I want to buy Uranium, 27% cheaper

April 10, 2024 Leave a comment

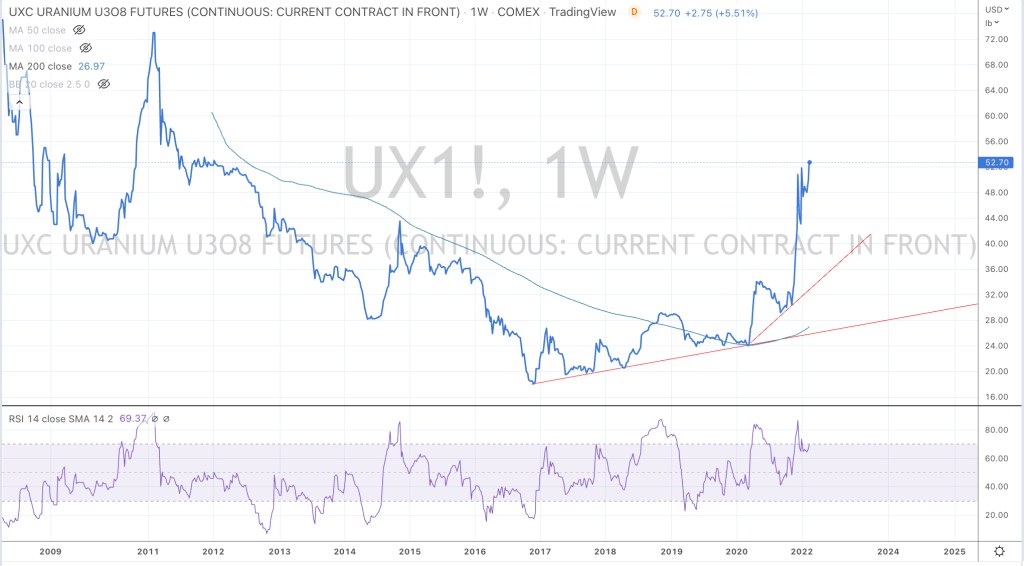

#Uranium prices were recently basking in adulation.

As expected, that noise was occurring at recent ‘overbought’ extremes.

#U308 prices have declined since then……

while I remain a constructive longer term bull on the topic…..

I’ll look to add to uranium price “trackers” such as the #Sprott Physical Uranium Trust at C$20.50 and Yellow Cake plc at 450p

Their prices at the time of writing are C$28.43 and 616p respectively.

Uncannily, my suggest entry prices are approximately 27% below today’s.

April 9, 2024

by Rob Zdravevski

rob@karriasset.com.au