Cheaper fuel is good for trucking companies

October 5, 2023 Leave a comment

15 months ago, I wrote a note titled “Positioning in trucking companies”.

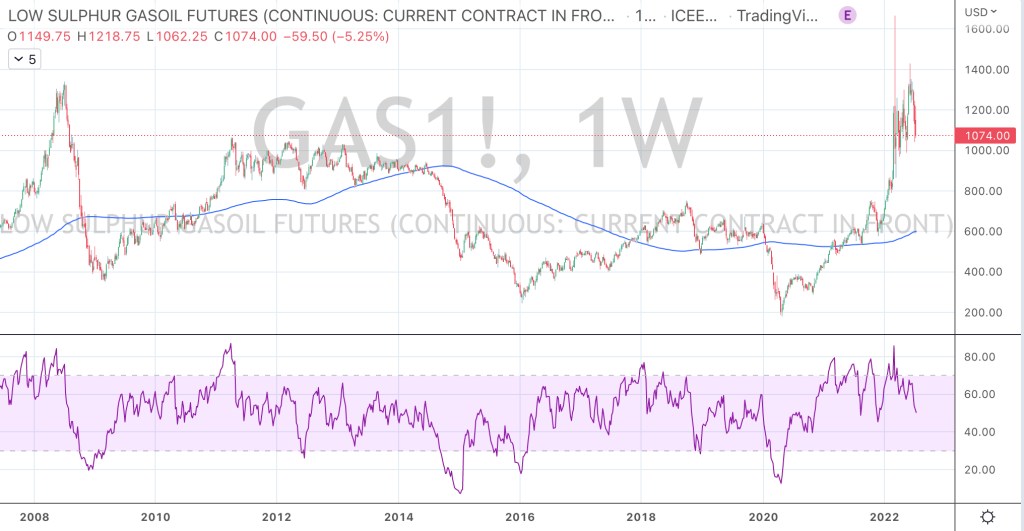

Within it, I mused “what if the price of of Diesel (Gasoil) halves?”

I went on to say, “what if it makes its way towards $600 and greets that 200 week moving average?”

If diesel prices would fall by 50%, then I figured that would be good for trucking (transportation) companies.

Back then, the shares in trucking companies were cheap, unloved and trading in their doldrums.

The Gasoil price did halve and it did trade and touched its 200 week moving average.

The stock prices of GXO Logistics and XPO between the week of July 13, 2022 and the week of July 24, 2023 rose 58% and 121% respectively.

Incidentally, my ‘Macro Extremes’ edition for the week ending July 24, 2023 listed the Gasoil price in the overbought section.

Those stocks were sold then…….

I’ll look to re-acquire them again, perhaps, when I see the Gasoil (Diesel) price re-visit its 200 week moving average.

October 5, 2023

by Rob Zdravevski

rob@karriasset.com.au