Energy correlations & buying moments

May 28, 2023 Leave a comment

Followers would recall my notes about peaks and mean reversion calls in various assets including energy.

I’ve been bearish on energy prices soon after the Russian/Ukraine war commenced.

Middle East Urea prices have mean reverted, falling from $900 to $290.

The Japan/Korea Market (JKM) LNG price has tanked from $68 to $9.

Now, I am preparing to buy and am becoming bullish on energy prices again.

The first chart attached chart shows the correlation between Urea and JKM LNG.

These correlations extends across many other commodities, stock prices and currencies.

The next chart is the Rotterdam Coal price compared to the JKM LNG price.

Lows in selected energy prices are likely be “put” in before the majority realise it.

Other energy prices such as Heating Oil, Crude and Distillates still have some lower travel before they bottom.

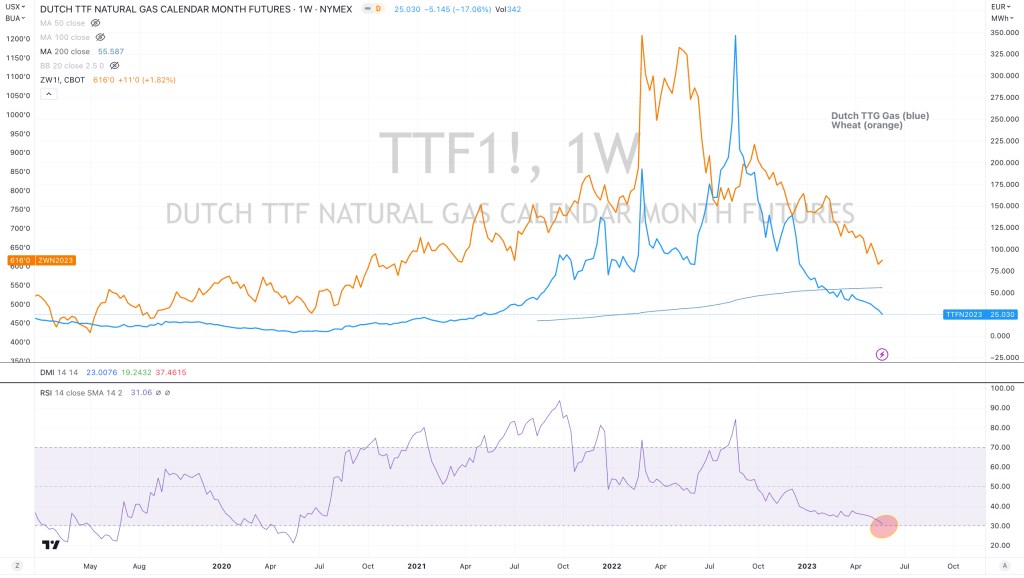

The 3rd chart in this series perversely compares the Dutch TTF Gas price to that of Wheat.

Remember when the financial media were reporting about these energy prices in recent months, after they had already tripled and on their way to peaking?

May 28, 2023

by Rob Zdravevski

rob@kariasset.com.au