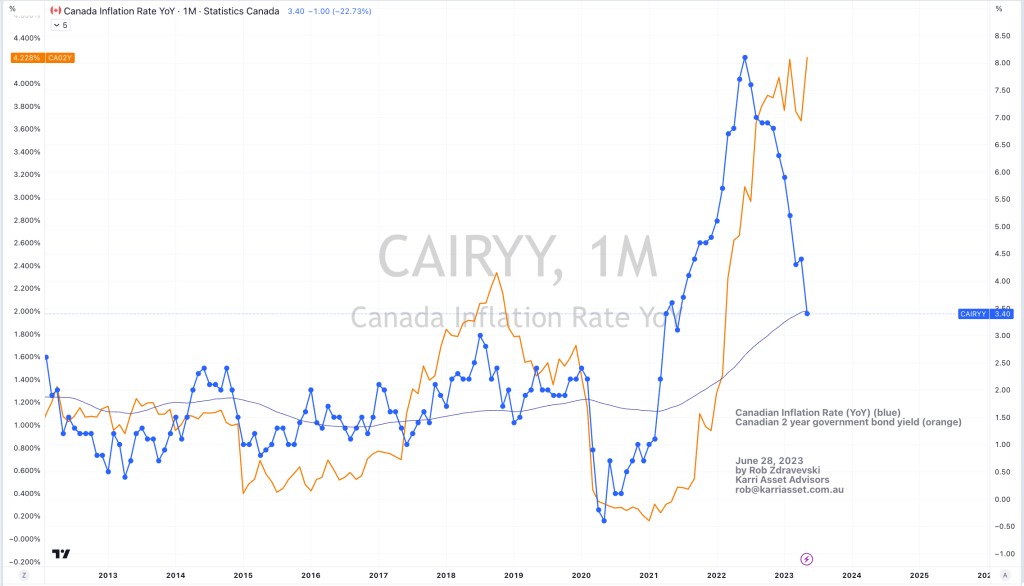

Canadian inflation and interest rates

June 28, 2023 Leave a comment

In my continuing story of expecting abating inflation….

Canadian inflation rates have completed their mean reversion to its 50 month moving average, as illustrated by the blue line in the chart below.

There may be one more lower print over the next month or so……

I expect Canadian interest rates to decline but not back to any type of mean.

I’ll look for the Canadian 2 year bond yields (currently 4.60%) to fall to the 4.20% – 4.05% range before rates embark on their next wave higher.

Until then, recent buyers of bonds will make money, perhaps equity like returns?

While that is playing out, I’m then looking for a 3rd wave of inflation in the form of ‘excuse inflation’ as prices of raw materials and finished products remain stubborn with sellers reluctant to discount and adjust.

It should be a short lived 3rd wave of inflation before meaningful demand destruction takes the upper hand and forces the sellers hand.

A later date, we’ll look for much more lower interest rates for the Canadian 2’s, maybe around 2.40% in a year’s time?

June 28, 2023

by Rob Zdravevski

rob@karriasset.com.au